- China

- /

- Auto Components

- /

- SHSE:603997

Asian Growth Stocks With Strong Insider Confidence For November 2025

Reviewed by Simply Wall St

As global markets navigate through mixed signals and economic adjustments, Asia remains a focal point with its unique blend of challenges and opportunities. In this environment, growth companies with high insider ownership can signal strong confidence in their future prospects, making them intriguing options for investors seeking stability and potential amidst the broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Ningbo Jifeng Auto Parts (SHSE:603997)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Jifeng Auto Parts Co., Ltd. manufactures automotive interior parts in China and internationally, with a market cap of CN¥17.61 billion.

Operations: Ningbo Jifeng Auto Parts Co., Ltd. generates its revenue primarily from the production and sale of automotive interior components both domestically and abroad.

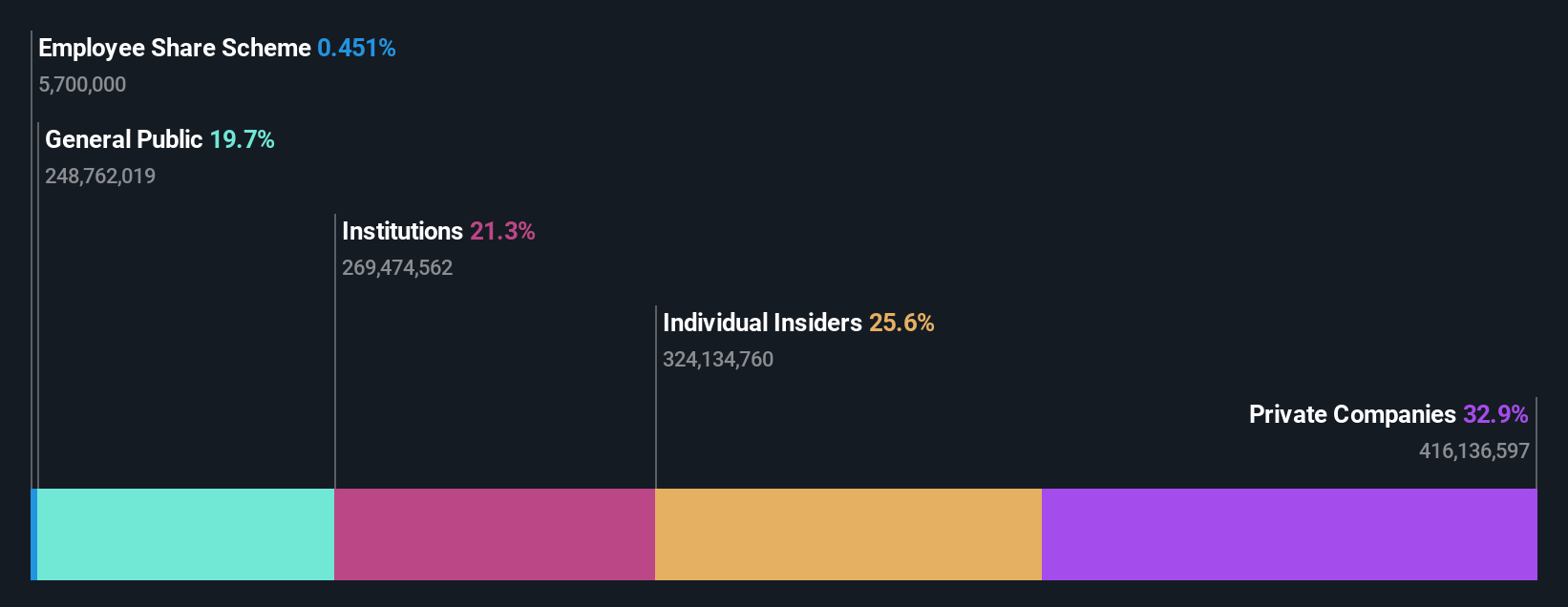

Insider Ownership: 25.6%

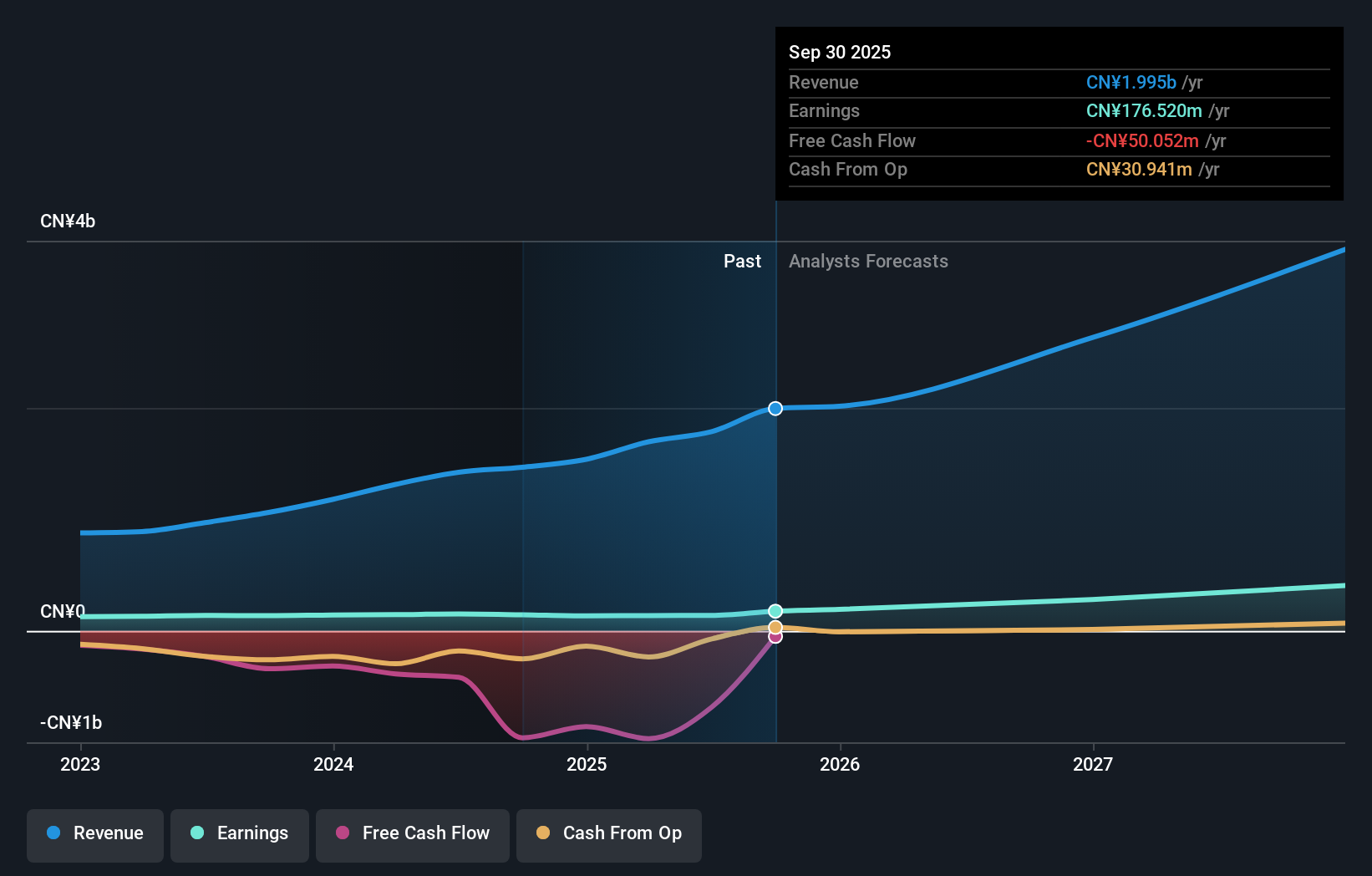

Ningbo Jifeng Auto Parts has shown a turnaround, reporting a net income of CNY 251.11 million for the nine months ending September 2025, compared to a loss last year. Its earnings are forecast to grow significantly at 61.4% annually, outpacing the CN market's growth rate. Despite trading at 58% below its estimated fair value, concerns remain as debt coverage by operating cash flow is inadequate and revenue growth is projected below significant thresholds.

- Click to explore a detailed breakdown of our findings in Ningbo Jifeng Auto Parts' earnings growth report.

- According our valuation report, there's an indication that Ningbo Jifeng Auto Parts' share price might be on the cheaper side.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Winning Health Technology Group Co., Ltd., with a market cap of CN¥20.20 billion, offers digital health services to medical and health institutions across China.

Operations: Winning Health Technology Group Co., Ltd. generates revenue by providing digital health services tailored for medical and health institutions within China.

Insider Ownership: 22.2%

Winning Health Technology Group is forecast to become profitable in three years, with expected annual earnings growth of 74.66%, surpassing the market average. Despite trading at 61.5% below estimated fair value, recent financials show a net loss of CNY 241.39 million for the first nine months of 2025, compared to a net income last year. Revenue is projected to grow at an impressive rate of 22.5% annually, outpacing the broader CN market's growth rate.

- Navigate through the intricacies of Winning Health Technology Group with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Winning Health Technology Group is priced lower than what may be justified by its financials.

Fengzhushou (SZSE:301382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fengzhushou Co., Ltd. offers mobile assistant services and hardware sales in China, with a market cap of CN¥10.48 billion.

Operations: Fengzhushou Co., Ltd. generates revenue through its mobile assistant services and hardware sales in China.

Insider Ownership: 22.8%

Fengzhushou Co., Ltd. demonstrates strong growth potential, with revenue and earnings expected to grow significantly faster than the Chinese market at 25.8% and 38.5% annually, respectively. Recent earnings results reflect robust performance with net income rising to CNY 134.43 million for the first nine months of 2025 from CNY 91.67 million a year ago. The company has completed a share buyback and plans a private placement involving substantial insider participation, indicating confidence in future prospects despite low return on equity forecasts and debt concerns.

- Dive into the specifics of Fengzhushou here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Fengzhushou's share price might be too optimistic.

Turning Ideas Into Actions

- Dive into all 619 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Looking For Alternative Opportunities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Jifeng Auto Parts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603997

Ningbo Jifeng Auto Parts

Manufactures automotive interior parts in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives