Stock Analysis

3 Promising Penny Stocks With Market Caps Over US$500M

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. indexes nearing record highs and smaller-cap indexes outperforming their larger counterparts, despite geopolitical tensions and economic uncertainties. In this context, identifying promising investment opportunities requires a keen eye for companies with solid fundamentals and growth potential. Penny stocks, though an outdated term, still represent smaller or newer companies that can offer significant value when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$68.57M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.205 | £418.21M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$146.79M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.59 | £68.47M | ★★★★☆☆ |

| CSE Global (SGX:544) | SGD0.44 | SGD310.8M | ★★★★★☆ |

Click here to see the full list of 5,772 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Shandong Mining Machinery Group (SZSE:002526)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shandong Mining Machinery Group Co., Ltd. operates in the manufacturing and distribution of mining machinery and equipment, with a market cap of CN¥4.83 billion.

Operations: Revenue segments for the company are not reported.

Market Cap: CN¥4.83B

Shandong Mining Machinery Group, with a market cap of CN¥4.83 billion, faces challenges in its financial performance. Over the past year, earnings have declined significantly by 59.6%, and profit margins decreased to 3.3% from 6.7%. Despite high-quality earnings and more cash than debt, the company's return on equity is low at 2.4%. Short-term assets of CN¥3.3 billion comfortably cover both short- and long-term liabilities, but negative operating cash flow raises concerns about debt coverage sustainability. Recent reports show declining sales and net income compared to last year, highlighting ongoing financial pressures for this penny stock contender.

- Jump into the full analysis health report here for a deeper understanding of Shandong Mining Machinery Group.

- Gain insights into Shandong Mining Machinery Group's past trends and performance with our report on the company's historical track record.

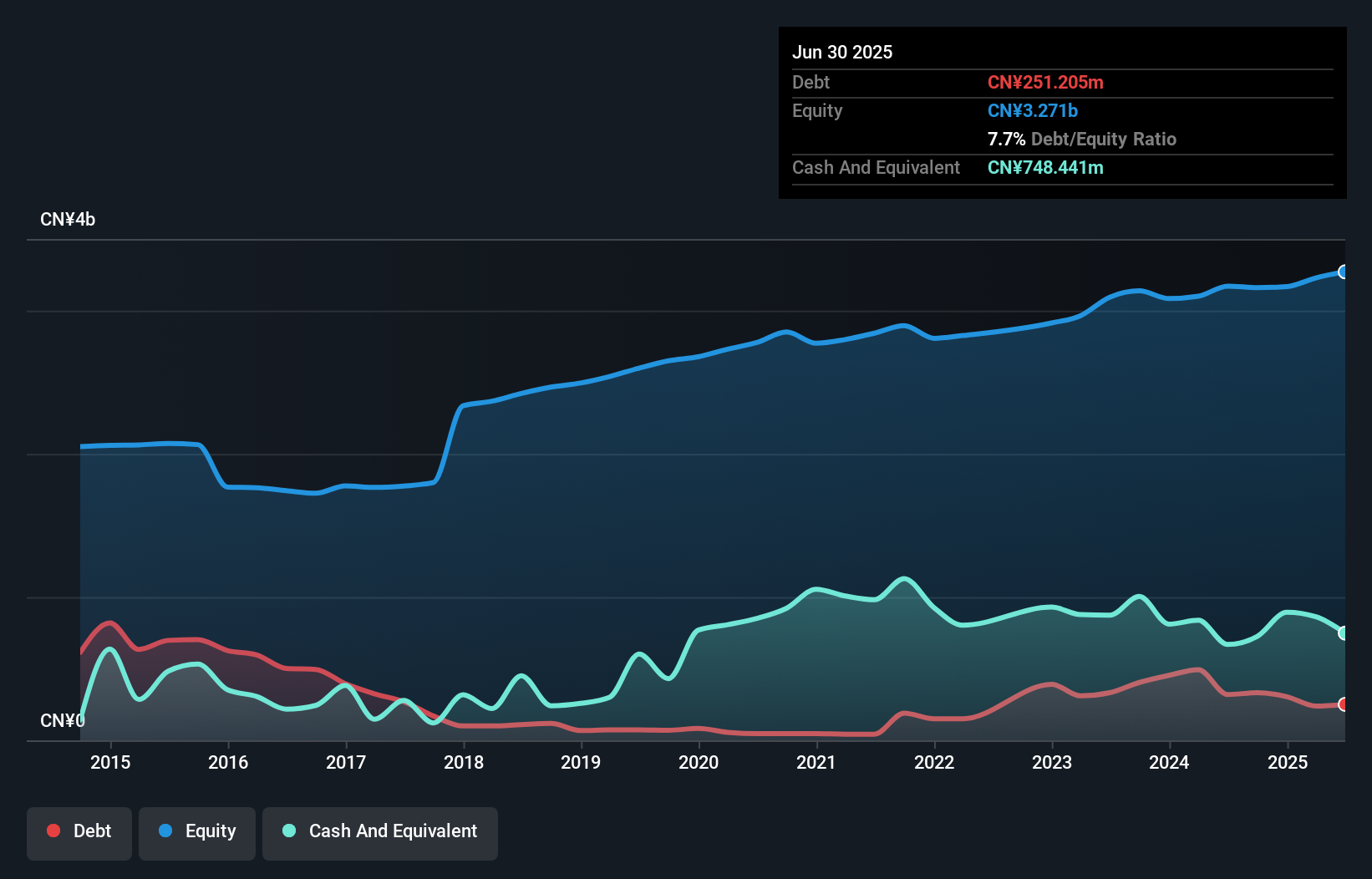

Fuan Pharmaceutical (Group) (SZSE:300194)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fuan Pharmaceutical (Group) Co., Ltd. engages in the research, development, production, and sale of chemical drugs in China and has a market capitalization of approximately CN¥5.77 billion.

Operations: The company generates revenue of CN¥2.66 billion from its operations in the pharmaceutical industry.

Market Cap: CN¥5.77B

Fuan Pharmaceutical (Group) Co., Ltd., with a market cap of CN¥5.77 billion, shows mixed financial signals for investors exploring penny stocks. The company reported revenue of CN¥1.99 billion and net income of CN¥301.61 million for the first nine months of 2024, indicating profitability despite a decline in profit margins from 12.2% to 10.6%. Its seasoned management team and board provide stability, while short-term assets exceed liabilities significantly, suggesting sound liquidity management. However, negative earnings growth over the past year and low return on equity at 6.4% highlight areas needing improvement amidst stable weekly volatility and no significant shareholder dilution recently.

- Click to explore a detailed breakdown of our findings in Fuan Pharmaceutical (Group)'s financial health report.

- Explore historical data to track Fuan Pharmaceutical (Group)'s performance over time in our past results report.

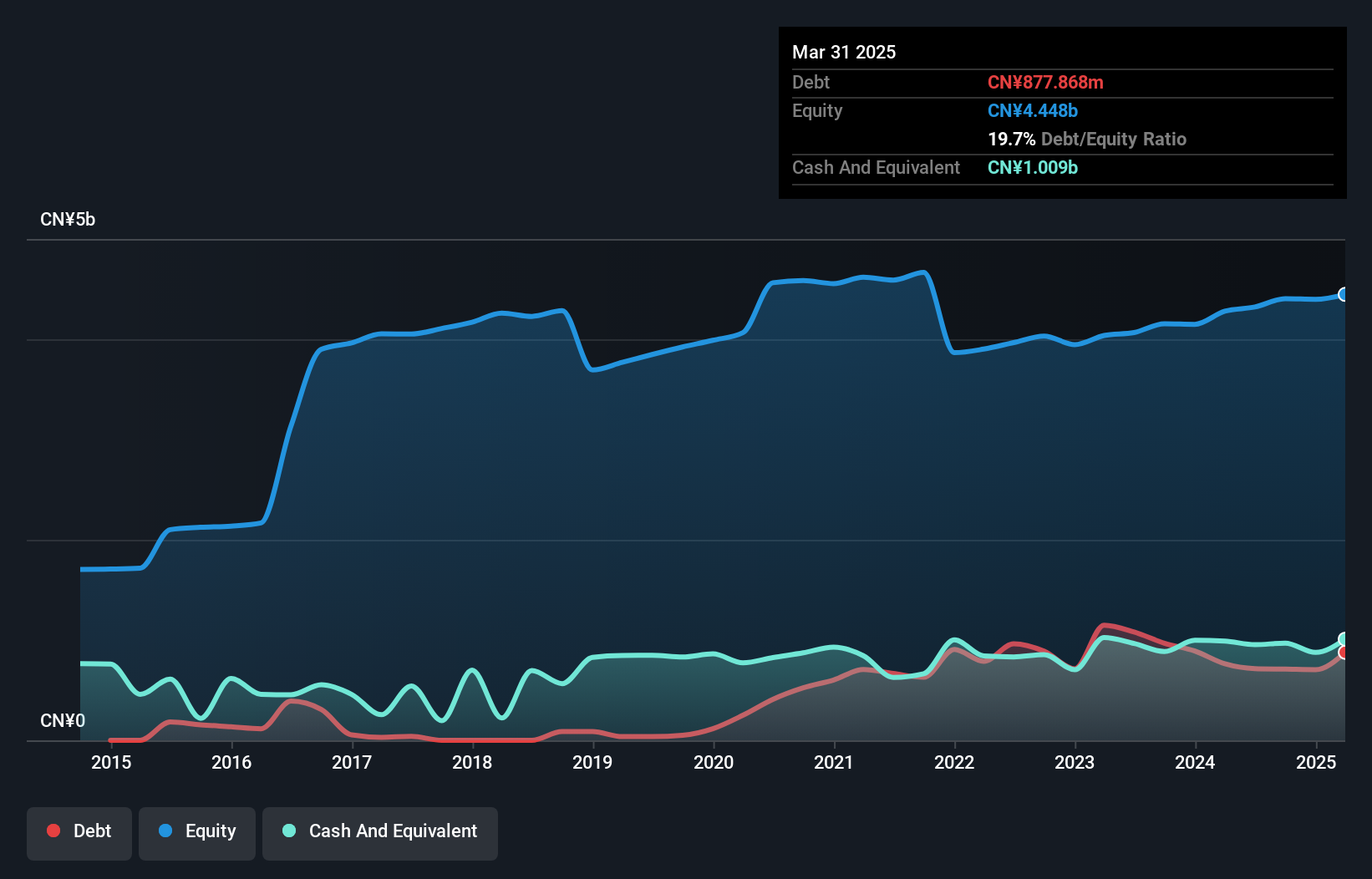

Tianjin Pengling GroupLtd (SZSE:300375)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tianjin Pengling Group Co., Ltd. specializes in the research, development, and manufacture of automotive fluid pipelines and sealing parts for both domestic and international markets, with a market cap of CN¥3.75 billion.

Operations: The company's revenue is primarily derived from its Non-Tire Rubber Products segment, which generated CN¥2.31 billion.

Market Cap: CN¥3.75B

Tianjin Pengling Group Ltd., with a market cap of CN¥3.75 billion, presents a complex picture for penny stock investors. The company's revenue from its Non-Tire Rubber Products segment reached CN¥2.31 billion, with recent earnings showing growth in sales and net income compared to the previous year. Despite this, challenges remain as profit margins have declined, and earnings have decreased by 8.2% annually over the past five years. Financial stability is evident as short-term assets cover liabilities well, but low return on equity at 2.7% and inexperienced management pose potential risks alongside stable weekly volatility and no significant shareholder dilution recently.

- Click here to discover the nuances of Tianjin Pengling GroupLtd with our detailed analytical financial health report.

- Understand Tianjin Pengling GroupLtd's track record by examining our performance history report.

Make It Happen

- Unlock our comprehensive list of 5,772 Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300194

Fuan Pharmaceutical (Group)

Research and develops, produces, and sells chemical drugs in the People's Republic of China.