- China

- /

- Auto Components

- /

- SHSE:601500

A Piece Of The Puzzle Missing From Jiangsu General Science Technology Co., Ltd.'s (SHSE:601500) 26% Share Price Climb

Jiangsu General Science Technology Co., Ltd. (SHSE:601500) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 64% in the last year.

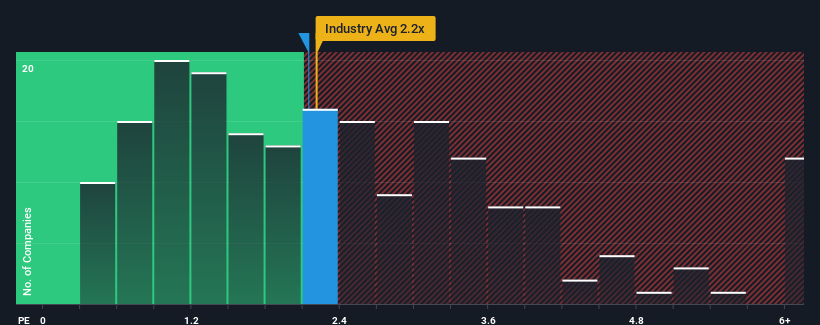

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Jiangsu General Science Technology's P/S ratio of 2.1x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in China is also close to 2.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Jiangsu General Science Technology

What Does Jiangsu General Science Technology's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Jiangsu General Science Technology has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jiangsu General Science Technology.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jiangsu General Science Technology's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.9% last year. Pleasingly, revenue has also lifted 42% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 43% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we find it interesting that Jiangsu General Science Technology is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Jiangsu General Science Technology's P/S?

Its shares have lifted substantially and now Jiangsu General Science Technology's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Jiangsu General Science Technology's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Jiangsu General Science Technology with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Jiangsu General Science Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601500

Jiangsu General Science Technology

Jiangsu General Science Technology Co., Ltd.

High growth potential with questionable track record.

Market Insights

Community Narratives