- China

- /

- Auto Components

- /

- SZSE:300928

Investors Give HAXC Holdings (Beijing) Co., Ltd. (SZSE:300928) Shares A 36% Hiding

The HAXC Holdings (Beijing) Co., Ltd. (SZSE:300928) share price has fared very poorly over the last month, falling by a substantial 36%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

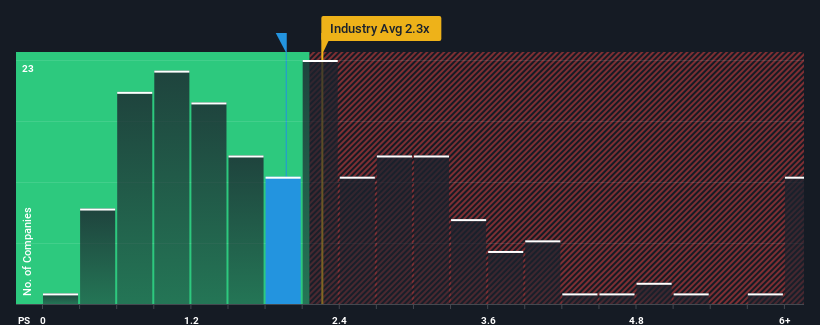

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about HAXC Holdings (Beijing)'s P/S ratio of 2x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in China is also close to 2.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for HAXC Holdings (Beijing)

What Does HAXC Holdings (Beijing)'s Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, HAXC Holdings (Beijing) has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HAXC Holdings (Beijing).Is There Some Revenue Growth Forecasted For HAXC Holdings (Beijing)?

In order to justify its P/S ratio, HAXC Holdings (Beijing) would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. The latest three year period has also seen a 19% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 47% per year as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 19% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that HAXC Holdings (Beijing)'s P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does HAXC Holdings (Beijing)'s P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for HAXC Holdings (Beijing) looks to be in line with the rest of the Auto Components industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, HAXC Holdings (Beijing)'s P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for HAXC Holdings (Beijing) (2 are a bit concerning) you should be aware of.

If you're unsure about the strength of HAXC Holdings (Beijing)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HAXC Holdings (Beijing) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300928

HAXC Holdings (Beijing)

Manufactures and sells automotive cockpit electronics.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives