- China

- /

- Auto Components

- /

- SZSE:301298

What Baoding Dongli Machinery Co.,Ltd.'s (SZSE:301298) 28% Share Price Gain Is Not Telling You

Baoding Dongli Machinery Co.,Ltd. (SZSE:301298) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

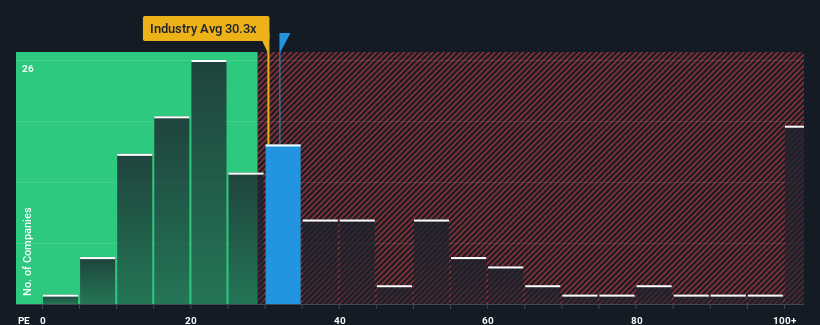

In spite of the firm bounce in price, there still wouldn't be many who think Baoding Dongli MachineryLtd's price-to-earnings (or "P/E") ratio of 31.9x is worth a mention when the median P/E in China is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Baoding Dongli MachineryLtd has been doing a decent job lately as it's been growing earnings at a reasonable pace. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for Baoding Dongli MachineryLtd

How Is Baoding Dongli MachineryLtd's Growth Trending?

In order to justify its P/E ratio, Baoding Dongli MachineryLtd would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.2% last year. The latest three year period has also seen a 25% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Baoding Dongli MachineryLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Baoding Dongli MachineryLtd's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Baoding Dongli MachineryLtd revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 2 warning signs for Baoding Dongli MachineryLtd (1 is potentially serious!) that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Baoding Dongli MachineryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301298

Baoding Dongli MachineryLtd

Manufactures and supplies automobile parts in China and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success