- China

- /

- Electrical

- /

- SZSE:002141

Promising Penny Stocks To Consider In October 2024

Reviewed by Simply Wall St

As global markets react to rising U.S. Treasury yields and a shallower Fed rate-cutting cycle, investors are reevaluating their strategies amid fluctuating economic indicators. For those exploring investment opportunities outside the mainstream, penny stocks—though an older term—remain a relevant area for potential growth. These stocks often represent smaller or newer companies that can offer unique value propositions at lower price points, particularly when they have strong balance sheets and fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR122.98M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.38 | CN¥2.15B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.765 | £473.73M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.36 | THB1.88B | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.12 | £426.67M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★★

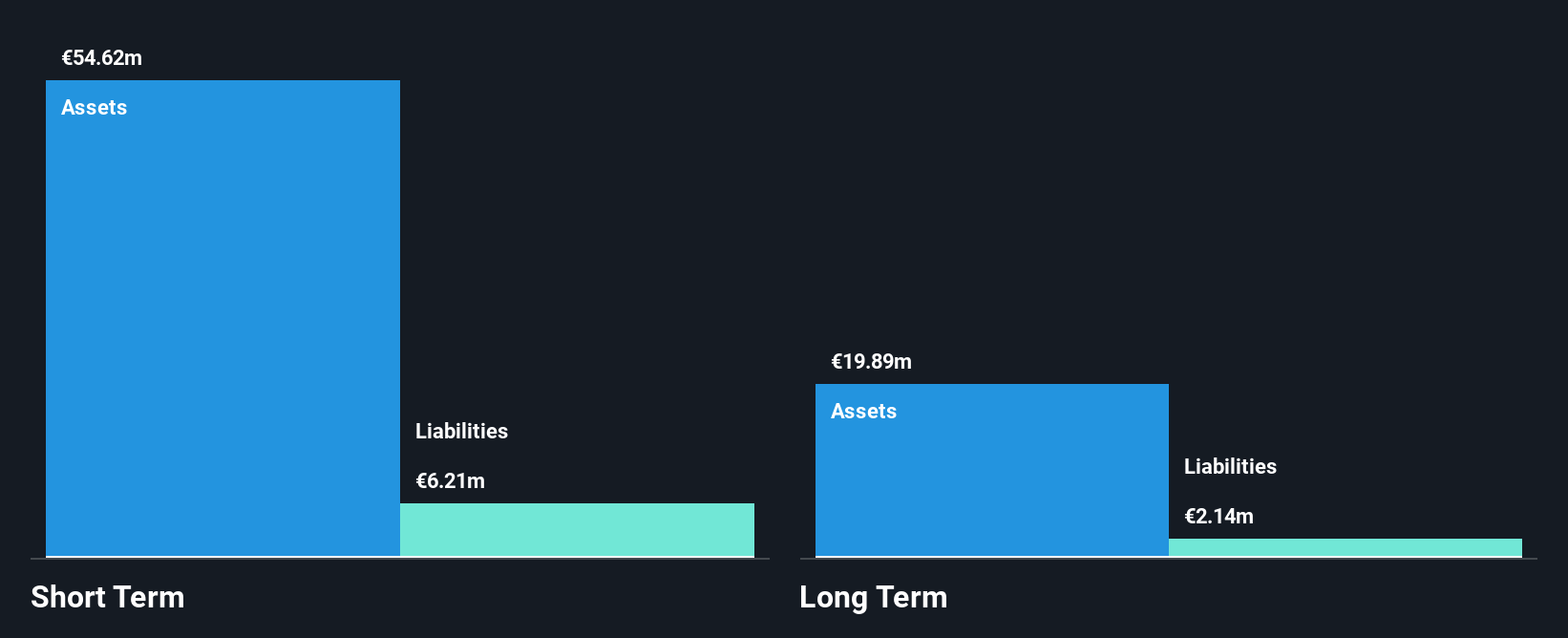

Overview: Nightingale Health Oyj is a health technology company that provides a health data platform for detecting disease risks across Finland, the United Kingdom, Europe, the United States, and internationally, with a market cap of €208.78 million.

Operations: The company generates revenue of €4.36 million from its Medical Labs & Research segment.

Market Cap: €208.78M

Nightingale Health Oyj, with a market cap of €208.78 million and revenue of €4.36 million, is navigating the penny stock landscape by leveraging its seasoned management team and strategic partnerships. Despite being unprofitable and having volatile share prices, the company has reduced its debt-to-equity ratio significantly over five years and maintains a cash runway exceeding three years. Recent regulatory approvals in Singapore and collaborations in the U.S., such as with Boston Heart Diagnostics, highlight potential growth avenues through innovative health checks that assess risks for multiple chronic diseases using advanced blood analysis technology.

- Click here and access our complete financial health analysis report to understand the dynamics of Nightingale Health Oyj.

- Gain insights into Nightingale Health Oyj's future direction by reviewing our growth report.

Zhejiang Yankon Group (SHSE:600261)

Simply Wall St Financial Health Rating: ★★★★★★

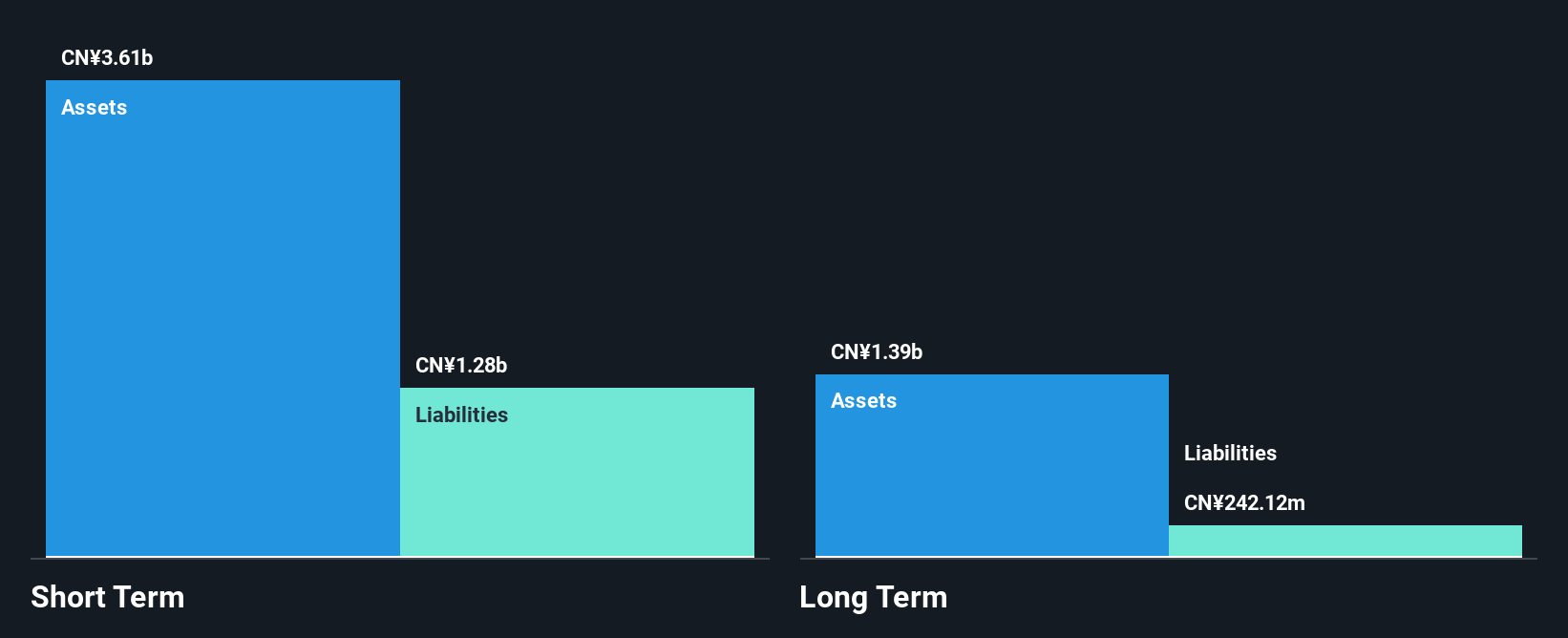

Overview: Zhejiang Yankon Group Co., Ltd. focuses on the research, development, production, and sales of lighting appliances in China with a market cap of CN¥4.14 billion.

Operations: No revenue segments have been reported for the company.

Market Cap: CN¥4.14B

Zhejiang Yankon Group, with a market cap of CN¥4.14 billion, has shown resilience in the penny stock arena through strong financial management and steady earnings growth. Its short-term assets of CN¥3.8 billion comfortably cover both short- and long-term liabilities, while recent earnings reports indicate a rise in sales to CN¥2,452.38 million for the nine months ended September 2024. The company's debt-to-equity ratio has improved significantly over five years, reflecting prudent fiscal strategies. However, its return on equity remains low at 6.5%, and dividend stability is uncertain due to an unstable track record.

- Jump into the full analysis health report here for a deeper understanding of Zhejiang Yankon Group.

- Understand Zhejiang Yankon Group's track record by examining our performance history report.

Infund Holding (SZSE:002141)

Simply Wall St Financial Health Rating: ★★★★☆☆

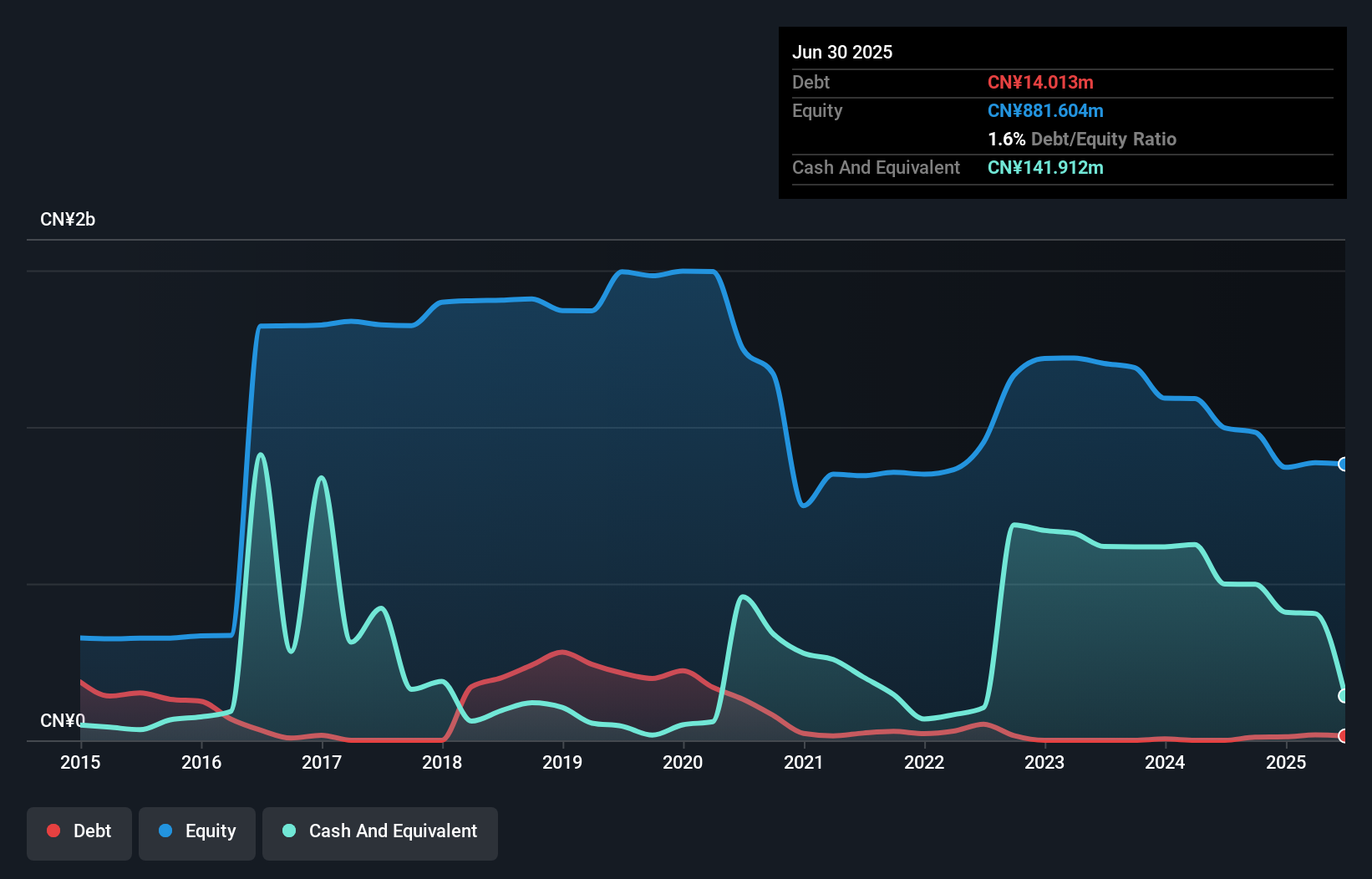

Overview: Infund Holding Co., Ltd. operates in China, focusing on micro enameled wire and veterinary vaccine businesses, with a market cap of CN¥1.46 billion.

Operations: The company's revenue is primarily derived from its Biological Products segment, which generated CN¥52.03 million, alongside contributions from Other Industries amounting to CN¥20.07 million.

Market Cap: CN¥1.46B

Infund Holding Co., Ltd. has demonstrated financial improvement despite being unprofitable, reducing its losses by 22.6% annually over the past five years and achieving a net income of CN¥1.6 million for the nine months ended September 2024, compared to a significant loss in the previous year. The company is debt-free, with short-term assets of CN¥637.7 million exceeding both short- and long-term liabilities, indicating solid liquidity management. Recent strategic moves include a share buyback program and an acquisition bid for a substantial stake in the company, reflecting active shareholder value enhancement efforts amidst volatile earnings performance.

- Click to explore a detailed breakdown of our findings in Infund Holding's financial health report.

- Examine Infund Holding's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Explore the 5,815 names from our Penny Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002141

Infund Holding

Engages in the micro enameled wire and veterinary vaccine businesses in China.

Adequate balance sheet with weak fundamentals.