- China

- /

- Auto Components

- /

- SHSE:603178

Market Participants Recognise Ningbo Shenglong Automotive Powertrain System Co.,Ltd.'s (SHSE:603178) Revenues Pushing Shares 26% Higher

Those holding Ningbo Shenglong Automotive Powertrain System Co.,Ltd. (SHSE:603178) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 218% following the latest surge, making investors sit up and take notice.

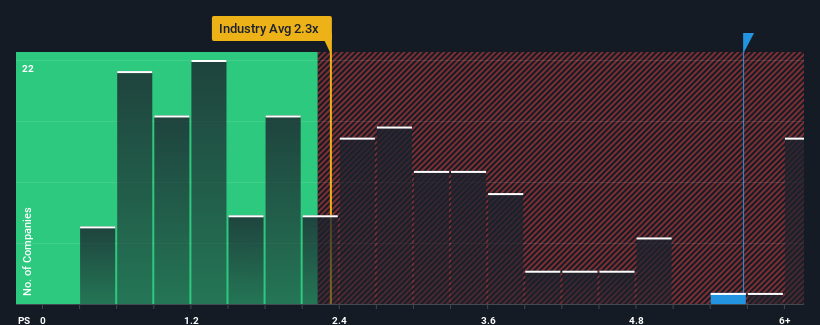

Since its price has surged higher, you could be forgiven for thinking Ningbo Shenglong Automotive Powertrain SystemLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.7x, considering almost half the companies in China's Auto Components industry have P/S ratios below 2.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Ningbo Shenglong Automotive Powertrain SystemLtd

How Ningbo Shenglong Automotive Powertrain SystemLtd Has Been Performing

Ningbo Shenglong Automotive Powertrain SystemLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ningbo Shenglong Automotive Powertrain SystemLtd.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Ningbo Shenglong Automotive Powertrain SystemLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.5%. Regardless, revenue has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 38% as estimated by the only analyst watching the company. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Ningbo Shenglong Automotive Powertrain SystemLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Ningbo Shenglong Automotive Powertrain SystemLtd's P/S?

Shares in Ningbo Shenglong Automotive Powertrain SystemLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Ningbo Shenglong Automotive Powertrain SystemLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Ningbo Shenglong Automotive Powertrain SystemLtd (of which 1 is concerning!) you should know about.

If you're unsure about the strength of Ningbo Shenglong Automotive Powertrain SystemLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Shenglong Automotive Powertrain SystemLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603178

Ningbo Shenglong Automotive Powertrain SystemLtd

Ningbo Shenglong Automotive Powertrain System Co.,Ltd.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success