- China

- /

- Aerospace & Defense

- /

- SHSE:600391

Aecc Aero Science and Technology Co.,Ltd (SHSE:600391) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Aecc Aero Science and Technology Co.,Ltd (SHSE:600391) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

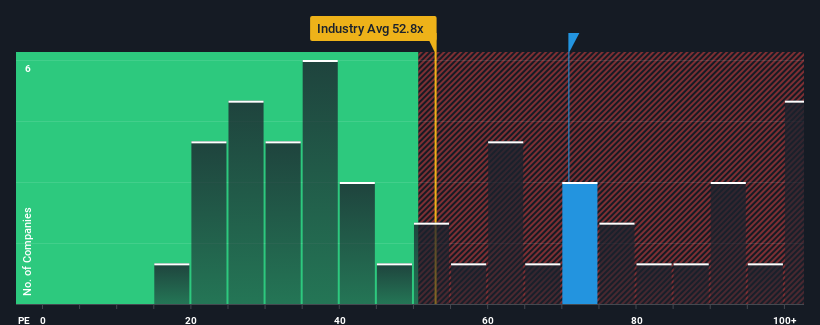

After such a large jump in price, Aecc Aero Science and TechnologyLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 70.8x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Aecc Aero Science and TechnologyLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Aecc Aero Science and TechnologyLtd

Is There Enough Growth For Aecc Aero Science and TechnologyLtd?

Aecc Aero Science and TechnologyLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 21% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 39% as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is not materially different.

With this information, we find it interesting that Aecc Aero Science and TechnologyLtd is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Aecc Aero Science and TechnologyLtd's P/E?

Shares in Aecc Aero Science and TechnologyLtd have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Aecc Aero Science and TechnologyLtd's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Aecc Aero Science and TechnologyLtd, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Aecc Aero Science and TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600391

Aecc Aero Science and TechnologyLtd

Engages in the research, development, manufacture, sale, and service of aircraft engines and gas turbine parts in China, rest of Asia, the United States, and Europe.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives