- China

- /

- Trade Distributors

- /

- SHSE:600710

Top Chinese Dividend Stocks To Consider In August 2024

Reviewed by Simply Wall St

As Chinese stocks have recently experienced declines amid a cautious economic environment, investors are increasingly focusing on stable income-generating options like dividend stocks. In this context, identifying robust dividend-paying companies can provide a reliable income stream and offer some stability in uncertain market conditions.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.58% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.86% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 5.17% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.53% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.87% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.25% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 5.52% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.92% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.91% | ★★★★★★ |

Click here to see the full list of 278 stocks from our Top Chinese Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

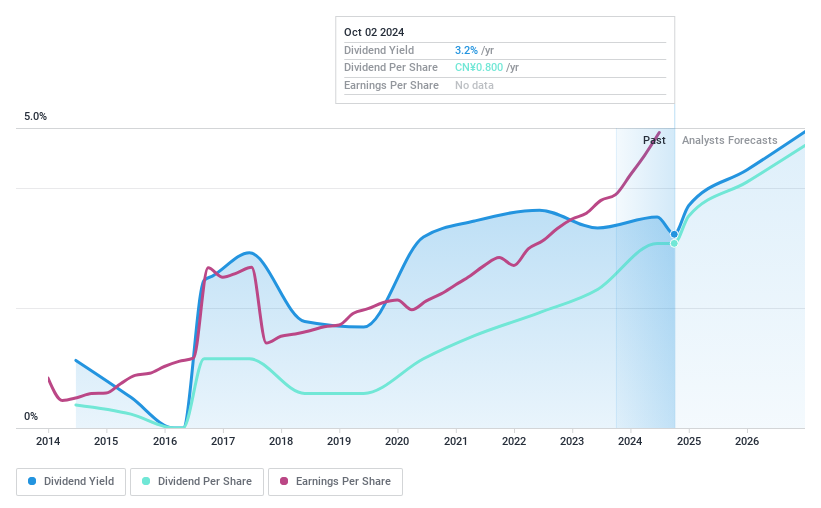

Henan Lingrui Pharmaceutical (SHSE:600285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Henan Lingrui Pharmaceutical Co., Ltd. produces and sells medicines in China, with a market cap of CN¥13.70 billion.

Operations: Henan Lingrui Pharmaceutical Co., Ltd. generates its revenue from the production and sale of medicines in China.

Dividend Yield: 3.3%

Henan Lingrui Pharmaceutical has a reasonable payout ratio of 67.7% and a cash payout ratio of 66.1%, indicating dividends are well-covered by earnings and cash flows. Despite a volatile dividend history over the past decade, recent growth in earnings (29.8% last year) supports potential stability. The dividend yield is attractive at 3.29%, placing it in the top quartile of Chinese market payers, though investors should note its past instability.

- Click to explore a detailed breakdown of our findings in Henan Lingrui Pharmaceutical's dividend report.

- Our valuation report here indicates Henan Lingrui Pharmaceutical may be undervalued.

Sumec (SHSE:600710)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumec Corporation Limited, with a market cap of CN¥10.51 billion, operates in the supply and industrial chain business in China.

Operations: Sumec Corporation Limited generates revenue through its supply and industrial chain business in China.

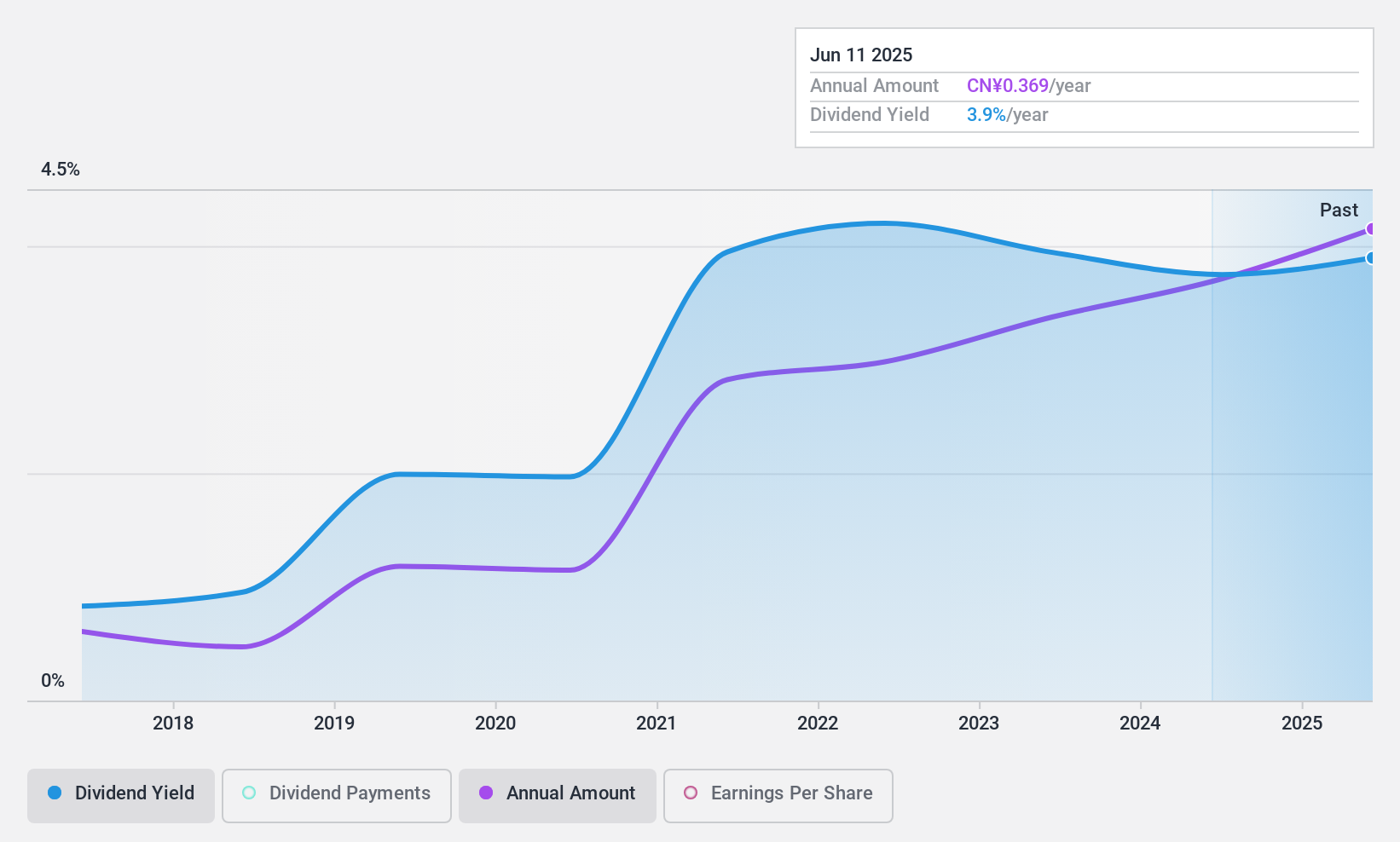

Dividend Yield: 4.1%

Sumec Corporation Limited's dividend payments are well-covered by earnings (payout ratio: 39.3%) and cash flows (cash payout ratio: 28.5%). While the company has a strong dividend yield of 4.1%, in the top 25% of Chinese market payers, its dividend history is relatively short at seven years with some volatility. Recent earnings growth, including a net income increase to CNY570.41 million for H1 2024, supports potential future payouts despite past instability.

- Click here and access our complete dividend analysis report to understand the dynamics of Sumec.

- Upon reviewing our latest valuation report, Sumec's share price might be too pessimistic.

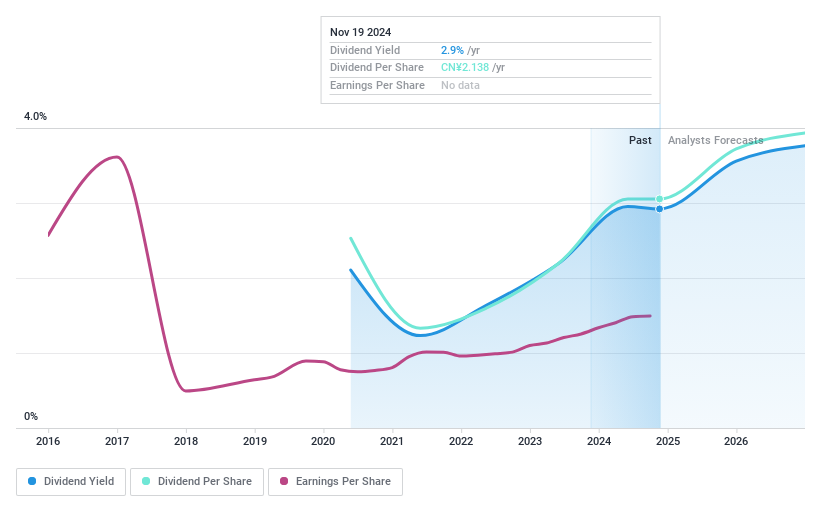

Goneo Group (SHSE:603195)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goneo Group Co., Ltd. provides electrical products and has a market cap of CN¥91.51 billion.

Operations: Goneo Group Co., Ltd. generates revenue primarily from its Electric Equipment segment, which reported CN¥16.16 billion.

Dividend Yield: 3%

Goneo Group's dividend payments are covered by earnings (payout ratio: 67.7%) and cash flows (cash payout ratio: 66.5%), but the company has only paid dividends for four years, with a history of volatility and an unstable track record. Recent buyback activity saw the repurchase of shares worth CNY325 million, potentially indicating confidence in future performance. Earnings grew by 23.8% over the past year, suggesting potential for sustained payouts despite historical unreliability.

- Get an in-depth perspective on Goneo Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that Goneo Group's share price might be on the cheaper side.

Where To Now?

- Investigate our full lineup of 278 Top Chinese Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600710

Flawless balance sheet with solid track record and pays a dividend.