- China

- /

- Auto Components

- /

- SZSE:300432

After Leaping 26% Fulin Precision Co., Ltd. (SZSE:300432) Shares Are Not Flying Under The Radar

Despite an already strong run, Fulin Precision Co., Ltd. (SZSE:300432) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 158% following the latest surge, making investors sit up and take notice.

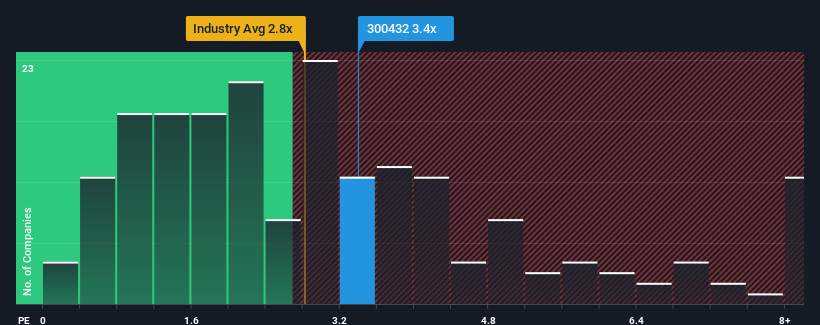

After such a large jump in price, given close to half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Fulin Precision as a stock to potentially avoid with its 3.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Fulin Precision

How Fulin Precision Has Been Performing

Fulin Precision could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Fulin Precision will help you uncover what's on the horizon.How Is Fulin Precision's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Fulin Precision's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 9.8%. Pleasingly, revenue has also lifted 220% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 68% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we can see why Fulin Precision is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Fulin Precision's P/S Mean For Investors?

The large bounce in Fulin Precision's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Fulin Precision shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Fulin Precision (of which 1 shouldn't be ignored!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300432

Fulin Precision

Engages in the research and development, manufacture, and sale of automotive engine parts in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives