- China

- /

- Electrical

- /

- SHSE:600110

A Piece Of The Puzzle Missing From Nuode New Materials Co.,Ltd.'s (SHSE:600110) 25% Share Price Climb

The Nuode New Materials Co.,Ltd. (SHSE:600110) share price has done very well over the last month, posting an excellent gain of 25%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

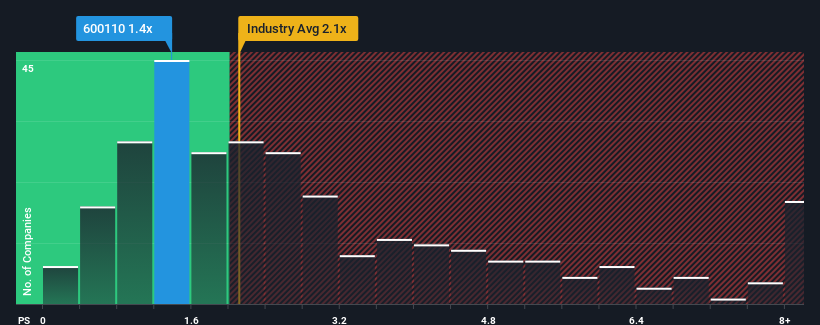

In spite of the firm bounce in price, considering around half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") above 2.1x, you may still consider Nuode New MaterialsLtd as an solid investment opportunity with its 1.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Nuode New MaterialsLtd

How Has Nuode New MaterialsLtd Performed Recently?

Nuode New MaterialsLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Nuode New MaterialsLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Nuode New MaterialsLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 42% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 32% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 23%, which is noticeably less attractive.

In light of this, it's peculiar that Nuode New MaterialsLtd's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift Nuode New MaterialsLtd's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Nuode New MaterialsLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Nuode New MaterialsLtd you should be aware of, and 2 of them are a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nuode New MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600110

Nuode New MaterialsLtd

Researches and develops, produces, and sells electrolytic copper foils for lithium battery in China and internationally.

High growth potential and fair value.

Market Insights

Community Narratives