- China

- /

- Auto Components

- /

- SZSE:300547

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets rally toward record highs, buoyed by optimism surrounding trade policies and advancements in artificial intelligence, small-cap stocks have not kept pace with their larger counterparts. Despite this disparity, the current economic landscape—marked by a resurgence in manufacturing activity and tempered consumer sentiment—presents unique opportunities for investors seeking undiscovered gems within the small-cap sector. Identifying promising stocks often involves looking for companies that can capitalize on emerging trends or possess strong fundamentals that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Xili Intelligent TechnologyLtd | NA | 10.32% | 5.63% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 14.05% | -0.88% | 72.94% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Zhejiang Rongtai Electric MaterialLtd (SHSE:603119)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Rongtai Electric Material Co., Ltd. operates in the electric materials industry with a market cap of CN¥9.76 billion.

Operations: Rongtai Electric Material's revenue streams and cost structures are not explicitly detailed in the provided text. However, with a market cap of CN¥9.76 billion, the company operates within the electric materials industry.

Zhejiang Rongtai Electric Material, a small player in the electrical industry, has demonstrated robust growth with earnings surging 40.8% over the past year, outpacing the industry's modest 0.8% rise. The company boasts high-quality earnings and maintains a strong financial position with more cash than total debt, ensuring interest payments are comfortably covered. Despite no share repurchases from October to December 2024, they completed a buyback of 936,590 shares earlier for CNY 22.51 million. Future prospects look promising as earnings are forecasted to grow at an impressive rate of 33.41% annually.

DongGuan Winnerway Industry Zone (SZSE:000573)

Simply Wall St Value Rating: ★★★★☆☆

Overview: DongGuan Winnerway Industry Zone LTD. operates in the real estate development sector in China with a market capitalization of CN¥3.41 billion.

Operations: DongGuan Winnerway Industry Zone LTD. derives its revenue primarily from real estate development activities in China. The company's financial performance includes a net profit margin that reflects its profitability relative to total revenue.

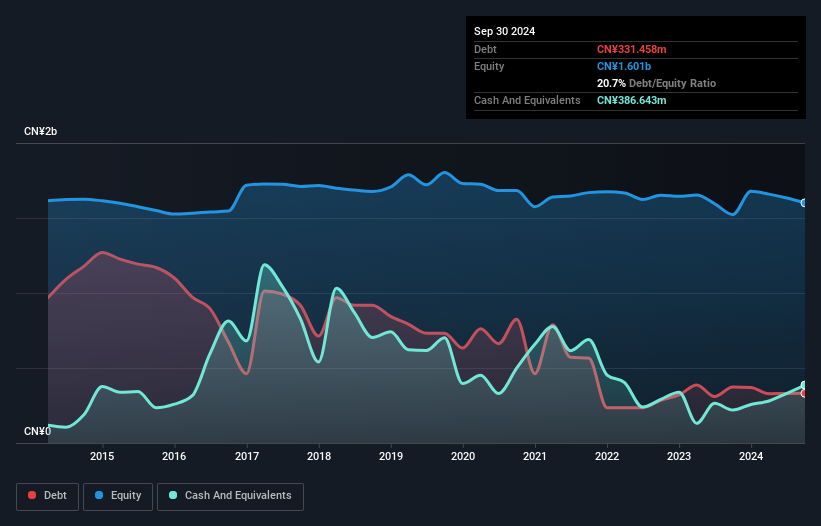

DongGuan Winnerway Industry Zone, a relatively small player in its sector, has shown notable financial resilience. This year, it turned profitable and reduced its debt to equity ratio from 40.6% to 20.7% over five years. Despite high-quality earnings and a price-to-earnings ratio of 35.7x—below the industry average of 43.3x—the company reported a net loss of ¥38.76 million for the first nine months of 2024, down from ¥68.31 million last year, indicating improvement in financial health amidst volatility in share price over recent months.

Sichuan Chuanhuan TechnologyLtd (SZSE:300547)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Chuanhuan Technology Co., Ltd. focuses on the research, development, production, and sale of automotive rubber hose series products in China with a market capitalization of CN¥6.59 billion.

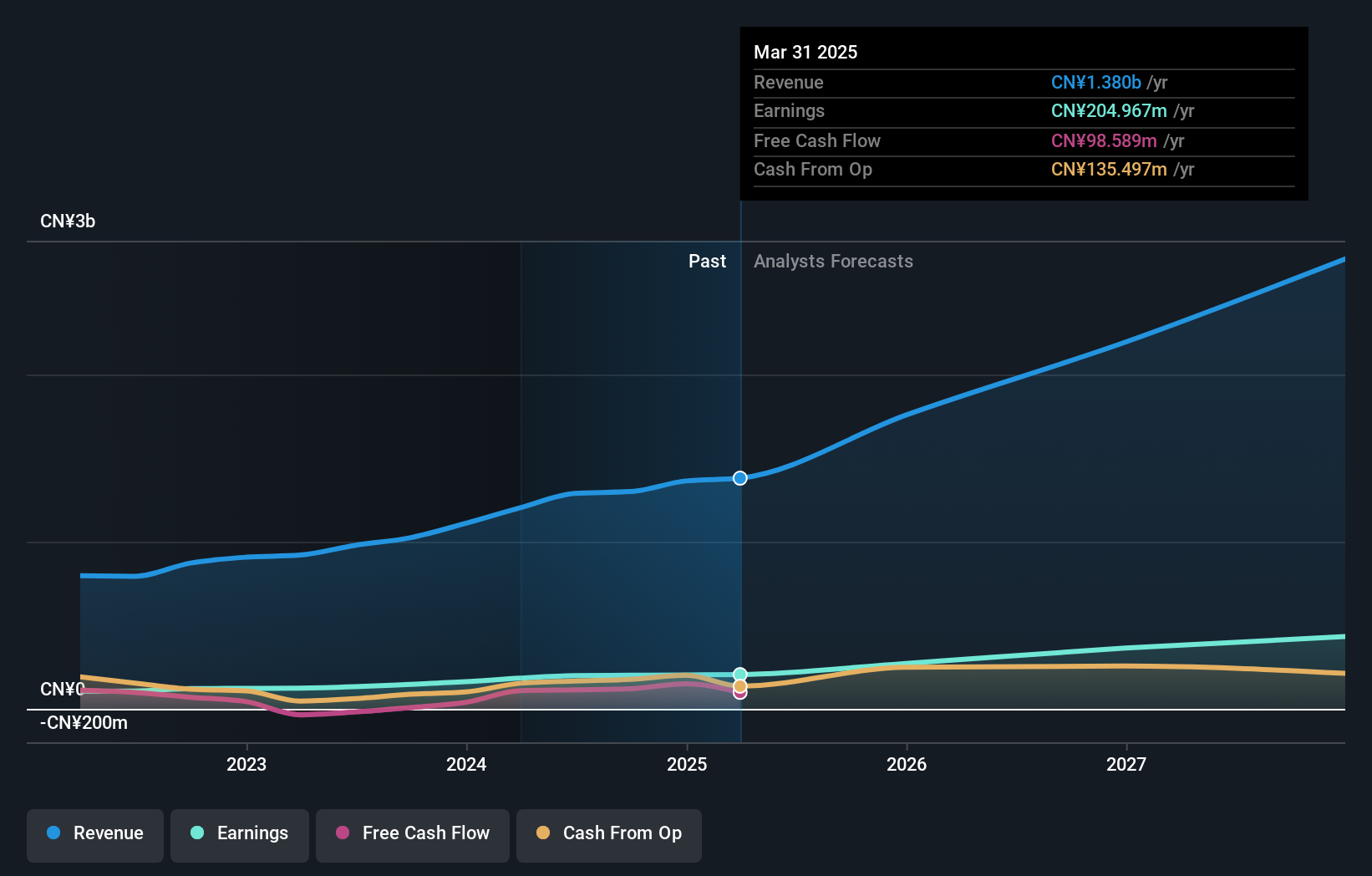

Operations: With a revenue of CN¥1.30 billion from non-tire rubber products, Sichuan Chuanhuan Technology Co., Ltd. operates primarily in the automotive sector.

