- China

- /

- Auto Components

- /

- SZSE:300926

A Piece Of The Puzzle Missing From Jiangsu Bojun Industrial Technology Co., Ltd's (SZSE:300926) 33% Share Price Climb

Jiangsu Bojun Industrial Technology Co., Ltd (SZSE:300926) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

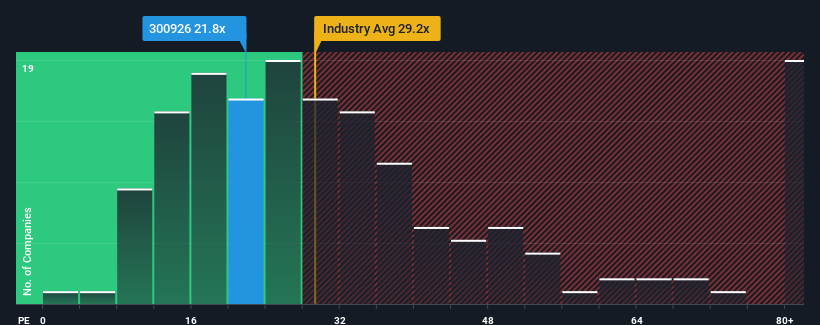

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Jiangsu Bojun Industrial Technology as an attractive investment with its 21.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Jiangsu Bojun Industrial Technology as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Jiangsu Bojun Industrial Technology

How Is Jiangsu Bojun Industrial Technology's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Jiangsu Bojun Industrial Technology's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 83%. The strong recent performance means it was also able to grow EPS by 381% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 27% per year as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

With this information, we find it odd that Jiangsu Bojun Industrial Technology is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Jiangsu Bojun Industrial Technology's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Jiangsu Bojun Industrial Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Jiangsu Bojun Industrial Technology that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300926

Jiangsu Bojun Industrial Technology

Engages in the research and development, production, and sale of precision automotive parts and molds in China and internationally.

Solid track record and fair value.

Market Insights

Community Narratives