In recent weeks, Chinese stocks have experienced a notable surge, buoyed by optimism surrounding Beijing's comprehensive support measures despite ongoing challenges in manufacturing and real estate sectors. As investors navigate these dynamic market conditions, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those seeking to balance growth with consistent returns.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 3.94% | ★★★★★★ |

| Lao Feng Xiang (SHSE:600612) | 3.10% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.13% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.18% | ★★★★★★ |

| Changchun High-Tech Industry (Group) (SZSE:000661) | 4.09% | ★★★★★★ |

| Zhejiang HangminLtd (SHSE:600987) | 3.80% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.49% | ★★★★★★ |

| China Merchants Bank (SHSE:600036) | 5.24% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.91% | ★★★★★★ |

Click here to see the full list of 178 stocks from our Top Chinese Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Fujian Expressway DevelopmentLtd (SHSE:600033)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fujian Expressway Development Co., Ltd is involved in the investment, construction, toll collection, maintenance, and management of expressways in China with a market capitalization of CN¥10.29 billion.

Operations: Fujian Expressway Development Co., Ltd generates revenue primarily through its activities in expressway investment, construction, toll collection, maintenance, and operational management within China.

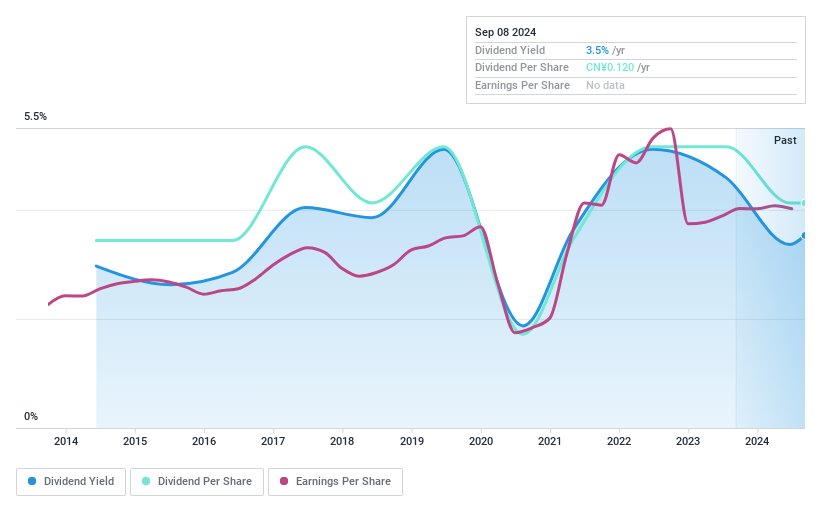

Dividend Yield: 3.2%

Fujian Expressway Development Ltd. offers a mixed picture for dividend investors. Despite a volatile and unreliable dividend history over the past decade, the company's dividends are well covered by earnings and cash flows, with payout ratios of 36.5% and 23.4%, respectively. Its dividend yield of 3.2% ranks in the top 25% of Chinese market payers, though recent earnings show marginal growth with net income at CNY 531.12 million for H1 2024, unchanged from last year.

- Unlock comprehensive insights into our analysis of Fujian Expressway DevelopmentLtd stock in this dividend report.

- According our valuation report, there's an indication that Fujian Expressway DevelopmentLtd's share price might be on the cheaper side.

China Merchants Bank (SHSE:600036)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China Merchants Bank Co., Ltd., along with its subsidiaries, offers a range of banking products and services and has a market cap of approximately CN¥970.34 billion.

Operations: China Merchants Bank Co., Ltd.'s revenue is primarily derived from Retail Financial services at CN¥164.21 billion and Wholesale Financial services at CN¥124.99 billion.

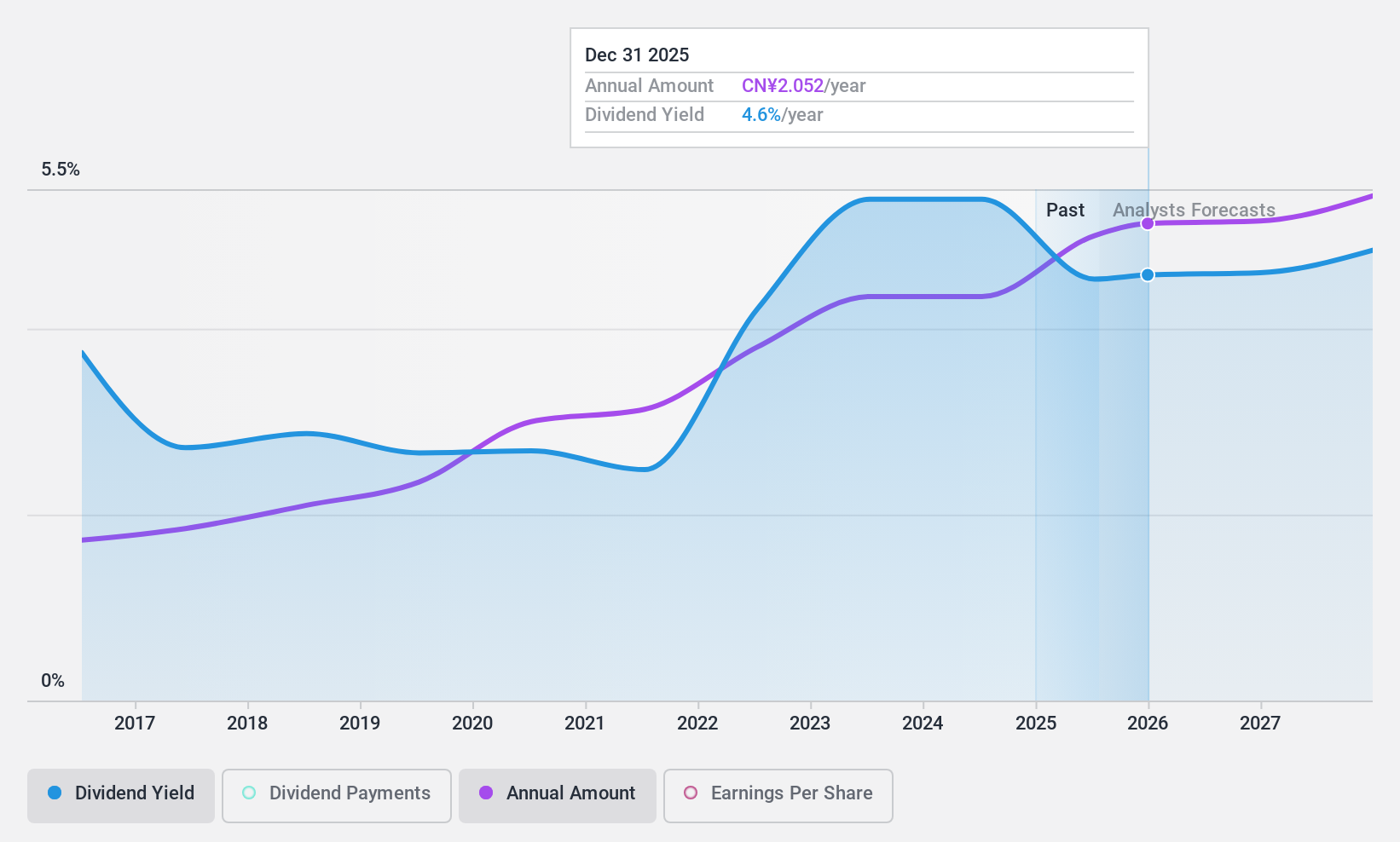

Dividend Yield: 5.2%

China Merchants Bank stands out with a reliable dividend yield of 5.24%, ranking in the top 25% of Chinese market payers. Its dividends are well covered by earnings, maintaining a low payout ratio of 35.3%. Over the past decade, dividends have been stable and growing, supported by consistent earnings growth. Recent H1 2024 results show slight declines in net interest income and net income compared to last year but maintain strong fundamentals for continued dividend reliability.

- Get an in-depth perspective on China Merchants Bank's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that China Merchants Bank is priced higher than what may be justified by its financials.

Xiamen Xiangyu (SHSE:600057)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen Xiangyu Co., Ltd. offers supply chain services in the People’s Republic of China and has a market cap of CN¥14.56 billion.

Operations: Xiamen Xiangyu Co., Ltd.'s revenue segments include supply chain services within the People's Republic of China.

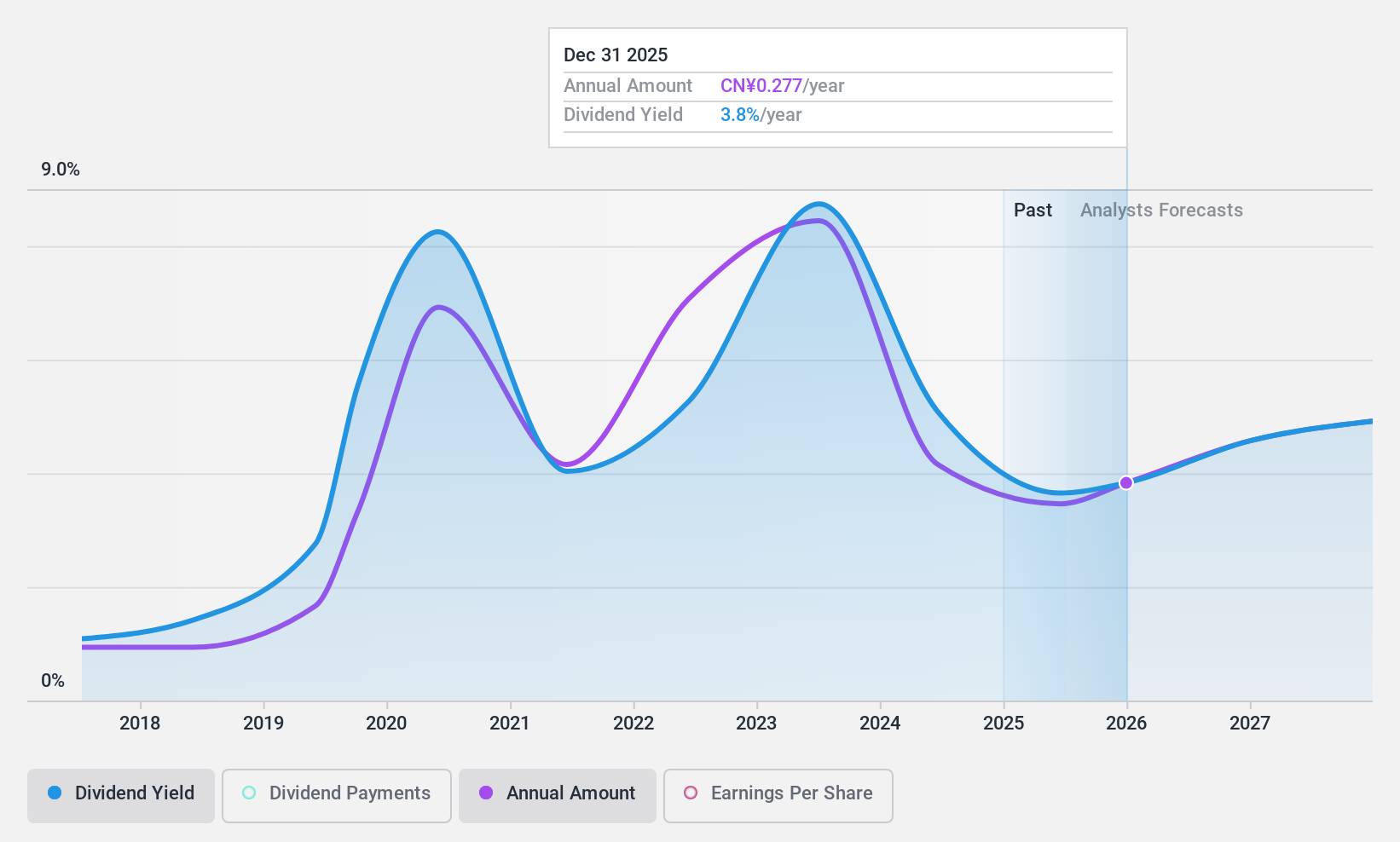

Dividend Yield: 4.7%

Xiamen Xiangyu's dividend yield of 4.68% places it among the top 25% in China, though its track record is unstable with only seven years of payments and volatility. Despite high debt levels, dividends are well-covered by earnings (payout ratio: 55.1%) and cash flows (cash payout ratio: 6.6%). Recent H1 2024 results show a decline in sales to CNY 203.13 billion and net income to CNY 779.06 million, reflecting financial challenges impacting dividend reliability.

- Dive into the specifics of Xiamen Xiangyu here with our thorough dividend report.

- The valuation report we've compiled suggests that Xiamen Xiangyu's current price could be quite moderate.

Where To Now?

- Unlock our comprehensive list of 178 Top Chinese Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600057

Xiamen Xiangyu

Provides supply chain services in the People’s Republic of China.

Undervalued with excellent balance sheet and pays a dividend.