- China

- /

- Auto Components

- /

- SHSE:603166

GUILIN FUDA Co.,Ltd.'s (SHSE:603166) Shareholders Might Be Looking For Exit

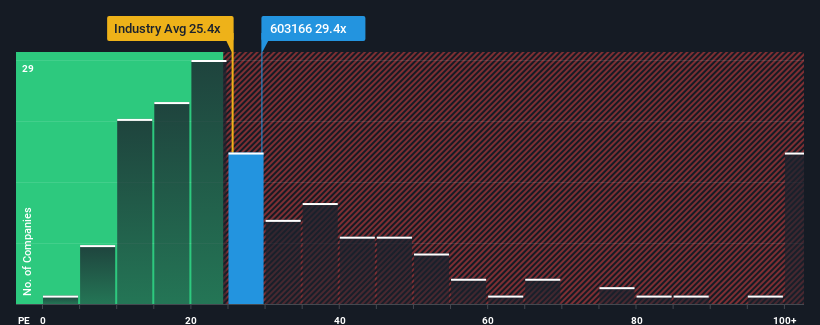

With a median price-to-earnings (or "P/E") ratio of close to 27x in China, you could be forgiven for feeling indifferent about GUILIN FUDA Co.,Ltd.'s (SHSE:603166) P/E ratio of 29.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's exceedingly strong of late, GUILIN FUDALtd has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for GUILIN FUDALtd

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like GUILIN FUDALtd's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 60% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 58% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's an unpleasant look.

In light of this, it's somewhat alarming that GUILIN FUDALtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of GUILIN FUDALtd revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with GUILIN FUDALtd (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on GUILIN FUDALtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603166

GUILIN FUDALtd

Researches and develops, produces, and sells auto parts and components in China.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives