- Taiwan

- /

- Semiconductors

- /

- TWSE:5285

3 Global Dividend Stocks To Consider With At Least 3% Yield

Reviewed by Simply Wall St

As global markets grapple with escalating geopolitical tensions and fluctuating trade dynamics, investors are increasingly seeking stability amid uncertainty. In such an environment, dividend stocks with yields of at least 3% can offer a steady income stream, making them an attractive option for those looking to balance risk and reward.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.63% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.14% | ★★★★★★ |

| NCD (TSE:4783) | 4.23% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.30% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.19% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.32% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.89% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.48% | ★★★★★★ |

Click here to see the full list of 1562 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

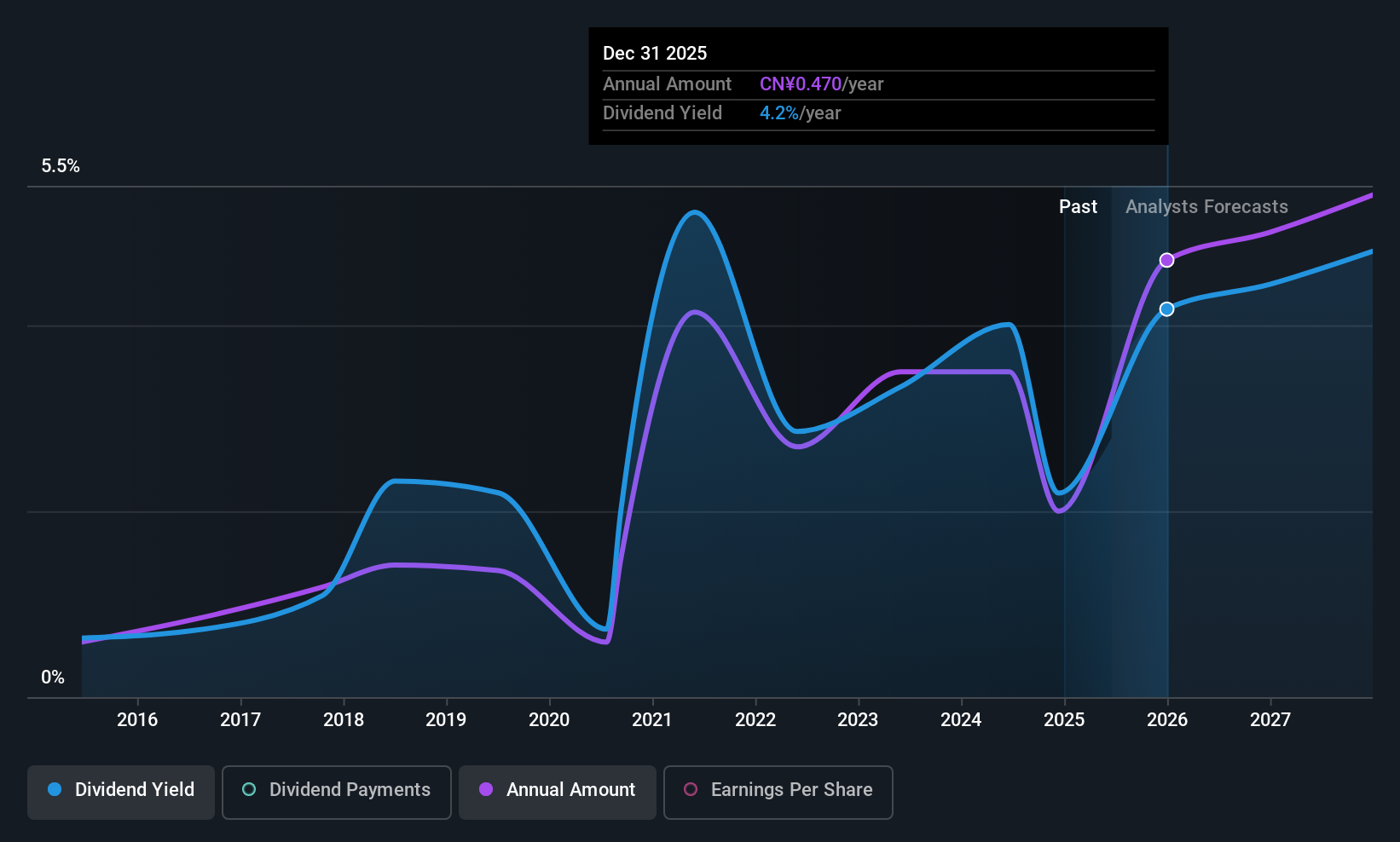

Wuxi Huaguang Environment & Energy GroupLtd (SHSE:600475)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wuxi Huaguang Environment & Energy Group Co., Ltd. operates in the environmental and energy sectors, focusing on providing solutions for waste treatment and energy recovery, with a market cap of CN¥9.81 billion.

Operations: Wuxi Huaguang Environment & Energy Group Ltd. generates its revenue primarily through its operations in the environmental and energy sectors, specifically focusing on waste treatment and energy recovery solutions.

Dividend Yield: 3.9%

Wuxi Huaguang Environment & Energy Group Ltd. offers dividends that are well covered by earnings and cash flows, with a payout ratio of 65.9% and a cash payout ratio of 34.5%. Despite its top-tier dividend yield in the Chinese market at 3.92%, the company's dividend history has been unstable and volatile over the past decade. Recent financials show declining sales and net income, but a share repurchase program is underway to bolster shareholder value using CNY 150 million funds.

- Click here to discover the nuances of Wuxi Huaguang Environment & Energy GroupLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Wuxi Huaguang Environment & Energy GroupLtd is trading behind its estimated value.

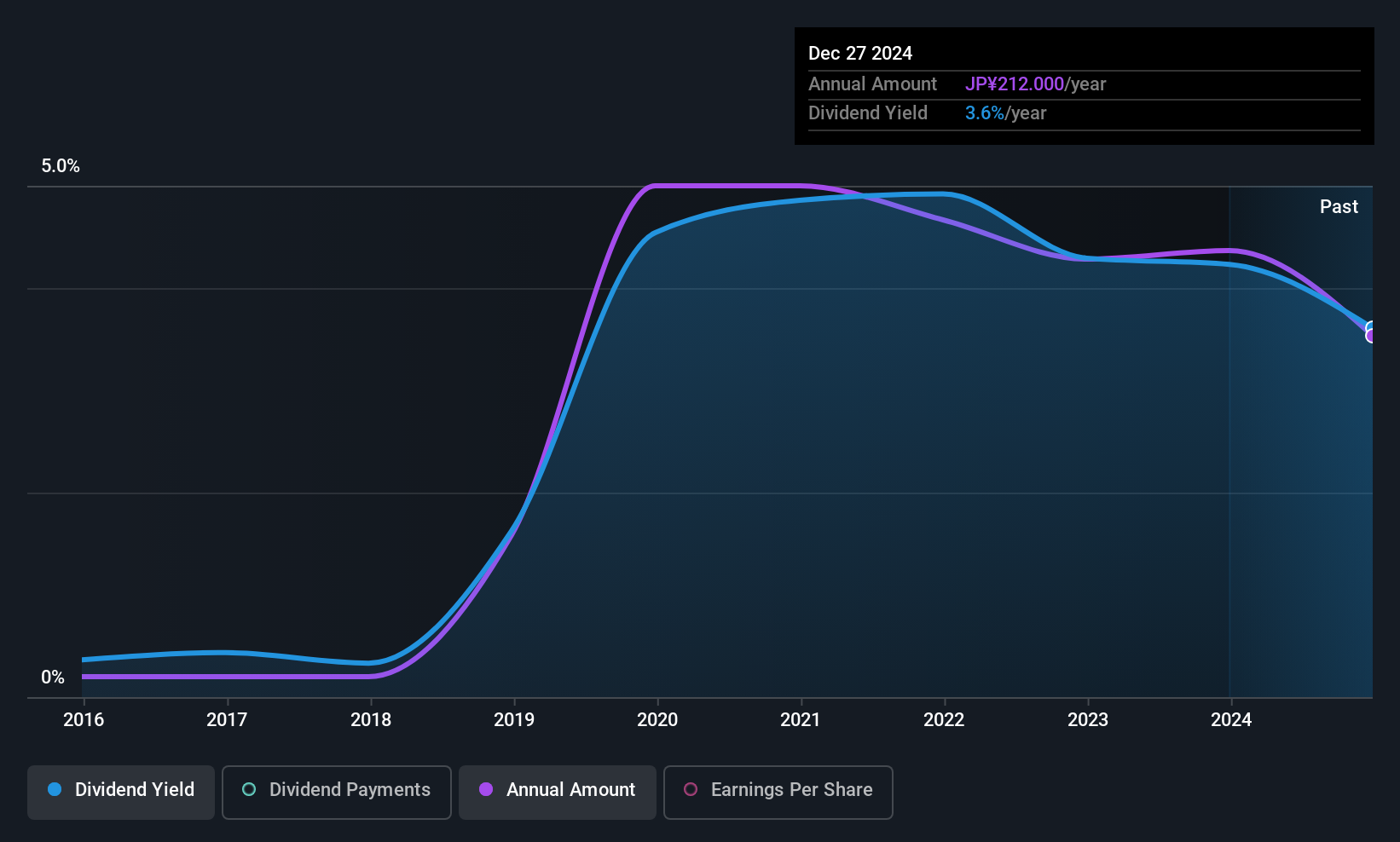

Nakano RefrigeratorsLtd (TSE:6411)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nakano Refrigerators Co., Ltd. designs, manufactures, sells, installs, and provides after-sales services for refrigerated showcases, refrigerators, freezers, and related products in Japan with a market cap of ¥29.31 billion.

Operations: Nakano Refrigerators Co., Ltd.'s revenue primarily comes from the design, manufacturing, sales, installation, and after-sales services of refrigerated showcases and related cooling products in Japan.

Dividend Yield: 3%

Nakano Refrigerators Ltd. has a history of increasing dividends over the past decade, although payments have been volatile with significant annual drops. The company's dividend yield of 3.02% lags behind top-tier payers in Japan, but its payouts are well covered by earnings and cash flows, with payout ratios of 54% and 27.5%, respectively. Recent news includes a proposed acquisition by Marunouchi Capital for ¥26.4 billion, potentially impacting future dividend policies as the company may go private.

- Get an in-depth perspective on Nakano RefrigeratorsLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Nakano RefrigeratorsLtd's shares may be trading at a premium.

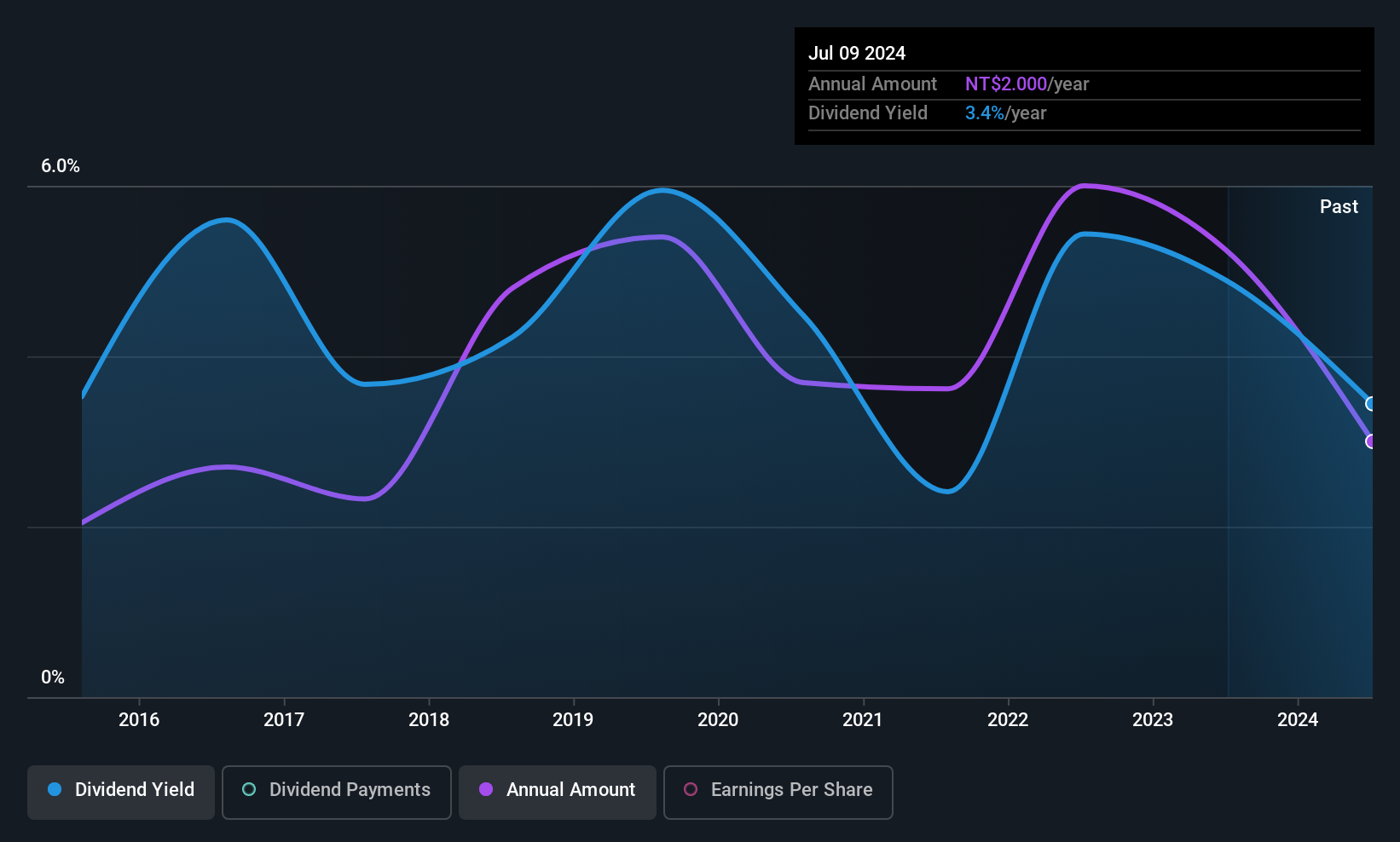

Jih Lin Technology (TWSE:5285)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jih Lin Technology Co., Ltd. manufactures and sells lead frames and tooling products in Taiwan, China, and internationally, with a market cap of NT$4.58 billion.

Operations: Jih Lin Technology's revenue primarily comes from its Semiconductor Lead Frame Production and Sales Operations, generating NT$5.18 billion.

Dividend Yield: 4.1%

Jih Lin Technology's dividend payments, covered by earnings with an 83.5% payout ratio and cash flows at 54.5%, have grown over the past decade but remain unreliable due to volatility. The dividend yield of 4.08% is below Taiwan's top-tier payers, while its P/E ratio of 20.5x suggests good value compared to industry peers. Recent Q1 results showed increased sales (TWD 1,335.41 million) but decreased net income (TWD 43.74 million).

- Unlock comprehensive insights into our analysis of Jih Lin Technology stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Jih Lin Technology is priced higher than what may be justified by its financials.

Taking Advantage

- Delve into our full catalog of 1562 Top Global Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5285

Jih Lin Technology

Manufactures and sells lead frames and tooling products in Taiwan, China, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives