- China

- /

- Auto Components

- /

- SHSE:600178

Benign Growth For Harbin Dongan Auto Engine Co.,Ltd (SHSE:600178) Underpins Stock's 29% Plummet

Harbin Dongan Auto Engine Co.,Ltd (SHSE:600178) shares have had a horrible month, losing 29% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 66% in the last year.

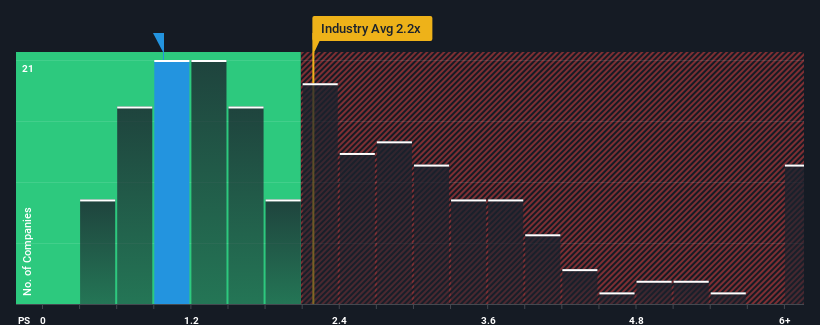

Although its price has dipped substantially, considering around half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.2x, you may still consider Harbin Dongan Auto EngineLtd as an solid investment opportunity with its 1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Harbin Dongan Auto EngineLtd

How Harbin Dongan Auto EngineLtd Has Been Performing

For example, consider that Harbin Dongan Auto EngineLtd's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Harbin Dongan Auto EngineLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Harbin Dongan Auto EngineLtd's earnings, revenue and cash flow.How Is Harbin Dongan Auto EngineLtd's Revenue Growth Trending?

Harbin Dongan Auto EngineLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 24% shows it's noticeably less attractive.

In light of this, it's understandable that Harbin Dongan Auto EngineLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Harbin Dongan Auto EngineLtd's P/S Mean For Investors?

The southerly movements of Harbin Dongan Auto EngineLtd's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Harbin Dongan Auto EngineLtd revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Harbin Dongan Auto EngineLtd that we have uncovered.

If you're unsure about the strength of Harbin Dongan Auto EngineLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Dongan Auto EngineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600178

High growth potential with adequate balance sheet.

Market Insights

Community Narratives