- China

- /

- Auto Components

- /

- SHSE:603596

3 Growth Stocks On The Chinese Exchange With Up To 39% Insider Ownership

Reviewed by Simply Wall St

Chinese equities have recently faced downward pressure, with the Shanghai Composite Index and the blue-chip CSI 300 both experiencing declines. Despite this, insider ownership remains a key indicator of potential growth, as it often signals confidence from those closest to the company's operations. In this article, we will explore three growth stocks on the Chinese exchange that boast up to 39% insider ownership.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 26.5% |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 28.4% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 36.1% |

Underneath we present a selection of stocks filtered out by our screen.

Beijing Tricolor Technology (SHSE:603516)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Tricolor Technology Co., Ltd manufactures and sells professional audio and video products worldwide, with a market cap of CN¥6.60 billion.

Operations: The company's revenue segments include CN¥498.28 million from the Display Control Industry and a Segment Adjustment of CN¥3.40 million.

Insider Ownership: 39.1%

Beijing Tricolor Technology is expected to see substantial earnings growth of 60.9% per year, outpacing the Chinese market's 22.2%. Revenue is forecast to grow at an impressive 37.3% annually, also exceeding market expectations of 13.7%. However, shareholders have faced dilution over the past year and the stock has experienced high volatility in recent months. Despite these challenges, strong insider ownership aligns management interests with those of shareholders, supporting long-term growth potential.

- Click here and access our complete growth analysis report to understand the dynamics of Beijing Tricolor Technology.

- Upon reviewing our latest valuation report, Beijing Tricolor Technology's share price might be too optimistic.

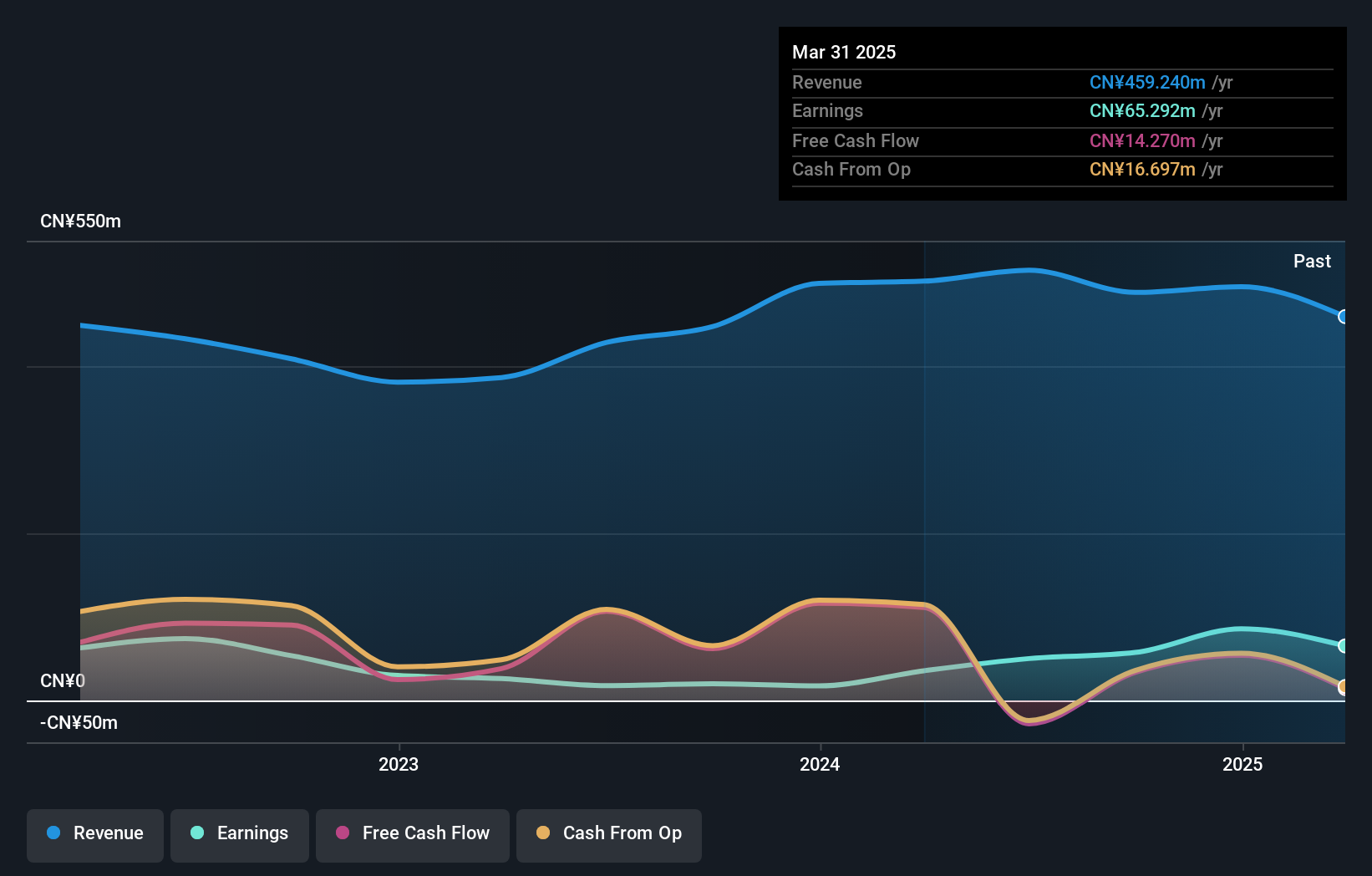

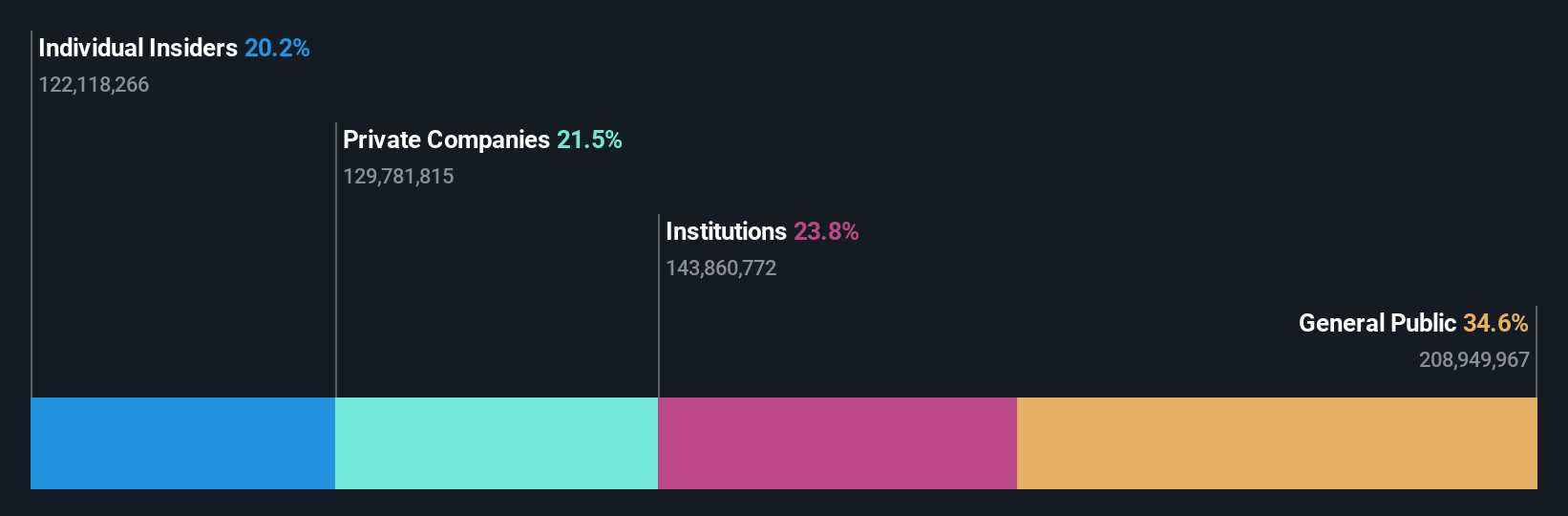

Bethel Automotive Safety Systems (SHSE:603596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bethel Automotive Safety Systems Co., Ltd develops, manufactures, and sells automotive brake system products for commercial vehicles in China and has a market cap of CN¥24.60 billion.

Operations: The company's revenue segment primarily consists of CN¥7.83 billion from the manufacturing and selling of automobile and related accessories.

Insider Ownership: 21.5%

Bethel Automotive Safety Systems is poised for substantial growth, with earnings forecast to increase by 24.67% annually, outpacing the Chinese market's 22.2%. Revenue is also expected to grow significantly at 23% per year. Despite trading at a significant discount (68.5%) below its estimated fair value and having high non-cash earnings, the company has faced shareholder dilution over the past year and forecasts a modest return on equity of 18.8% in three years.

- Click here to discover the nuances of Bethel Automotive Safety Systems with our detailed analytical future growth report.

- The analysis detailed in our Bethel Automotive Safety Systems valuation report hints at an deflated share price compared to its estimated value.

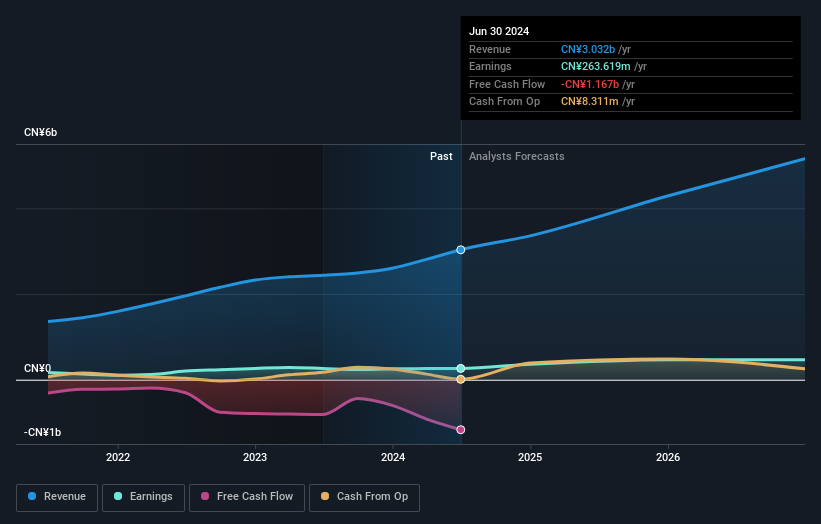

Konfoong Materials International (SZSE:300666)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Konfoong Materials International Co., Ltd. (SZSE:300666) specializes in the production and sale of high-purity metal materials and has a market cap of CN¥13.96 billion.

Operations: Konfoong Materials International generates CN¥2.81 billion in revenue from the Computer, Communications, and other Electronic Equipment Manufacturing segment.

Insider Ownership: 24%

Konfoong Materials International is set for significant growth, with earnings projected to rise by 22.8% annually, surpassing the Chinese market's average. Revenue is also expected to grow at 21.9% per year, outpacing the broader market's 13.7%. Despite a recent dividend decrease and a buyback of shares worth CNY 50 million, insider ownership remains high. However, the company's return on equity is forecasted to be low at 9% in three years.

- Dive into the specifics of Konfoong Materials International here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Konfoong Materials International shares in the market.

Make It Happen

- Access the full spectrum of 357 Fast Growing Chinese Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bethel Automotive Safety Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603596

Bethel Automotive Safety Systems

Develops, manufactures, and sells automotive brake system related products for commercial vehicles in China.

Flawless balance sheet and undervalued.