- China

- /

- Auto Components

- /

- SZSE:300681

Why We're Not Concerned Yet About Zhuhai Enpower Electric Co.,Ltd.'s (SZSE:300681) 27% Share Price Plunge

Zhuhai Enpower Electric Co.,Ltd. (SZSE:300681) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

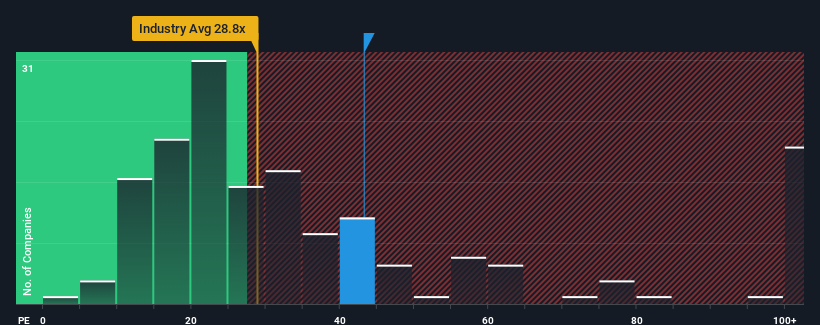

Even after such a large drop in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may still consider Zhuhai Enpower ElectricLtd as a stock to potentially avoid with its 43.2x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Zhuhai Enpower ElectricLtd has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Zhuhai Enpower ElectricLtd

Is There Enough Growth For Zhuhai Enpower ElectricLtd?

Zhuhai Enpower ElectricLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 195%. The strong recent performance means it was also able to grow EPS by 448% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 35% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Zhuhai Enpower ElectricLtd is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From Zhuhai Enpower ElectricLtd's P/E?

There's still some solid strength behind Zhuhai Enpower ElectricLtd's P/E, if not its share price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Zhuhai Enpower ElectricLtd maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zhuhai Enpower ElectricLtd (at least 1 which is concerning), and understanding them should be part of your investment process.

You might be able to find a better investment than Zhuhai Enpower ElectricLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhuhai Enpower ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300681

Zhuhai Enpower ElectricLtd

Engages in the research and development, production, and sale of new energy vehicle power systems in China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives