Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Tianneng Battery Group Co., Ltd. (SHSE:688819) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Tianneng Battery Group

How Much Debt Does Tianneng Battery Group Carry?

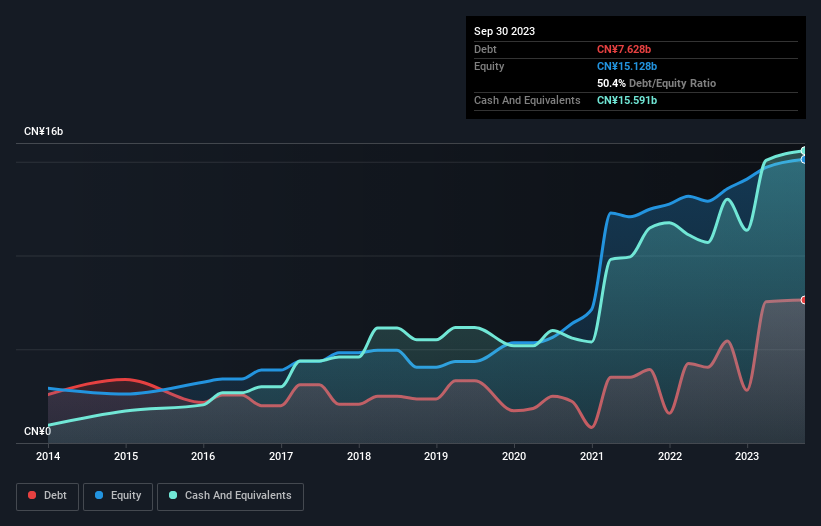

The image below, which you can click on for greater detail, shows that at September 2023 Tianneng Battery Group had debt of CN¥7.63b, up from CN¥5.44b in one year. However, its balance sheet shows it holds CN¥15.6b in cash, so it actually has CN¥7.96b net cash.

How Strong Is Tianneng Battery Group's Balance Sheet?

We can see from the most recent balance sheet that Tianneng Battery Group had liabilities of CN¥22.6b falling due within a year, and liabilities of CN¥2.68b due beyond that. On the other hand, it had cash of CN¥15.6b and CN¥5.66b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥4.06b.

Given Tianneng Battery Group has a market capitalization of CN¥27.9b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Tianneng Battery Group also has more cash than debt, so we're pretty confident it can manage its debt safely.

Also positive, Tianneng Battery Group grew its EBIT by 22% in the last year, and that should make it easier to pay down debt, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Tianneng Battery Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Tianneng Battery Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Tianneng Battery Group's free cash flow amounted to 35% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

Although Tianneng Battery Group's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of CN¥7.96b. And it impressed us with its EBIT growth of 22% over the last year. So we are not troubled with Tianneng Battery Group's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Tianneng Battery Group has 2 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Tianneng Battery Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688819

Tianneng Battery Group

Researches, develops, produces, and sells electric special vehicle and new energy vehicle power batteries, automotive start-stop batteries, energy storage batteries, 3C batteries, backup batteries, and fuel cells in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives