- China

- /

- Construction

- /

- SHSE:600248

Little Excitement Around Shaanxi Construction Engineering Group Corporation Limited's (SHSE:600248) Earnings

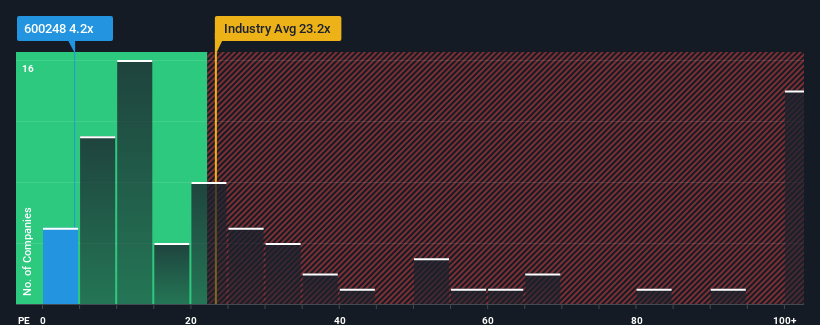

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 39x, you may consider Shaanxi Construction Engineering Group Corporation Limited (SHSE:600248) as a highly attractive investment with its 4.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Shaanxi Construction Engineering Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Shaanxi Construction Engineering Group

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Shaanxi Construction Engineering Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 8.8% last year. Still, lamentably EPS has fallen 27% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 17% as estimated by the sole analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 37%, which is noticeably more attractive.

With this information, we can see why Shaanxi Construction Engineering Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shaanxi Construction Engineering Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Shaanxi Construction Engineering Group (2 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600248

Shaanxi Construction Engineering Group

Through its subsidiaries, engages in general engineering construction business in China and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success