The total return for Bank of Hangzhou (SHSE:600926) investors has risen faster than earnings growth over the last five years

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Bank of Hangzhou share price has climbed 54% in five years, easily topping the market return of 17% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 41%, including dividends.

Although Bank of Hangzhou has shed CN¥2.7b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Bank of Hangzhou

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

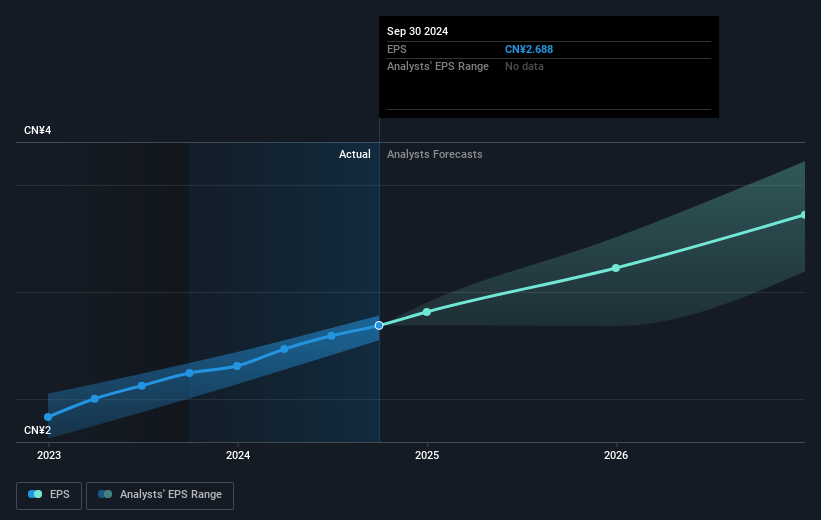

During five years of share price growth, Bank of Hangzhou achieved compound earnings per share (EPS) growth of 19% per year. The EPS growth is more impressive than the yearly share price gain of 9% over the same period. So one could conclude that the broader market has become more cautious towards the stock. The reasonably low P/E ratio of 5.09 also suggests market apprehension.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Bank of Hangzhou's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Bank of Hangzhou, it has a TSR of 84% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Bank of Hangzhou has rewarded shareholders with a total shareholder return of 41% in the last twelve months. And that does include the dividend. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Importantly, we haven't analysed Bank of Hangzhou's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course Bank of Hangzhou may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Hangzhou might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600926

Bank of Hangzhou

Provides various banking products and services to individuals, corporate, and small and micro businesses in China.

Flawless balance sheet, undervalued and pays a dividend.