Investors Appear Satisfied With BAIC BluePark New Energy Technology Co.,Ltd.'s (SHSE:600733) Prospects As Shares Rocket 29%

BAIC BluePark New Energy Technology Co.,Ltd. (SHSE:600733) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 119% in the last year.

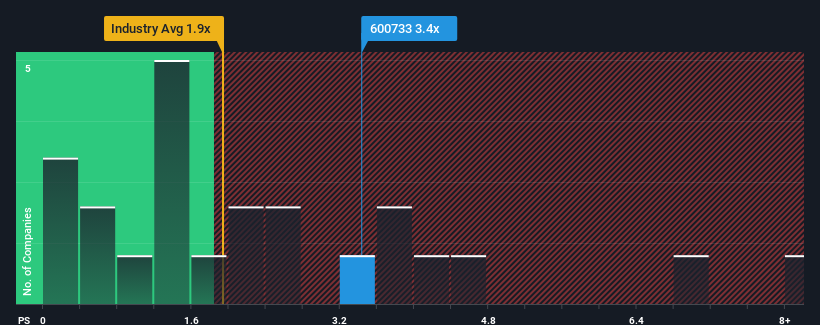

After such a large jump in price, you could be forgiven for thinking BAIC BluePark New Energy TechnologyLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in China's Auto industry have P/S ratios below 1.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for BAIC BluePark New Energy TechnologyLtd

How Has BAIC BluePark New Energy TechnologyLtd Performed Recently?

With revenue growth that's inferior to most other companies of late, BAIC BluePark New Energy TechnologyLtd has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think BAIC BluePark New Energy TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For BAIC BluePark New Energy TechnologyLtd?

In order to justify its P/S ratio, BAIC BluePark New Energy TechnologyLtd would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The latest three year period has also seen an excellent 99% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 57% per year as estimated by the three analysts watching the company. With the industry only predicted to deliver 17% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that BAIC BluePark New Energy TechnologyLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does BAIC BluePark New Energy TechnologyLtd's P/S Mean For Investors?

The large bounce in BAIC BluePark New Energy TechnologyLtd's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that BAIC BluePark New Energy TechnologyLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Auto industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for BAIC BluePark New Energy TechnologyLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BAIC BluePark New Energy Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600733

BAIC BluePark New Energy Technology

BAIC BluePark New Energy Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026