- China

- /

- Auto Components

- /

- SZSE:002472

Investors Still Aren't Entirely Convinced By Zhejiang Shuanghuan Driveline Co.,Ltd.'s (SZSE:002472) Earnings Despite 35% Price Jump

Zhejiang Shuanghuan Driveline Co.,Ltd. (SZSE:002472) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 2.2% isn't as impressive.

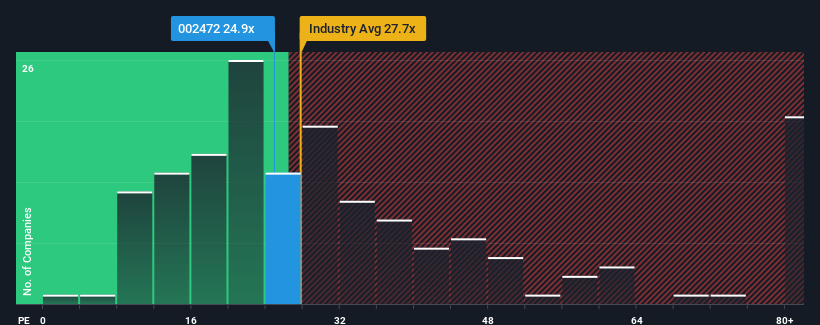

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may still consider Zhejiang Shuanghuan DrivelineLtd as an attractive investment with its 24.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Zhejiang Shuanghuan DrivelineLtd as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Zhejiang Shuanghuan DrivelineLtd

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Zhejiang Shuanghuan DrivelineLtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 27%. Pleasingly, EPS has also lifted 295% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 18% per annum over the next three years. With the market predicted to deliver 19% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Zhejiang Shuanghuan DrivelineLtd's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Zhejiang Shuanghuan DrivelineLtd's P/E?

Despite Zhejiang Shuanghuan DrivelineLtd's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Zhejiang Shuanghuan DrivelineLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Zhejiang Shuanghuan DrivelineLtd with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Shuanghuan DrivelineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002472

Zhejiang Shuanghuan DrivelineLtd

Engages in the design, research and development, and manufacturing of mechanical transmission gears and related parts in China and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026