- China

- /

- Auto Components

- /

- SHSE:688326

Market Might Still Lack Some Conviction On Beijing Jingwei Hirain Technologies Co., Inc. (SHSE:688326) Even After 26% Share Price Boost

Beijing Jingwei Hirain Technologies Co., Inc. (SHSE:688326) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

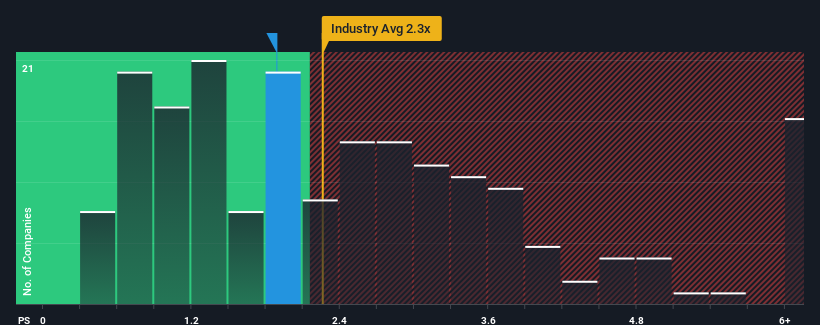

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Beijing Jingwei Hirain Technologies' P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in China is also close to 2.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Beijing Jingwei Hirain Technologies

How Has Beijing Jingwei Hirain Technologies Performed Recently?

Beijing Jingwei Hirain Technologies' revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Jingwei Hirain Technologies will help you uncover what's on the horizon.How Is Beijing Jingwei Hirain Technologies' Revenue Growth Trending?

Beijing Jingwei Hirain Technologies' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 89% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 33% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Beijing Jingwei Hirain Technologies is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Its shares have lifted substantially and now Beijing Jingwei Hirain Technologies' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Beijing Jingwei Hirain Technologies currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Beijing Jingwei Hirain Technologies with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingwei Hirain Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688326

Beijing Jingwei Hirain Technologies

Beijing Jingwei Hirain Technologies Co., Inc.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives