Sumec And 2 Other Leading Dividend Stocks On The Chinese Exchange

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by fluctuating inflation rates and monetary policy adjustments, China's stock market has shown resilience, buoyed by strong export figures despite domestic economic pressures. In this context, dividend stocks like Sumec can offer investors potential stability and income generation opportunities within the dynamic Chinese market. A good dividend stock typically combines sustainable payout ratios with robust business models, especially crucial in times of economic uncertainty. Investors might find such stocks appealing as they can potentially provide steady returns amidst volatile market conditions.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.62% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.71% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.97% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.78% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.72% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.68% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.89% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.57% | ★★★★★★ |

Click here to see the full list of 245 stocks from our Top Chinese Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

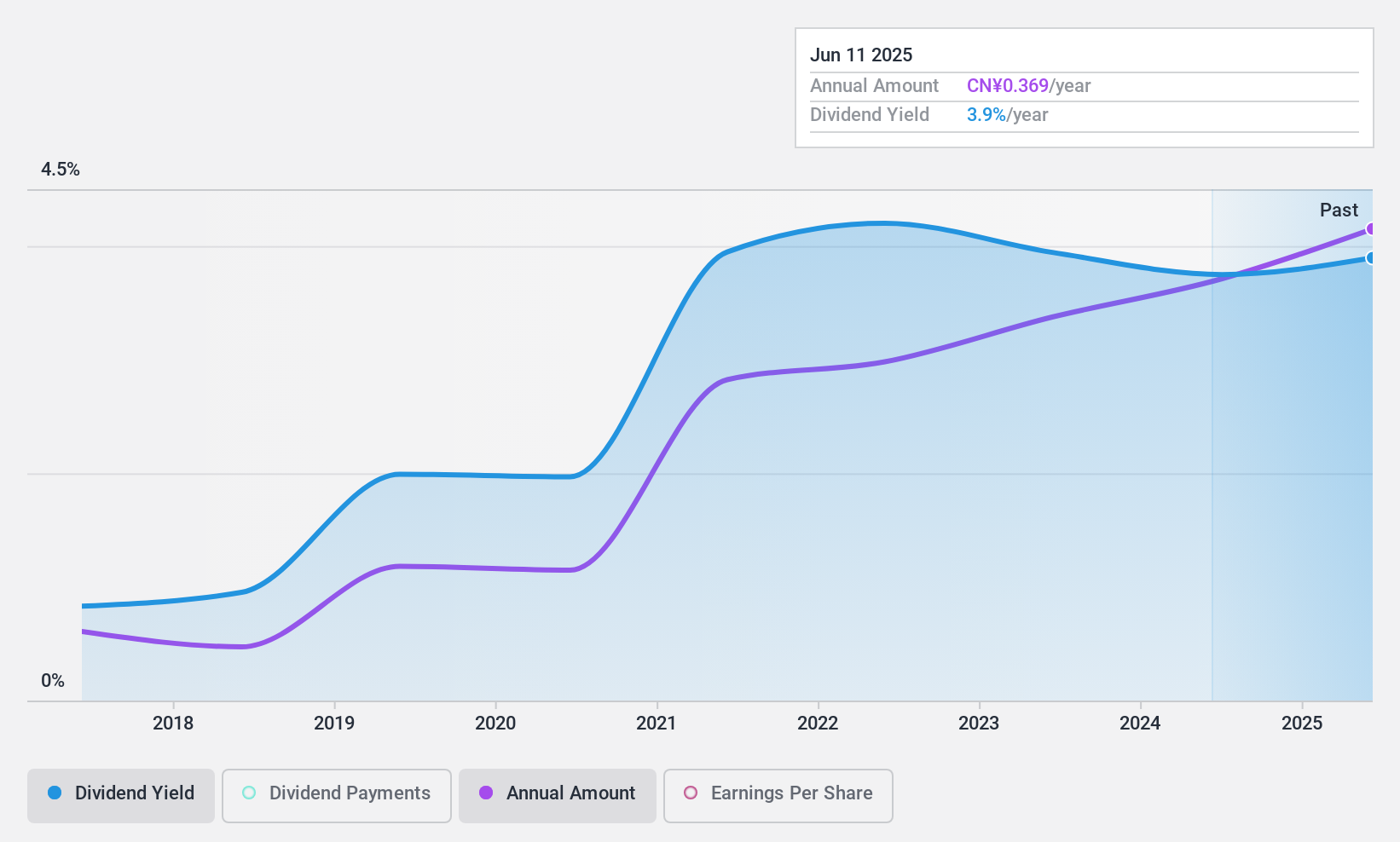

Sumec (SHSE:600710)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumec Corporation Limited operates in the supply and industrial chain sectors within China, with a market capitalization of approximately CN¥10.57 billion.

Operations: Sumec Corporation Limited generates its revenue through various segments in the supply and industrial chain sectors within China.

Dividend Yield: 4.1%

Sumec's dividend yield of 4.08% ranks in the top 25% in the Chinese market, supported by a reasonable payout ratio of 39.3%, ensuring dividends are well-covered by earnings and cash flows (cash payout ratio at 40.5%). Despite this, Sumec has a less stable dividend history with volatile payments over its seven-year dividend-paying period. Recent financials show a dip in sales from CNY 64.50 billion to CNY 55.93 billion year-over-year for the half year ended June 30, 2024, though net income rose to CNY 570.41 million from CNY 509.12 million, indicating some resilience.

- Unlock comprehensive insights into our analysis of Sumec stock in this dividend report.

- Our valuation report here indicates Sumec may be undervalued.

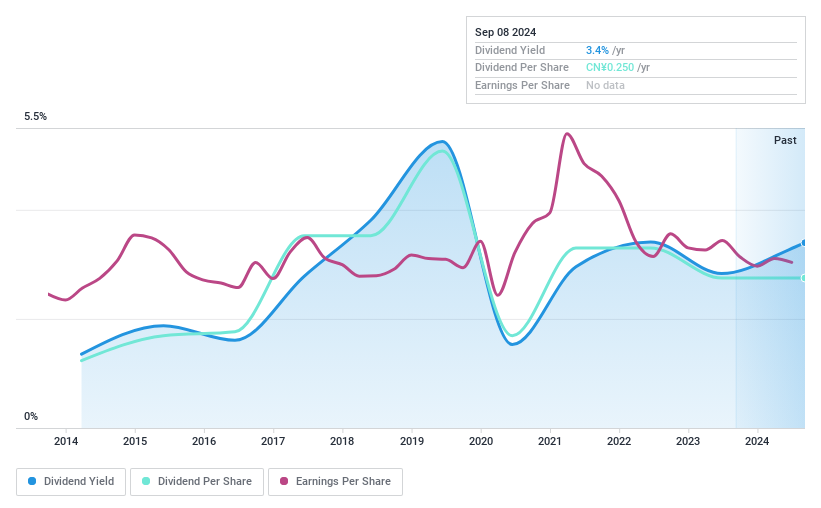

Changchun FAWAY Automobile ComponentsLtd (SHSE:600742)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Changchun FAWAY Automobile Components Co., Ltd. specializes in the research, design, development, manufacture, and sale of auto parts in China, with a market capitalization of approximately CN¥5.87 billion.

Operations: Changchun FAWAY Automobile Components Co., Ltd. generates revenue primarily through its manufacturing segment, which accounted for CN¥21.12 billion.

Dividend Yield: 3.2%

Changchun FAWAY Automobile Components Ltd. reported a Q1 2024 revenue increase to CNY 4.50 billion, up from CNY 4.15 billion year-over-year, with net income rising to CNY 94.05 million from CNY 68.72 million. Despite a decade of increasing dividend payments, the company's dividend history is marked by volatility and unreliability, with a current yield of 3.16%, ranking in the top quartile in China's market average of 2.56%. Dividends are well-supported by earnings and cash flows with payout ratios at 34% and cash payout ratio at just over 19%, respectively.

- Navigate through the intricacies of Changchun FAWAY Automobile ComponentsLtd with our comprehensive dividend report here.

- According our valuation report, there's an indication that Changchun FAWAY Automobile ComponentsLtd's share price might be on the cheaper side.

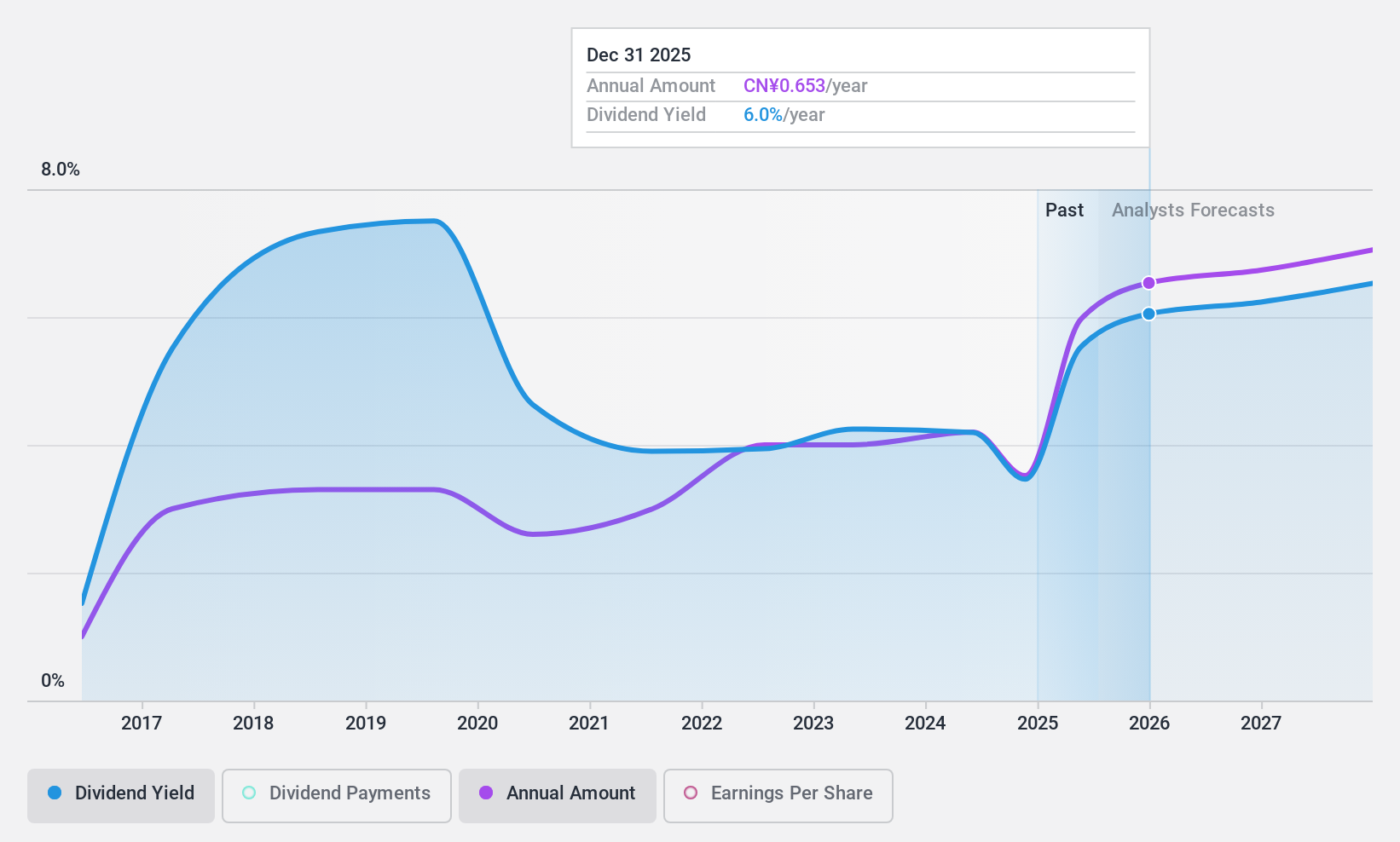

MeiHua Holdings GroupLtd (SHSE:600873)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MeiHua Holdings Group Co., Ltd is a synthetic biology company specializing in amino acid nutrition and health solutions, operating both in China and internationally, with a market capitalization of approximately CN¥29.78 billion.

Operations: MeiHua Holdings Group Co., Ltd generates its revenue primarily through the provision of amino acid nutrition and health solutions.

Dividend Yield: 4%

MeiHua Holdings Group Ltd. offers a dividend yield of 4.02%, placing it in the top 25% of Chinese market payers. Despite a history of increasing dividends over the past decade, payments have shown significant volatility. Currently, the stock is valued at 49.9% below its estimated fair value and analysts expect a potential price increase of 31.7%. Earnings are projected to grow by 8.22% annually, with dividends well-covered by earnings and cash flows, having payout ratios of 39.3% and 33.8%, respectively.

- Delve into the full analysis dividend report here for a deeper understanding of MeiHua Holdings GroupLtd.

- Insights from our recent valuation report point to the potential undervaluation of MeiHua Holdings GroupLtd shares in the market.

Next Steps

- Take a closer look at our Top Chinese Dividend Stocks list of 245 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600873

MeiHua Holdings GroupLtd

A synthetic biology company, provides amino acid nutrition and health solutions in China and internationally.

Very undervalued with flawless balance sheet and pays a dividend.