- China

- /

- Auto Components

- /

- SZSE:002213

Subdued Growth No Barrier To Shenzhen Dawei Innovation Technology Co., Ltd. (SZSE:002213) With Shares Advancing 30%

Shenzhen Dawei Innovation Technology Co., Ltd. (SZSE:002213) shares have continued their recent momentum with a 30% gain in the last month alone. The annual gain comes to 132% following the latest surge, making investors sit up and take notice.

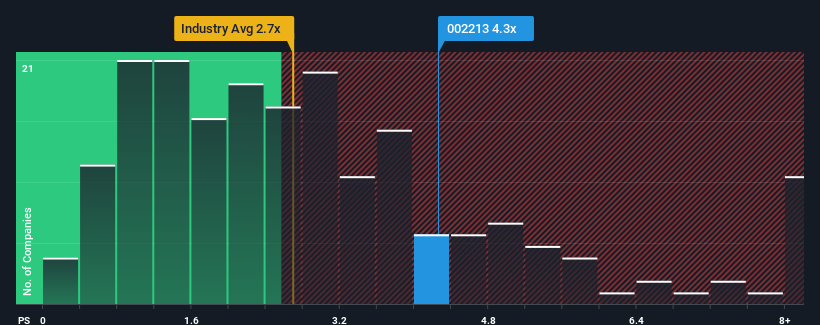

Since its price has surged higher, when almost half of the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider Shenzhen Dawei Innovation Technology as a stock probably not worth researching with its 4.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Shenzhen Dawei Innovation Technology

How Shenzhen Dawei Innovation Technology Has Been Performing

Shenzhen Dawei Innovation Technology certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen Dawei Innovation Technology's earnings, revenue and cash flow.How Is Shenzhen Dawei Innovation Technology's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shenzhen Dawei Innovation Technology's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 41% last year. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it concerning that Shenzhen Dawei Innovation Technology is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Shenzhen Dawei Innovation Technology's P/S Mean For Investors?

The large bounce in Shenzhen Dawei Innovation Technology's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Shenzhen Dawei Innovation Technology currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Shenzhen Dawei Innovation Technology.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002213

Shenzhen Dawei Innovation Technology

Shenzhen Dawei Innovation Technology Co., Ltd.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives