- China

- /

- Auto Components

- /

- SZSE:301225

Undiscovered Gems in Global Markets for March 2025

Reviewed by Simply Wall St

As global markets grapple with tariff fears, inflation, and growth concerns, small-cap stocks have faced significant pressure, evidenced by the recent declines in key indices like the S&P MidCap 400 and Russell 2000. Amidst this volatility, discerning investors often seek out lesser-known opportunities that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mildef Crete | NA | 0.93% | 9.96% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Power HF | 2.91% | -6.25% | -22.13% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Neosem | 2.52% | 27.62% | 27.36% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shentong Technology Group (SHSE:605228)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shentong Technology Group Co., Ltd is engaged in the development, manufacturing, and sale of automotive parts within China, with a market capitalization of approximately CN¥5.26 billion.

Operations: Shentong Technology Group generates revenue primarily from the sales of auto parts and molds, totaling approximately CN¥1.55 billion. The company's financial performance is influenced by its cost structure and pricing strategies within the automotive sector.

Shentong Technology Group, a small cap player in the auto components industry, has shown impressive earnings growth of 56.9% over the past year, significantly outpacing the industry's 11%. Despite a volatile share price recently, it trades at 44.3% below its estimated fair value and holds high quality earnings. The company has more cash than total debt and is free cash flow positive with recent figures showing CNY 185.98 million for June 2024. Shentong's strategic buyback plan saw repurchases totaling CNY 52.94 million, indicating confidence in its valuation amidst a challenging five-year earnings decline of 25.2% annually.

Shenzhen Kingkey Smart Agriculture TimesLtd (SZSE:000048)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Kingkey Smart Agriculture Times Co., Ltd operates in the real estate and breeding sectors in China, with a market cap of CN¥8.08 billion.

Operations: Shenzhen Kingkey Smart Agriculture Times Co., Ltd generates revenue primarily from its real estate and breeding sectors. The company's net profit margin is 12.5%, indicating the percentage of revenue that remains as profit after all expenses are deducted.

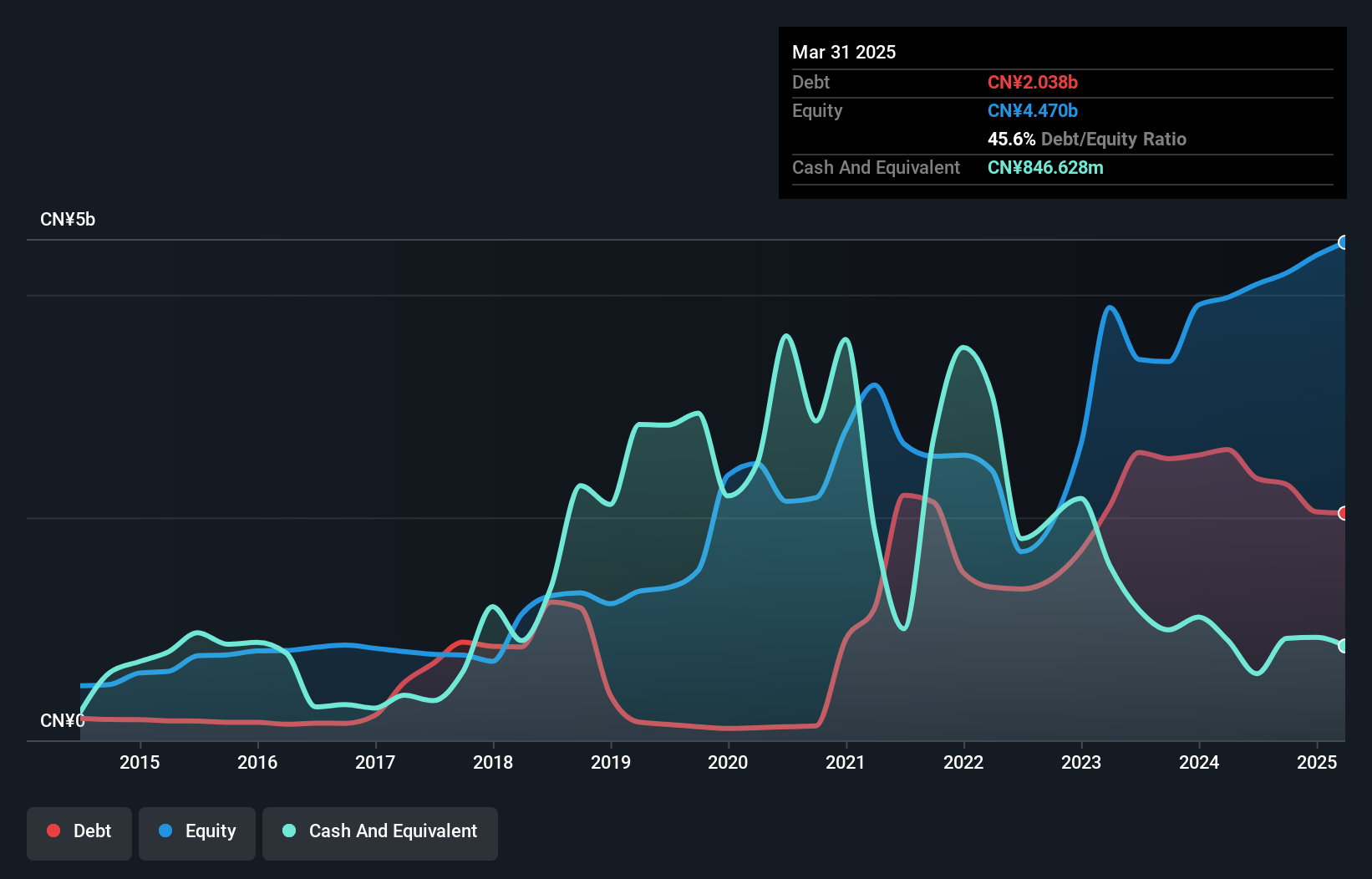

Shenzhen Kingkey Smart Agriculture Times Ltd., a small cap player, is trading at a favorable price-to-earnings ratio of 7.4x, significantly below the CN market average of 38.5x, suggesting good relative value in its industry. Despite high-quality past earnings and satisfactory net debt to equity ratio at 33%, recent challenges include a negative earnings growth of -47.5% over the past year compared to the Real Estate industry average of -38.5%. The company has also increased its debt to equity from 8% to 54.8% over five years, though interest payments are well covered by EBIT at 15.8x coverage, indicating manageable financial obligations despite forecasted earnings decline by an average of 1.9% annually for the next three years.

Hengbo HoldingsLtd (SZSE:301225)

Simply Wall St Value Rating: ★★★★★★

Overview: Hengbo Holdings Co., Ltd. focuses on the research, development, production, and sale of internal combustion engine air intake systems for automobiles, motorcycles, and general machinery with a market cap of CN¥3.82 billion.

Operations: Revenue for Hengbo Holdings is primarily derived from the Auto Parts & Accessories segment, totaling CN¥830.48 million.

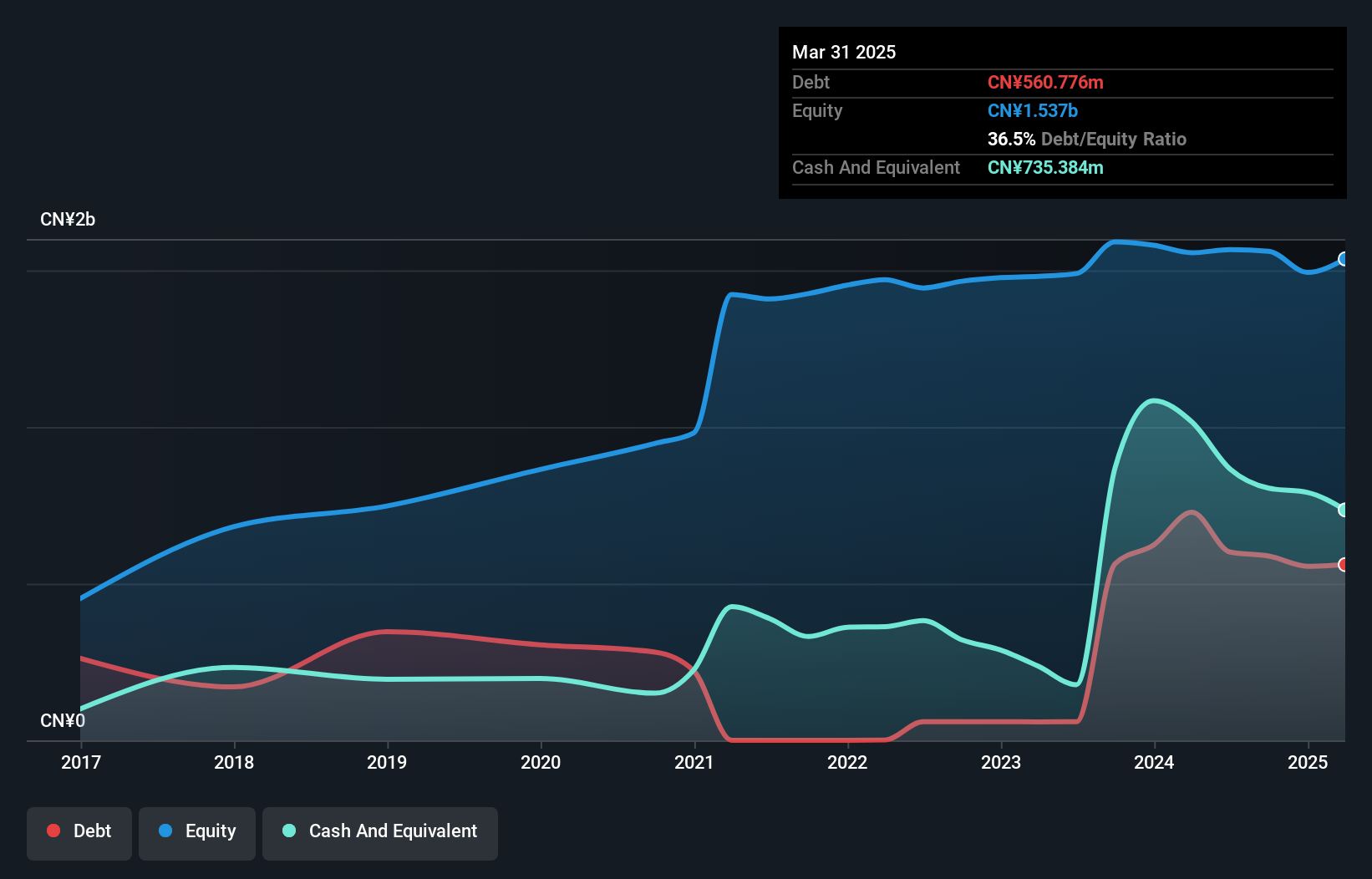

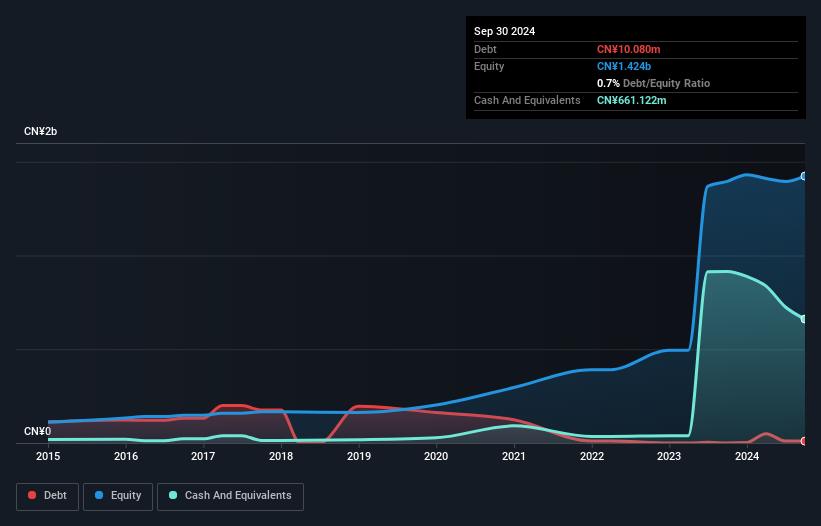

Hengbo Holdings, a small player in the auto components sector, has shown impressive earnings growth of 17% over the past year, outpacing the industry average of 11%. The company appears to be managing its debt effectively, with its debt-to-equity ratio dropping significantly from 88.9% to just 0.7% over five years. Despite not being free cash flow positive currently, Hengbo's profitability and ability to cover interest payments provide a stable financial footing. Its price-to-earnings ratio stands at 31.2x, which is competitive within the Chinese market context of 38.5x.

Where To Now?

- Click here to access our complete index of 3217 Global Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hengbo HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301225

Hengbo HoldingsLtd

Engages in the research, development, production, and sale of internal combustion engine air intake systems for automobiles, motorcycles, and general machinery.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives