As global markets continue to navigate a complex landscape, with U.S. stocks reaching new highs amid an active earnings season and inflationary pressures slightly above expectations, investors are increasingly looking for stability in their portfolios. In such times, dividend stocks can offer a reliable source of income and potential growth, making them an appealing choice for those seeking to balance risk and reward in the current economic climate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.18% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.14% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.27% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.64% | ★★★★★★ |

| Innotech (TSE:9880) | 4.81% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

Click here to see the full list of 2047 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

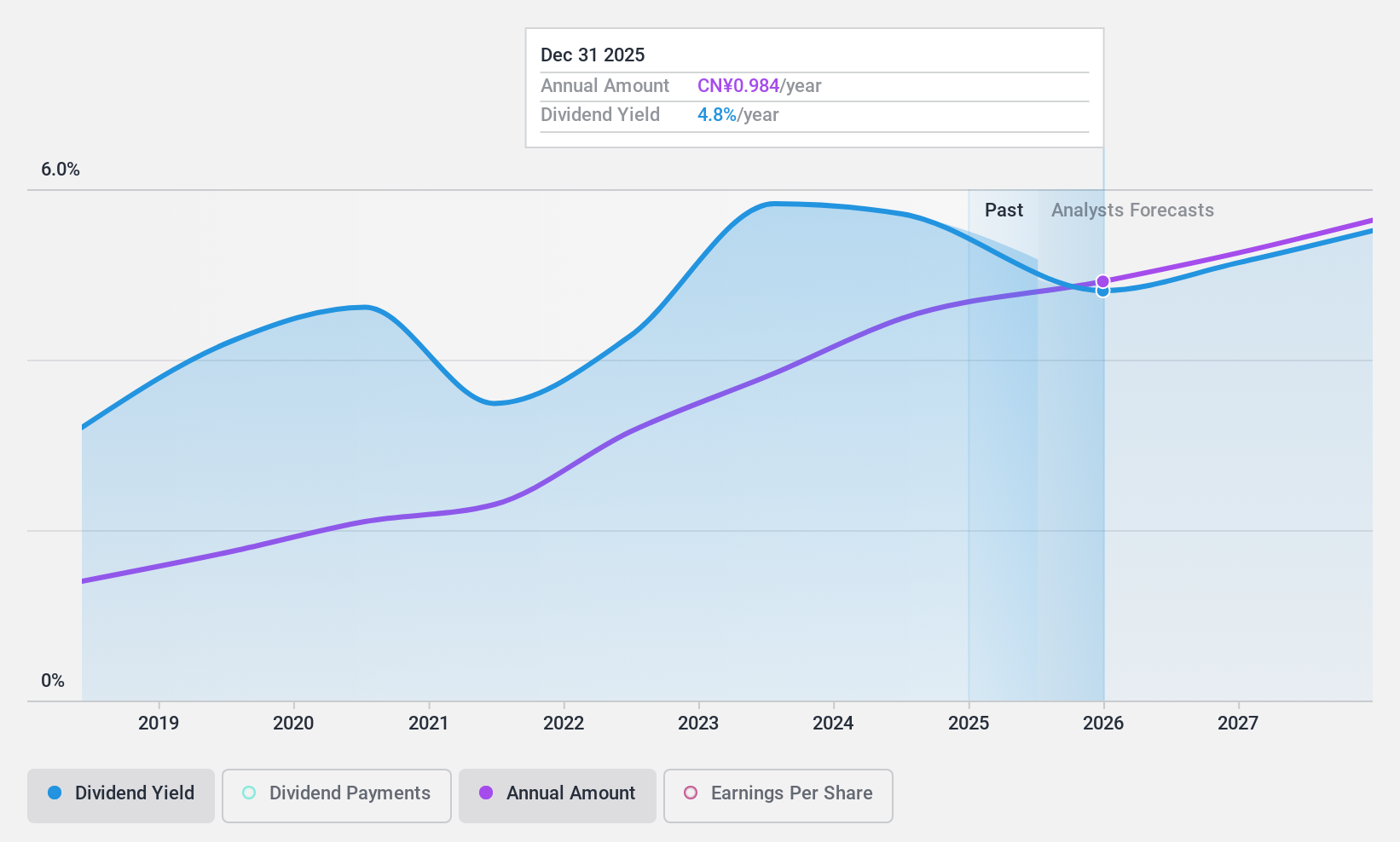

Bank of Changsha (SHSE:601577)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Changsha Co., Ltd. offers a range of commercial banking products and services to personal and business customers in China, with a market cap of CN¥33.22 billion.

Operations: Bank of Changsha Co., Ltd. generates revenue through its diverse array of commercial banking products and services tailored for individual and corporate clients across China.

Dividend Yield: 4.4%

Bank of Changsha's dividend is well-supported by a low payout ratio of 20.2%, indicating sustainability with future coverage projected at 23.5%. Although the dividend yield of 4.38% ranks in the top quartile within China, its track record spans less than a decade, suggesting potential instability. The stock trades significantly below estimated fair value and earnings have shown consistent growth, with recent half-year net income reaching CNY 4.12 billion, up from CNY 3.96 billion year-on-year.

