- China

- /

- Auto Components

- /

- SHSE:605333

Kunshan Huguang Auto Harness Co.,Ltd.'s (SHSE:605333) P/S Is Still On The Mark Following 26% Share Price Bounce

Kunshan Huguang Auto Harness Co.,Ltd. (SHSE:605333) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

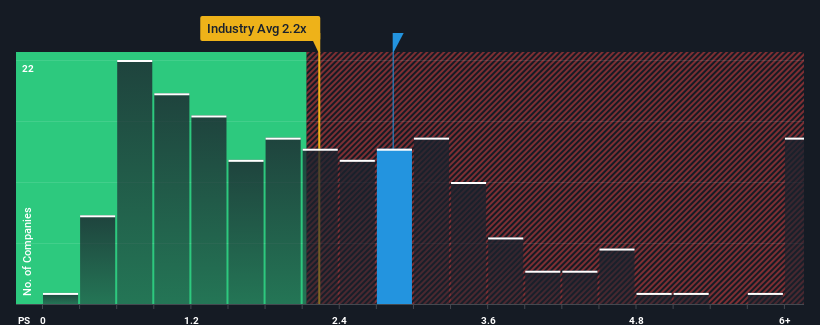

Since its price has surged higher, when almost half of the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Kunshan Huguang Auto HarnessLtd as a stock probably not worth researching with its 2.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Kunshan Huguang Auto HarnessLtd

How Has Kunshan Huguang Auto HarnessLtd Performed Recently?

With revenue growth that's inferior to most other companies of late, Kunshan Huguang Auto HarnessLtd has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Kunshan Huguang Auto HarnessLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Kunshan Huguang Auto HarnessLtd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kunshan Huguang Auto HarnessLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.8% gain to the company's revenues. The latest three year period has also seen an excellent 129% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 70% as estimated by the two analysts watching the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Kunshan Huguang Auto HarnessLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Kunshan Huguang Auto HarnessLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Kunshan Huguang Auto HarnessLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 2 warning signs for Kunshan Huguang Auto HarnessLtd you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kunshan Huguang Auto HarnessLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605333

Kunshan Huguang Auto HarnessLtd

Engages in the research and development, production, and sales of automotive high and low voltage wiring harness assembly products in China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.