Global Growth Companies With High Insider Ownership June 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rising oil prices due to escalating Middle East tensions and mixed economic signals, investors are closely watching the movements of major indices. Despite recent declines in U.S. stocks and challenges in Europe and Asia, opportunities remain for growth companies with high insider ownership, as these entities often demonstrate strong alignment between management and shareholder interests—a key factor in navigating uncertain market conditions effectively.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Schooinc (TSE:264A) | 30.6% | 68.9% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.3% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Fulin Precision (SZSE:300432) | 13.6% | 43% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen VMAX New Energy (SHSE:688612)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen VMAX New Energy Co., Ltd. focuses on the research, development, production, sale, and technical services of new energy vehicle power products both in China and internationally, with a market cap of CN¥10.97 billion.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, which generated CN¥6.05 billion.

Insider Ownership: 38.4%

Revenue Growth Forecast: 23% p.a.

Shenzhen VMAX New Energy demonstrates strong growth potential with forecasted revenue and earnings expected to grow significantly faster than the Chinese market. Despite a decline in profit margins from 9.7% to 6.4%, the company is trading at a substantial discount to its estimated fair value, presenting an attractive valuation relative to peers. Recent financials show stable sales at CNY 1.35 billion, while insider activity remains neutral with no significant buying or selling reported recently.

- Dive into the specifics of Shenzhen VMAX New Energy here with our thorough growth forecast report.

- The analysis detailed in our Shenzhen VMAX New Energy valuation report hints at an deflated share price compared to its estimated value.

Sinodata (SZSE:002657)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sinodata Co., Ltd. is involved in application software development and offers technical services and computer information system integration both in China and internationally, with a market cap of CN¥8.63 billion.

Operations: Sinodata Co., Ltd. generates revenue through the development of application software, provision of technical services, and integration of computer information systems across domestic and international markets.

Insider Ownership: 14.9%

Revenue Growth Forecast: 25.1% p.a.

Sinodata's revenue is forecast to grow at 25.1% annually, outpacing the Chinese market average of 12.4%. Despite recent losses, with a net loss of CNY 38.68 million in Q1 2025, earnings are expected to grow by over 91% per year and become profitable within three years. The stock remains volatile with no significant insider trading activity reported recently, while Return on Equity is projected to be low at 3% in three years.

- Click here and access our complete growth analysis report to understand the dynamics of Sinodata.

- According our valuation report, there's an indication that Sinodata's share price might be on the expensive side.

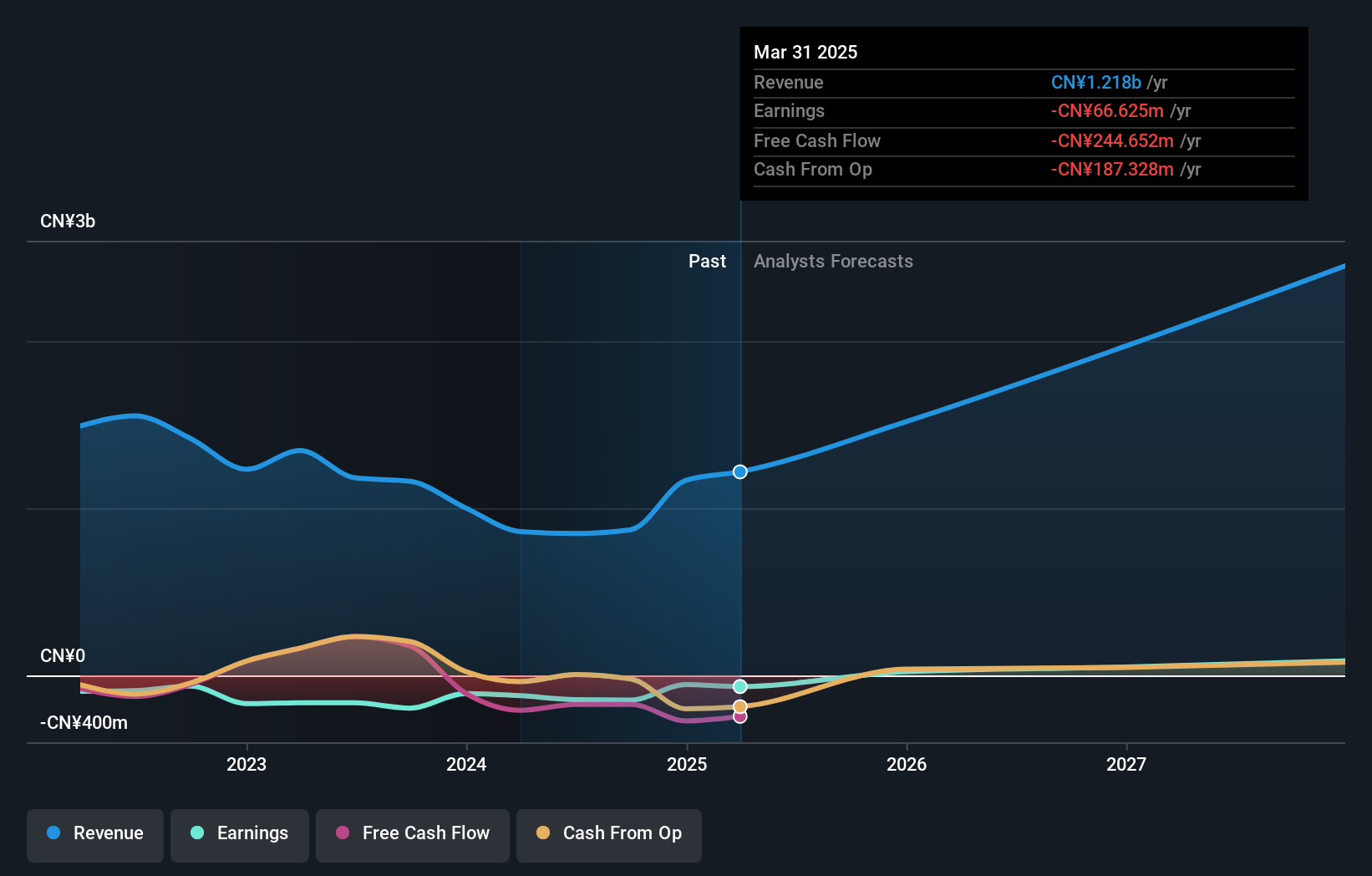

Shenzhen Yinghe Technology (SZSE:300457)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Yinghe Technology Co., Ltd specializes in the R&D, production, and sale of lithium-ion battery automation equipment in China, with a market cap of CN¥10.91 billion.

Operations: The company generates revenue primarily from its lithium-ion battery automation equipment business in China.

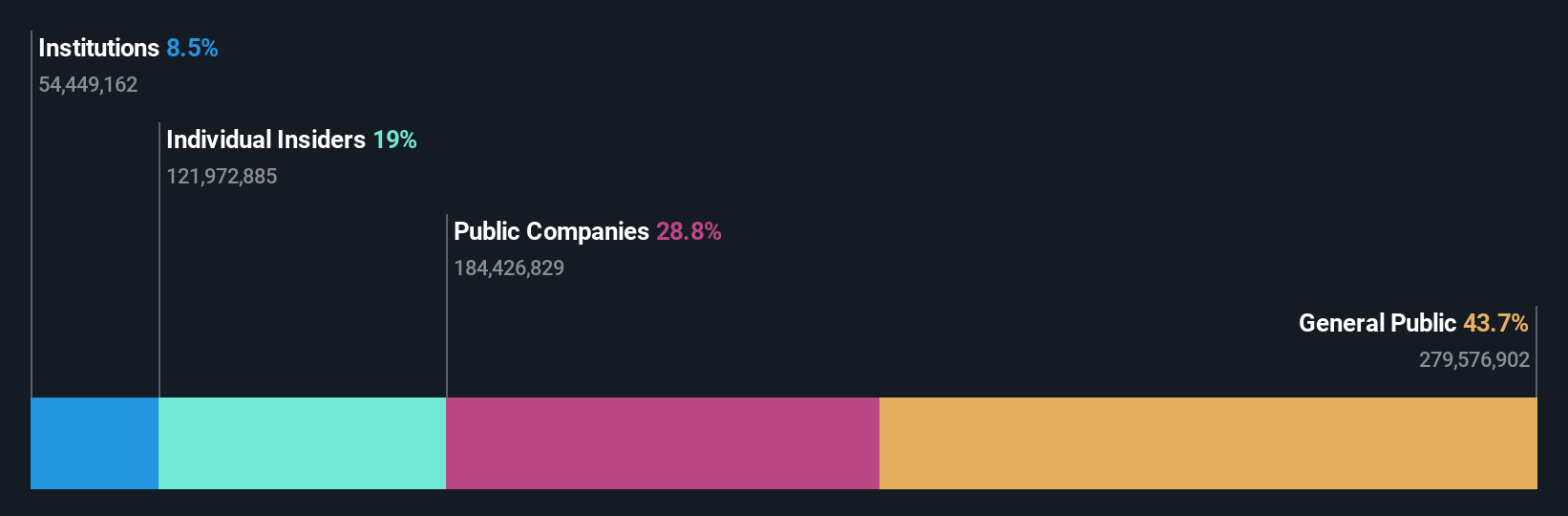

Insider Ownership: 19%

Revenue Growth Forecast: 18.7% p.a.

Shenzhen Yinghe Technology's earnings are projected to grow significantly at 36% annually, surpassing the Chinese market average. Despite a challenging Q1 2025 with net income dropping to CNY 15.16 million from CNY 158.53 million year-on-year, the company maintains a favorable valuation with its P/E ratio below the market average. Recent share buybacks totaling CNY 98.93 million indicate confidence in future prospects, though revenue growth is expected to be slower than earnings growth projections.

- Click to explore a detailed breakdown of our findings in Shenzhen Yinghe Technology's earnings growth report.

- Upon reviewing our latest valuation report, Shenzhen Yinghe Technology's share price might be too pessimistic.

Seize The Opportunity

- Embark on your investment journey to our 830 Fast Growing Global Companies With High Insider Ownership selection here.

- Ready For A Different Approach? This technology could replace computers: discover the 24 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300457

Shenzhen Yinghe Technology

Engages in the research and development, production, and sale of lithium-ion battery automation equipment in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives