- China

- /

- Aerospace & Defense

- /

- SHSE:600118

Investors who have held China SpacesatLtd (SHSE:600118) over the last year have watched its earnings decline along with their investment

This week we saw the China Spacesat Co.,Ltd. (SHSE:600118) share price climb by 14%. The stock is actually down over the last year. But it did better than its market, which fell 18%.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for China SpacesatLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

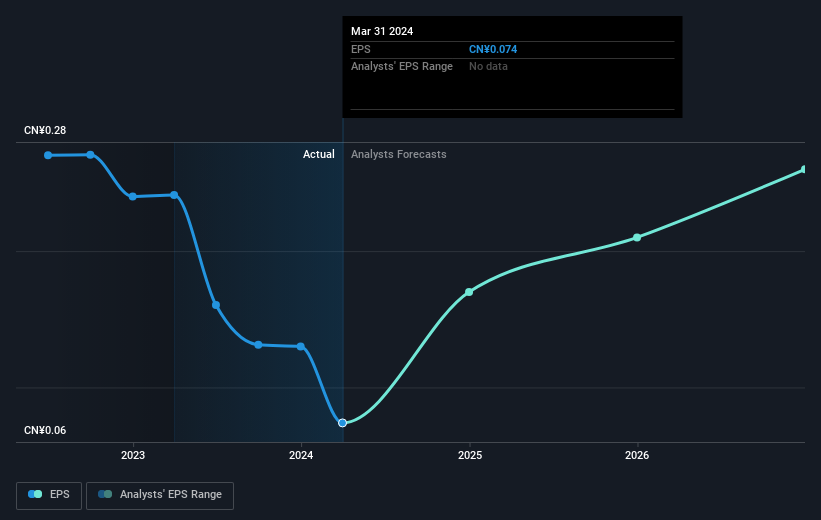

Unfortunately China SpacesatLtd reported an EPS drop of 69% for the last year. The share price fall of 14% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. With a P/E ratio of 320.95, it's fair to say the market sees an EPS rebound on the cards.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on China SpacesatLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Although it hurts that China SpacesatLtd returned a loss of 14% in the last twelve months, the broader market was actually worse, returning a loss of 18%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 2% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand China SpacesatLtd better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for China SpacesatLtd you should be aware of.

But note: China SpacesatLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600118

China SpacesatLtd

Engages in the research and development, design, manufacture, and sale of satellites and related products.

Excellent balance sheet with reasonable growth potential.