- China

- /

- Gas Utilities

- /

- SHSE:603706

Top Dividend Stocks In China For July 2024

Reviewed by Simply Wall St

As of late, the Chinese stock market has shown signs of weakening, with major indices like the Shanghai Composite and the CSI 300 experiencing slight declines amid economic slowdown concerns. This backdrop sets a cautious stage for investors looking at dividend stocks in China, where stability and consistent yield become even more crucial in navigating uncertain times.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.67% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.76% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.55% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.66% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.91% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.30% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.54% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.59% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

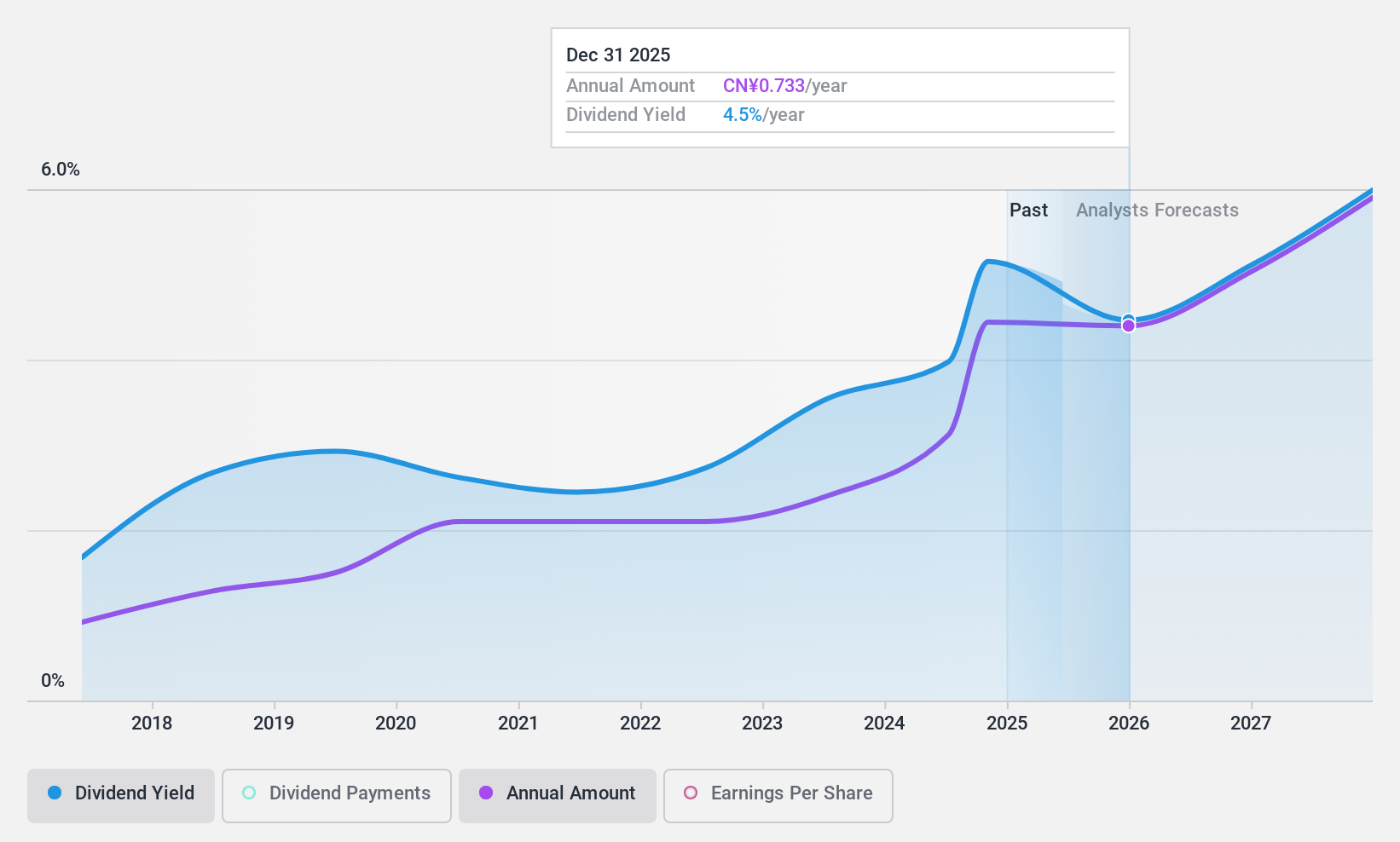

Bank of Hangzhou (SHSE:600926)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Hangzhou Co., Ltd. offers a range of banking products and services to individuals, corporations, and small to micro businesses in China, with a market capitalization of approximately CN¥80.65 billion.

Operations: Bank of Hangzhou Co., Ltd. generates revenue by providing diverse banking products and services tailored for individual customers, corporations, and small to micro-sized enterprises across China.

Dividend Yield: 3.8%

Bank of Hangzhou has shown a robust financial performance with a notable increase in net income from CNY 11.68 billion to CNY 14.38 billion year-over-year and consistent growth in quarterly earnings, highlighting its potential for sustained profitability. Despite a relatively short history of dividend payments—only seven years—the dividends are well-covered by earnings with a low payout ratio of 21.1%, indicating reliability and potential for future increases. However, the track record is not long enough to confirm long-term stability, and the dividend yield, while competitive at 3.82%, accompanies an unstable dividend history which could concern conservative investors seeking predictable returns.

- Unlock comprehensive insights into our analysis of Bank of Hangzhou stock in this dividend report.

- The analysis detailed in our Bank of Hangzhou valuation report hints at an deflated share price compared to its estimated value.

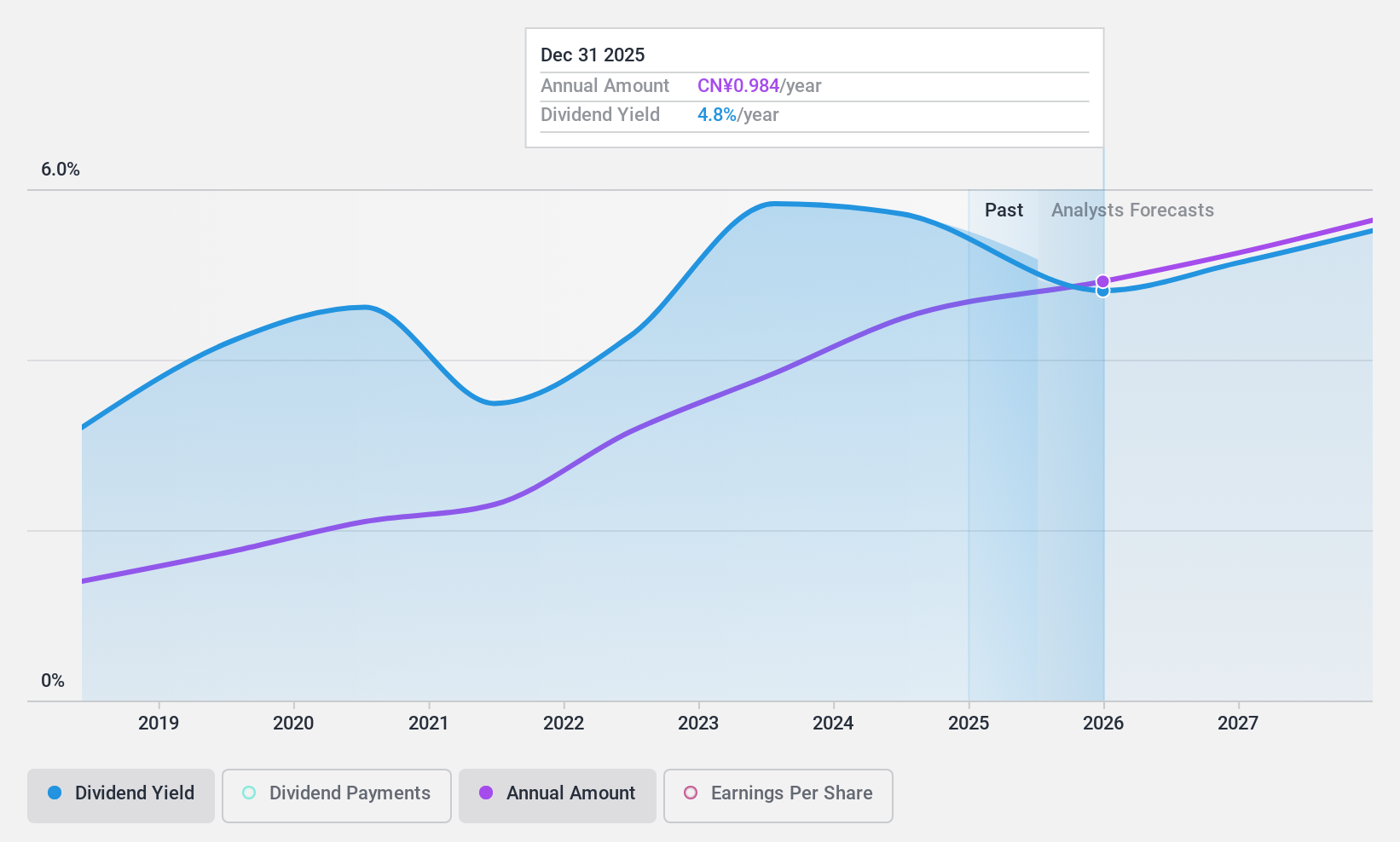

Bank of Chengdu (SHSE:601838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Chengdu Co., Ltd. operates as a commercial bank offering a range of banking products and services in China, with a market capitalization of approximately CN¥60.45 billion.

Operations: Bank of Chengdu Co., Ltd. does not provide detailed breakdowns of its revenue segments in the provided text.

Dividend Yield: 5.7%

Bank of Chengdu reported a solid increase in Q1 2024 earnings, with net interest income rising to CNY 4.63 billion and net income up to CNY 2.85 billion. Despite a short dividend history of six years, the bank has shown consistent dividend growth with a stable payout ratio of 29.1%, suggesting reliability in its payments. The dividends are currently well-covered by earnings and expected to remain so over the next three years, although the bank's brief history of dividend payments may raise concerns about long-term sustainability.

- Get an in-depth perspective on Bank of Chengdu's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Bank of Chengdu's share price might be too pessimistic.

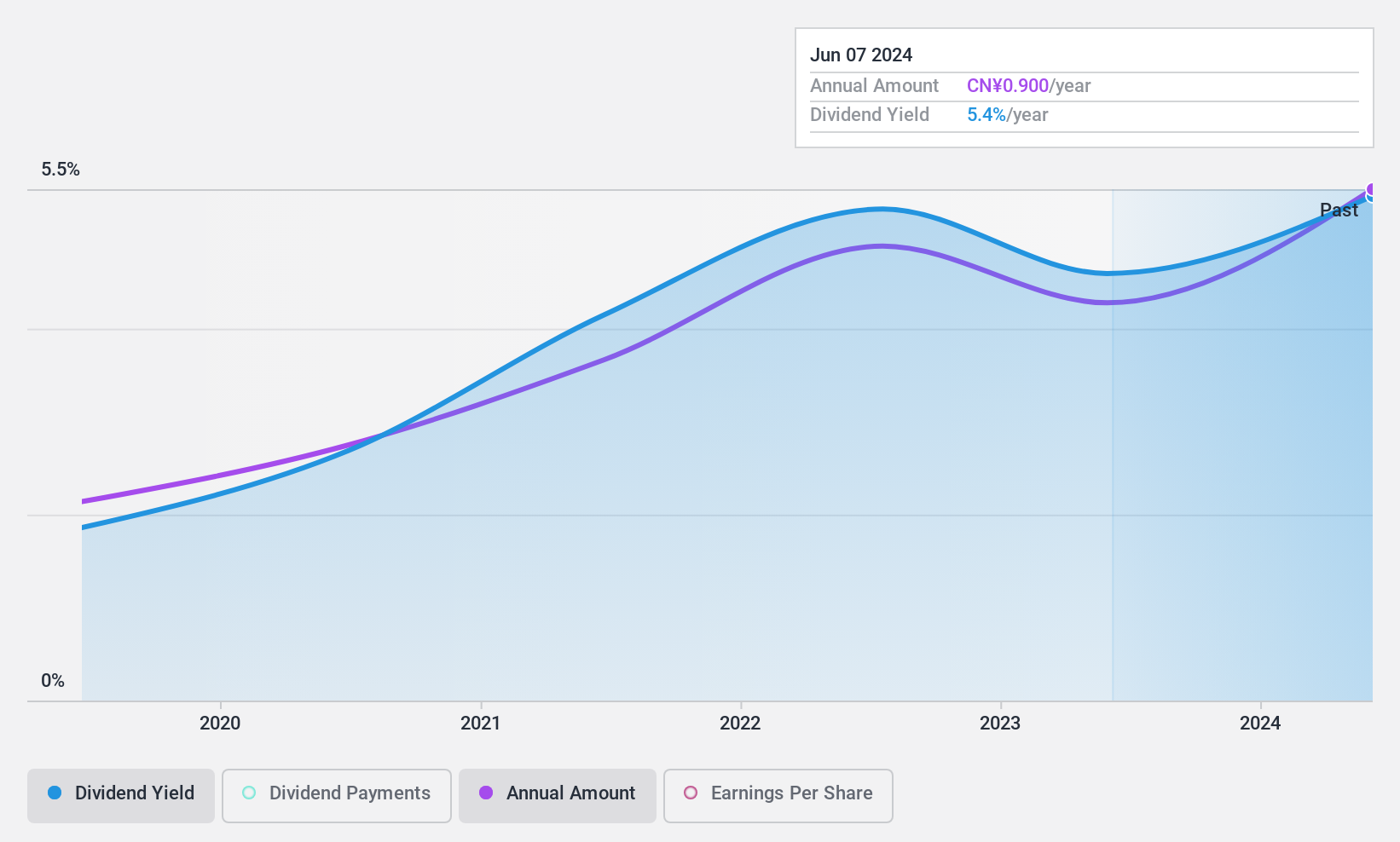

Xinjiang East Universe GasLtd (SHSE:603706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang East Universe Gas Co., Ltd. operates in natural gas sales, equipment installation, and heating services with a market capitalization of approximately CN¥2.88 billion.

Operations: Xinjiang East Universe Gas Co., Ltd. generates its revenue primarily from three activities: selling natural gas, installing natural gas facilities, and providing natural gas heating services.

Dividend Yield: 5.9%

Xinjiang East Universe Gas Co. Ltd. has demonstrated robust earnings growth, with a 45.5% increase over the past year, supporting a sustainable dividend yield of 5.91%, among the top quartile in the Chinese market. Despite trading at 56.9% below estimated fair value and maintaining dividends with an earnings payout ratio of 84% and cash payout ratio of 48.6%, its dividend history under ten years suggests potential concerns about long-term stability and reliability in future payouts.

- Navigate through the intricacies of Xinjiang East Universe GasLtd with our comprehensive dividend report here.

- Our expertly prepared valuation report Xinjiang East Universe GasLtd implies its share price may be lower than expected.

Summing It All Up

- Get an in-depth perspective on all 235 Top Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603706

Xinjiang East Universe GasLtd

Engages in the natural gas sales, natural gas facility equipment installation, and natural gas heating businesses.

Solid track record with excellent balance sheet and pays a dividend.