- Dive into the specifics of Bank of Changsha here with our thorough dividend report.

- Our valuation report here indicates Bank of Changsha may be undervalued.

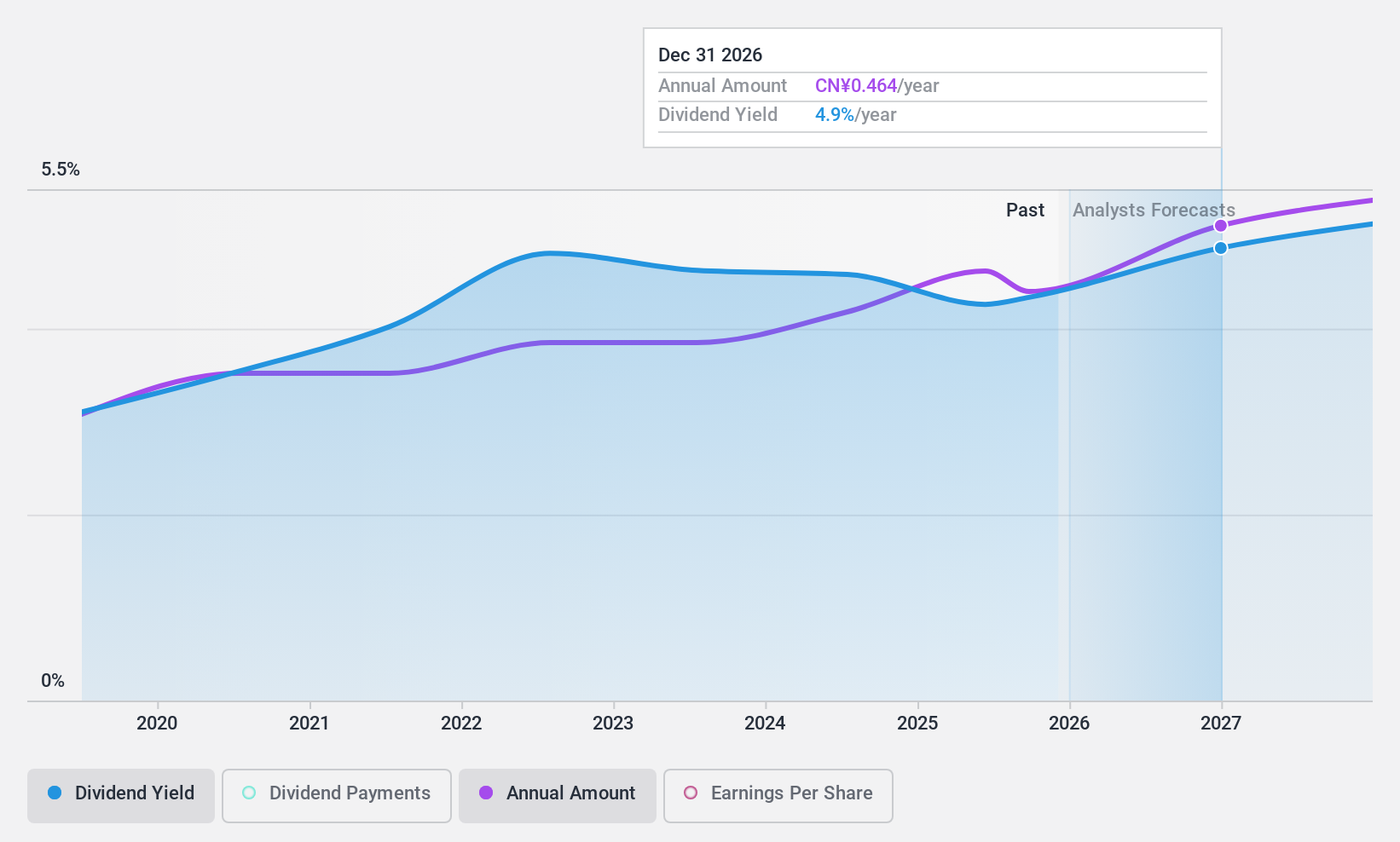

Bank of Chengdu (SHSE:601838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Chengdu Co., Ltd. offers a range of commercial banking products and services in China, with a market cap of CN¥59.61 billion.

Operations: Bank of Chengdu Co., Ltd.'s revenue is primarily derived from Company Banking (CN¥10.03 billion), Fund Operation Business (CN¥5.73 billion), and Personal Business Banking (CN¥4.53 billion).

Dividend Yield: 5.5%

Bank of Chengdu's dividend is well-supported with a payout ratio of 28.6%, ensuring coverage by earnings and projected to remain sustainable at 29.4% in three years. The yield of 5.48% places it among the top dividend payers in China, despite a short history of six years. Recent earnings growth reinforces its financial health, with net income rising to CNY 6.17 billion for the half-year ending June 2024 from CNY 5.58 billion previously, reflecting robust profitability trends.

- Get an in-depth perspective on Bank of Chengdu's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Bank of Chengdu shares in the market.

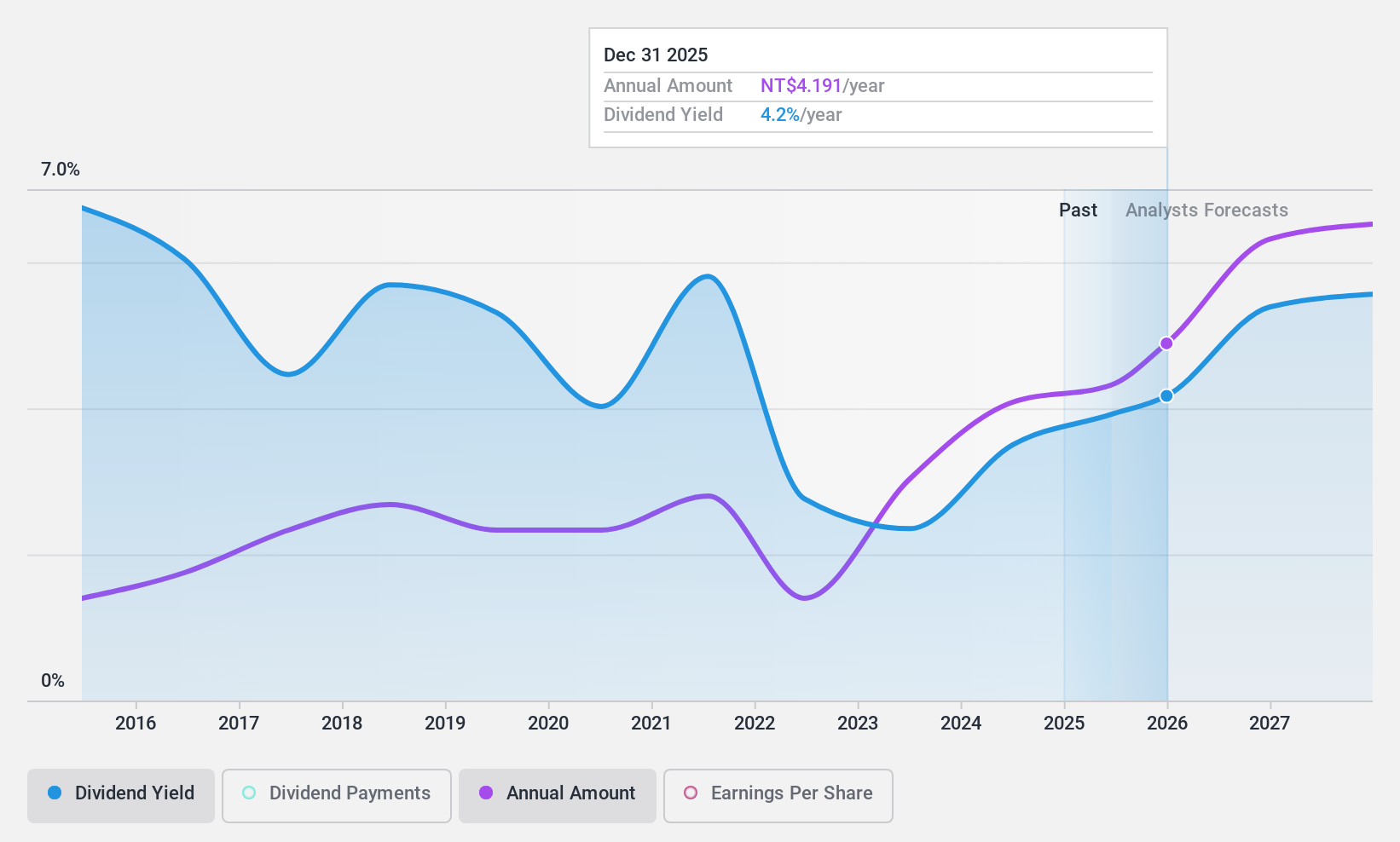

Sunonwealth Electric Machine Industry (TWSE:2421)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sunonwealth Electric Machine Industry Co., Ltd. manufactures and sells precision motors and thermal solutions globally, with a market cap of NT$27.15 billion.

Operations: Sunonwealth Electric Machine Industry Co., Ltd.'s revenue is primarily derived from Greater China, contributing NT$21.88 billion, followed by Europe and America with NT$844.49 million.

Dividend Yield: 3.2%

Sunonwealth Electric Machine Industry's dividend is covered by earnings with a 71% payout ratio and a cash payout ratio of 42.7%, indicating sustainability. However, the dividend has been volatile over the past decade, showing instability despite growth in payments during this period. The yield of 3.23% is below Taiwan's top quartile benchmark of 4.37%. Recent product innovations at the OCP Global Summit may impact future financial performance positively but do not directly affect dividends currently.

- Click here and access our complete dividend analysis report to understand the dynamics of Sunonwealth Electric Machine Industry.

- According our valuation report, there's an indication that Sunonwealth Electric Machine Industry's share price might be on the cheaper side.

Seize The Opportunity

- Dive into all 2047 of the Top Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2421

Sunonwealth Electric Machine Industry

Manufactures and sells precision motors and thermal solutions worldwide.

Flawless balance sheet, undervalued and pays a dividend.