- Chile

- /

- Water Utilities

- /

- SNSE:ESSBIO-C

Investors Appear Satisfied With Essbio S.A.'s (SNSE:ESSBIO-C) Prospects As Shares Rocket 48%

Essbio S.A. (SNSE:ESSBIO-C) shareholders have had their patience rewarded with a 48% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 26% in the last year.

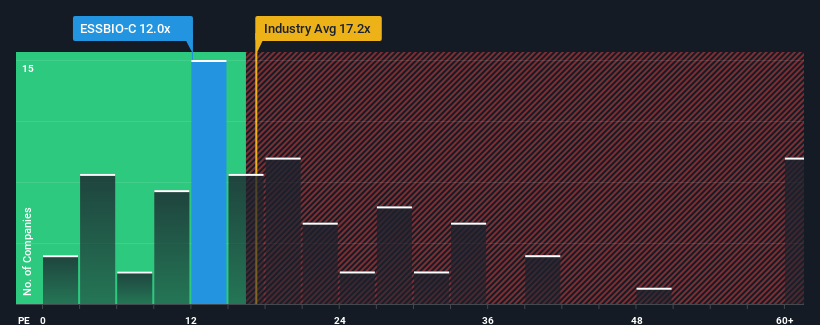

Since its price has surged higher, Essbio's price-to-earnings (or "P/E") ratio of 12x might make it look like a sell right now compared to the market in Chile, where around half of the companies have P/E ratios below 9x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's exceedingly strong of late, Essbio has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Essbio

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Essbio's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 355%. The latest three year period has also seen an excellent 61% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Essbio is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Essbio's P/E

Essbio's P/E is getting right up there since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Essbio revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 4 warning signs for Essbio (3 can't be ignored!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Essbio. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Essbio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ESSBIO-C

Essbio

Primarily engages in the provision of sanitation services in Chile.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026