- China

- /

- Auto Components

- /

- SZSE:002611

Guangdong Dongfang Precision Science & Technology Co., Ltd.'s (SZSE:002611) Shares Bounce 35% But Its Business Still Trails The Market

Guangdong Dongfang Precision Science & Technology Co., Ltd. (SZSE:002611) shares have continued their recent momentum with a 35% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 64%.

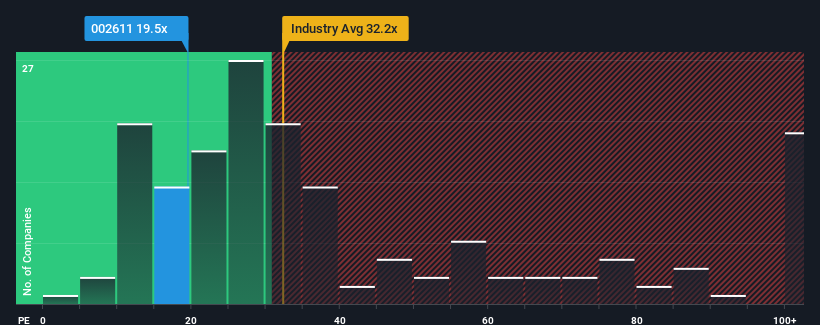

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may still consider Guangdong Dongfang Precision Science & Technology as an attractive investment with its 19.5x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Guangdong Dongfang Precision Science & Technology's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Guangdong Dongfang Precision Science & Technology

Does Growth Match The Low P/E?

Guangdong Dongfang Precision Science & Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 16% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 40% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Guangdong Dongfang Precision Science & Technology is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Guangdong Dongfang Precision Science & Technology's P/E

The latest share price surge wasn't enough to lift Guangdong Dongfang Precision Science & Technology's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Guangdong Dongfang Precision Science & Technology revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Guangdong Dongfang Precision Science & Technology with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Guangdong Dongfang Precision Science & Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002611

Guangdong Dongfang Precision Science & Technology

Engages in the research, development, production, and sale of corrugated packaging equipment in China and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives