- China

- /

- Auto Components

- /

- SHSE:688819

Investors Aren't Buying Tianneng Battery Group Co., Ltd.'s (SHSE:688819) Earnings

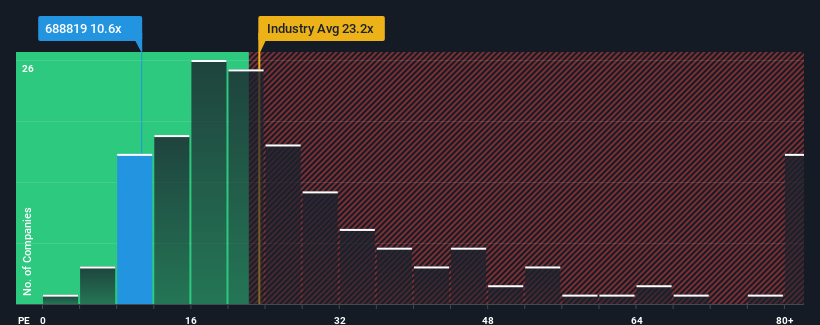

Tianneng Battery Group Co., Ltd.'s (SHSE:688819) price-to-earnings (or "P/E") ratio of 10.6x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 27x and even P/E's above 52x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Tianneng Battery Group has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Tianneng Battery Group

Is There Any Growth For Tianneng Battery Group?

In order to justify its P/E ratio, Tianneng Battery Group would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a decent 13% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the dual analysts watching the company. With the market predicted to deliver 21% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Tianneng Battery Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Tianneng Battery Group's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Tianneng Battery Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Tianneng Battery Group (1 is significant!) that we have uncovered.

You might be able to find a better investment than Tianneng Battery Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tianneng Battery Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688819

Tianneng Battery Group

Researches, develops, produces, and sells electric special vehicle and new energy vehicle power batteries, automotive start-stop batteries, energy storage batteries, 3C batteries, backup batteries, and fuel cells in China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success