- China

- /

- Auto Components

- /

- SHSE:603190

Yantai Yatong Precision Mechanical's (SHSE:603190) Sluggish Earnings Might Be Just The Beginning Of Its Problems

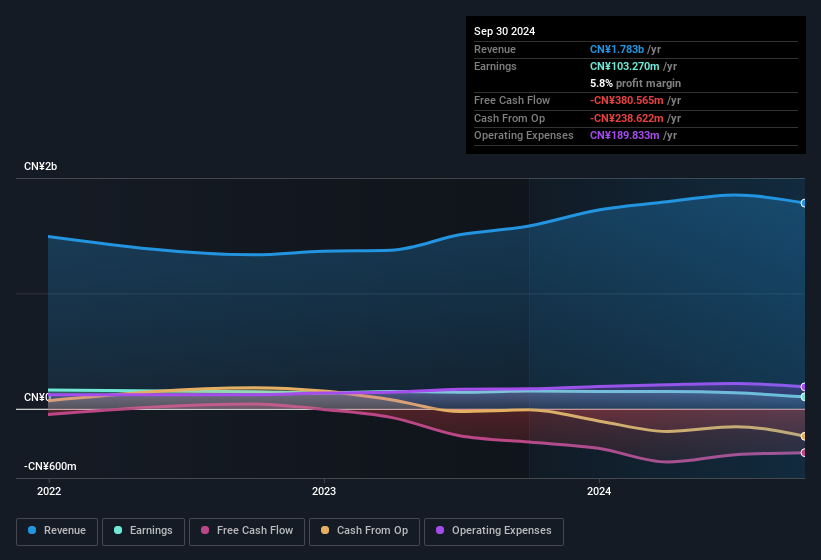

A lackluster earnings announcement from Yantai Yatong Precision Mechanical Corporation (SHSE:603190) last week didn't sink the stock price. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

Check out our latest analysis for Yantai Yatong Precision Mechanical

Zooming In On Yantai Yatong Precision Mechanical's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to September 2024, Yantai Yatong Precision Mechanical recorded an accrual ratio of 0.21. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Over the last year it actually had negative free cash flow of CN¥381m, in contrast to the aforementioned profit of CN¥103.3m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of CN¥381m, this year, indicates high risk.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Yantai Yatong Precision Mechanical.

Our Take On Yantai Yatong Precision Mechanical's Profit Performance

Yantai Yatong Precision Mechanical didn't convert much of its profit to free cash flow in the last year, which some investors may consider rather suboptimal. Because of this, we think that it may be that Yantai Yatong Precision Mechanical's statutory profits are better than its underlying earnings power. In further bad news, its earnings per share decreased in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Yantai Yatong Precision Mechanical, you'd also look into what risks it is currently facing. To help with this, we've discovered 2 warning signs (1 is a bit concerning!) that you ought to be aware of before buying any shares in Yantai Yatong Precision Mechanical.

This note has only looked at a single factor that sheds light on the nature of Yantai Yatong Precision Mechanical's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603190

Yantai Yatong Precision Mechanical

Engages in the research and development, production, sale, and service of auto parts and mining auxiliary transportation equipment in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives