As global markets react to the Federal Reserve's recent rate cut, Chinese equities have shown resilience despite mixed economic data. The Shanghai Composite and CSI 300 indices posted gains, suggesting that investors are cautiously optimistic about China's economic prospects. In this environment, identifying promising stocks requires a focus on companies with strong fundamentals and growth potential amid broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiangtan Electrochemical ScientificLtd | 50.35% | 14.78% | 38.33% | ★★★★★★ |

| Zhejiang Kingland Pipeline and TechnologiesLtd | 1.99% | 3.49% | -8.00% | ★★★★★★ |

| Forest Packaging GroupLtd | 14.94% | -8.49% | -7.06% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | NA | -10.91% | -28.38% | ★★★★★★ |

| Xiangyang Changyuandonggu Industry | 29.88% | -5.98% | -18.53% | ★★★★★★ |

| Founder Technology GroupLtd | 8.93% | -10.67% | 26.84% | ★★★★★★ |

| Zhejiang Chinastars New Materials Group | 43.19% | -3.60% | 2.29% | ★★★★★☆ |

| Hongrun Construction Group | 56.74% | -11.36% | 0.79% | ★★★★★☆ |

| Guangzhou LBP Medicine Science & Technology | 0.65% | 5.07% | -21.27% | ★★★★★☆ |

| Ningbo Kangqiang Electronics | 50.87% | 5.32% | -0.38% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Anhui Huaertai Chemical (SZSE:001217)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anhui Huaertai Chemical Co., Ltd. engages in the research and development, production, and sale of chemical products with a market cap of CN¥2.91 billion.

Operations: Anhui Huaertai Chemical generates revenue primarily from its Chemical segment (CN¥439.85 million) and Basic Chemical Industry segment (CN¥1.31 billion).

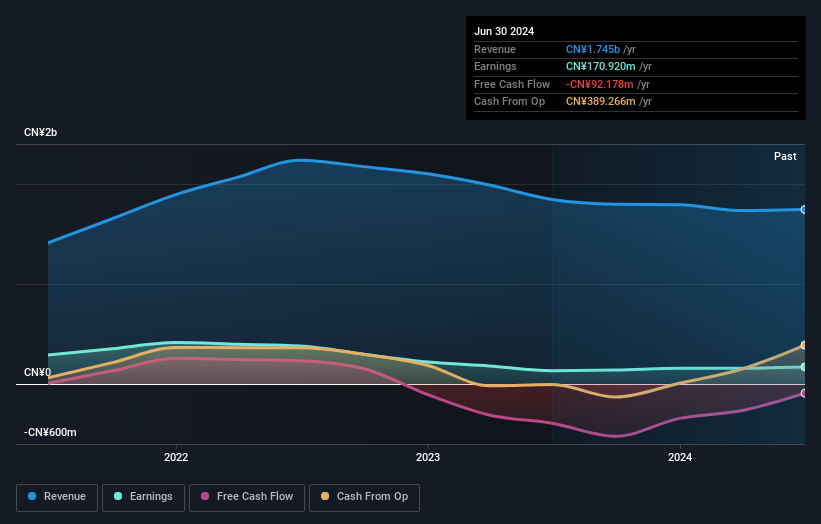

Anhui Huaertai Chemical, a smaller player in the chemicals sector, reported half-year revenue of CNY 825.07 million and net income of CNY 71.09 million as of June 2024. Despite a 9.9% annual earnings decline over five years, recent growth hit 28.2%, outpacing the industry average (-4.8%). The company’s debt to equity ratio improved from 14.9% to 2.3% over five years, and it trades at a notable discount—26.1% below estimated fair value—suggesting potential upside for investors seeking undervalued opportunities in China’s chemical industry.

Luyang Energy-Saving Materials (SZSE:002088)

Simply Wall St Value Rating: ★★★★★★

Overview: Luyang Energy-Saving Materials Co., Ltd. researches, develops, produces, and sells energy-saving products in the fields of ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick in China and internationally with a market cap of CN¥5.08 billion.

Operations: Luyang Energy-Saving Materials generates revenue primarily from the sale of ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick. The company reported a market cap of CN¥5.08 billion.

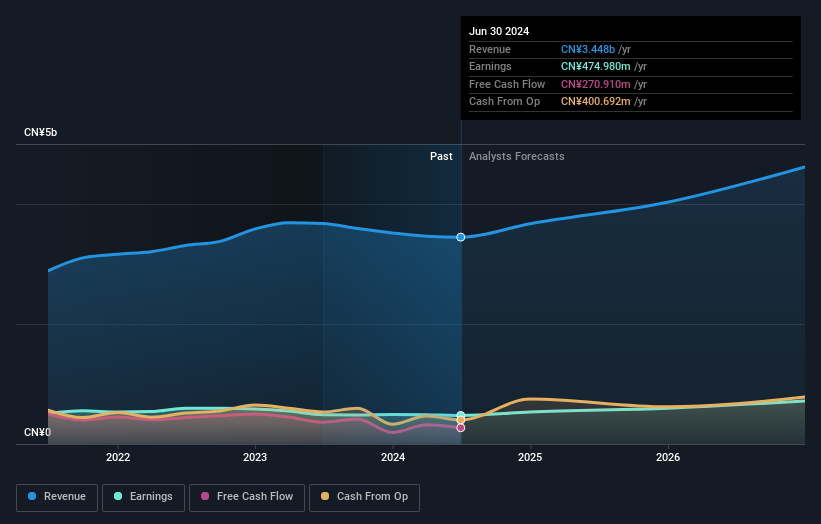

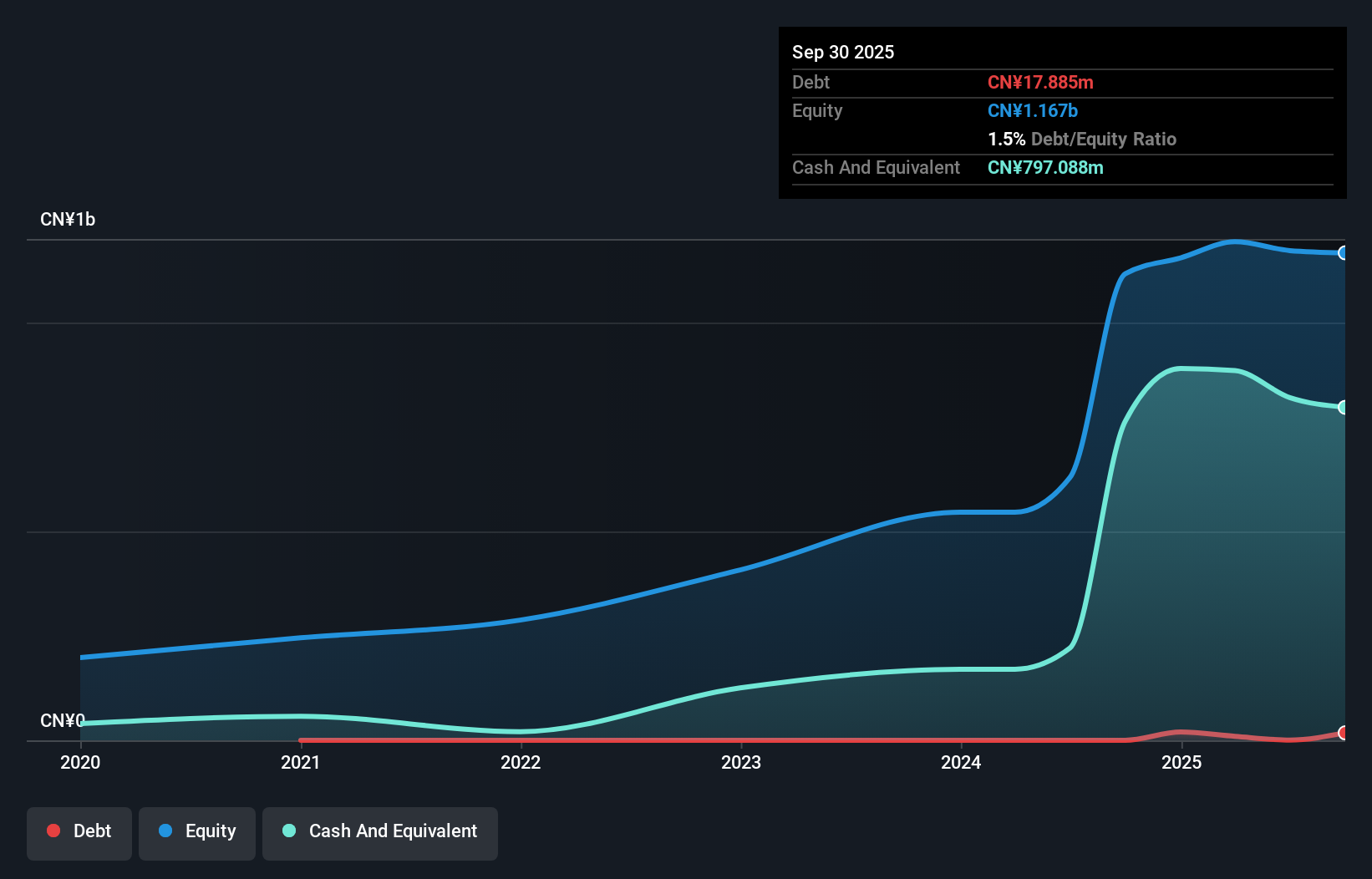

Luyang Energy-Saving Materials, a notable player in the energy-efficient materials sector, has shown mixed performance recently. Despite a reduction in sales to CNY 1.60 billion for the half-year ending June 2024 from CNY 1.66 billion previously, their debt-to-equity ratio improved significantly from 0.6 to 0.08 over five years. With earnings forecasted to grow at an annual rate of 15.66%, and trading at a P/E ratio of just 10.7x compared to the CN market's average of 26.4x, Luyang remains attractive despite recent net income dropping slightly from CNY 224 million to CNY 207 million year-over-year.

Hebei Keli Automobile Equipment (SZSE:301552)

Simply Wall St Value Rating: ★★★★★★

Overview: Hebei Keli Automobile Equipment Co., Ltd. (ticker: SZSE:301552) specializes in the production and sale of auto parts and accessories, with a market cap of CN¥2.72 billion.

Operations: The company generates revenue primarily from the sale of auto parts and accessories, amounting to CN¥564.81 million.

Hebei Keli Automobile Equipment has demonstrated strong performance with earnings growing 24.6% over the past year, surpassing the Auto Components industry’s 19.4%. The company reported half-year sales of CNY 283.03 million and net income of CNY 78.93 million, up from CNY 205.97 million and CNY 58.31 million respectively a year ago. Additionally, Hebei Keli completed an IPO raising CNY 510 million in July and is trading at a significant discount to its estimated fair value by approximately 21.7%.

Next Steps

- Dive into all 935 of the Chinese Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002088

Luyang Energy-Saving Materials

Researches and develops, produces, and sells energy-saving products in the field of ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick in China and internationally.

Flawless balance sheet average dividend payer.