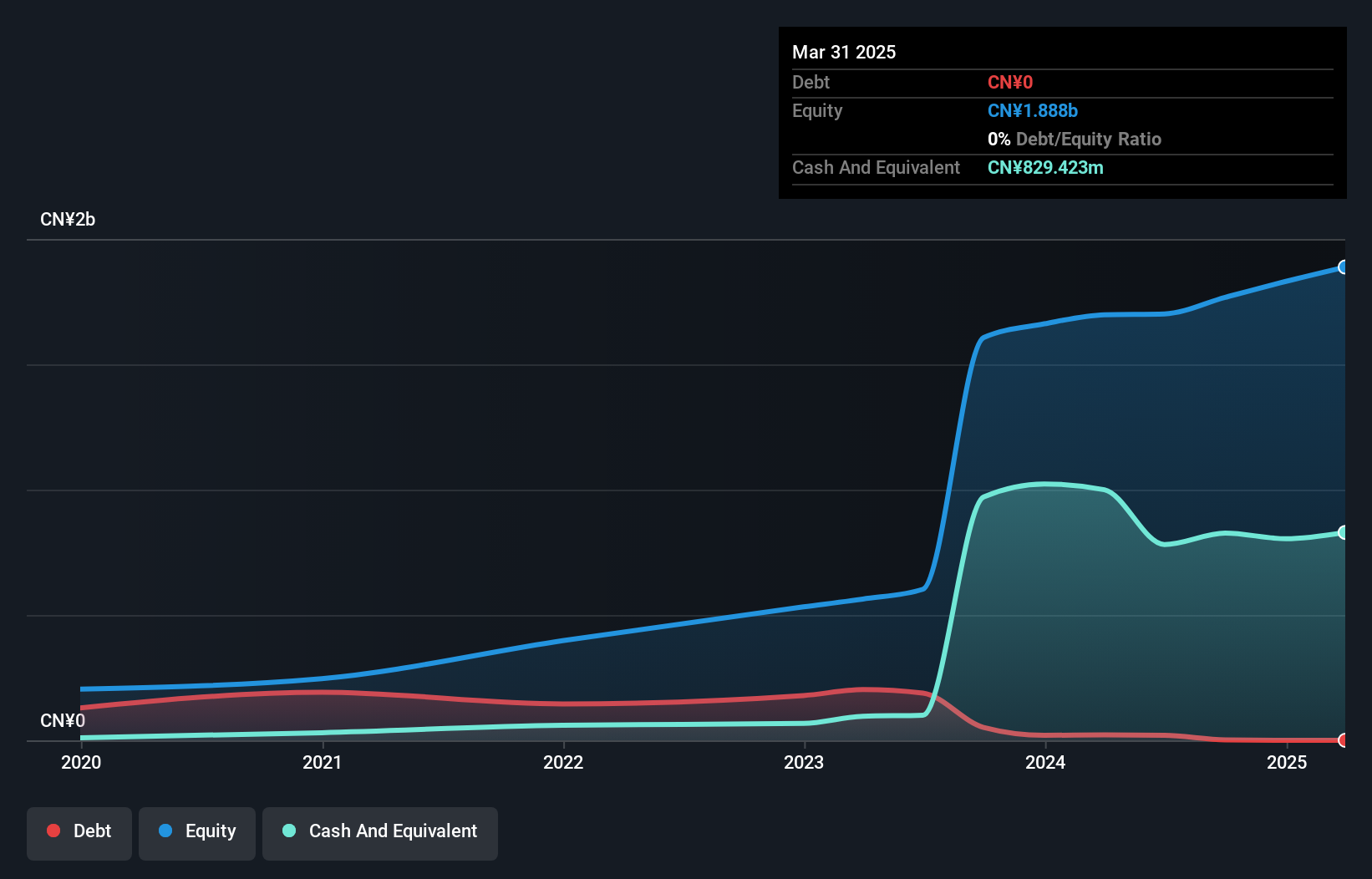

Sichuan Chuanhuan Technology, a promising player in the auto components sector, has demonstrated robust earnings growth of 37% over the past year, outpacing the industry average of 10%. With no debt on its books for five years, financial stability is a strong suit. The company offers good value with a price-to-earnings ratio of 32.8x compared to the broader CN market's 34.7x. Despite recent share price volatility, its high-quality earnings and positive free cash flow underscore resilience. A recent dividend announcement further highlights shareholder returns with CNY1.40 per 10 shares distributed in November 2024.

Summing It All Up

- Unlock our comprehensive list of 4671 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300547

Sichuan Chuanhuan TechnologyLtd

Engages in the research, development, production, and sale of automotive rubber hose series products in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives