Stock Analysis

- China

- /

- Auto Components

- /

- SZSE:002085

Are Zhejiang Wanfeng Auto Wheel Co., Ltd.'s (SZSE:002085) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

With its stock down 16% over the past month, it is easy to disregard Zhejiang Wanfeng Auto Wheel (SZSE:002085). However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Particularly, we will be paying attention to Zhejiang Wanfeng Auto Wheel's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Zhejiang Wanfeng Auto Wheel

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Zhejiang Wanfeng Auto Wheel is:

11% = CN¥1.1b ÷ CN¥9.5b (Based on the trailing twelve months to March 2024).

The 'return' refers to a company's earnings over the last year. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.11 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Zhejiang Wanfeng Auto Wheel's Earnings Growth And 11% ROE

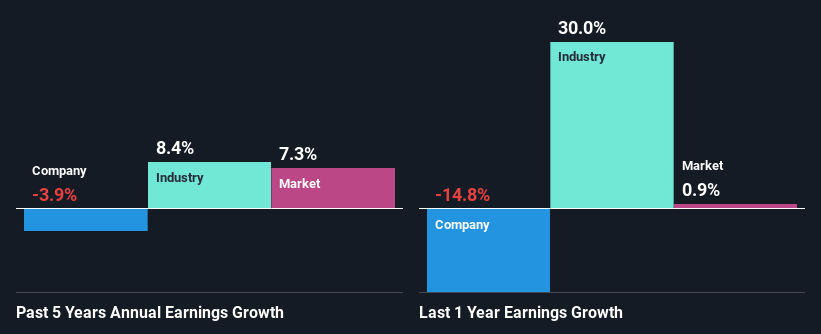

At first glance, Zhejiang Wanfeng Auto Wheel seems to have a decent ROE. Especially when compared to the industry average of 8.1% the company's ROE looks pretty impressive. As you might expect, the 3.9% net income decline reported by Zhejiang Wanfeng Auto Wheel is a bit of a surprise. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

That being said, we compared Zhejiang Wanfeng Auto Wheel's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 8.4% in the same 5-year period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Zhejiang Wanfeng Auto Wheel fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Zhejiang Wanfeng Auto Wheel Making Efficient Use Of Its Profits?

Despite having a normal three-year median payout ratio of 38% (where it is retaining 62% of its profits), Zhejiang Wanfeng Auto Wheel has seen a decline in earnings as we saw above. It looks like there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

In addition, Zhejiang Wanfeng Auto Wheel has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth.

Summary

On the whole, we do feel that Zhejiang Wanfeng Auto Wheel has some positive attributes. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return and is reinvesting ma huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. To know the 3 risks we have identified for Zhejiang Wanfeng Auto Wheel visit our risks dashboard for free.

Valuation is complex, but we're helping make it simple.

Find out whether Zhejiang Wanfeng Auto Wheel is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Zhejiang Wanfeng Auto Wheel is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002085

Zhejiang Wanfeng Auto Wheel

Engages in the manufacture and sale of automotive parts and aircrafts in China.

Flawless balance sheet average dividend payer.