- Chile

- /

- Trade Distributors

- /

- SNSE:COPEVAL

Compañía Agropecuaria Copeval's (SNSE:COPEVAL) Strong Earnings Are Of Good Quality

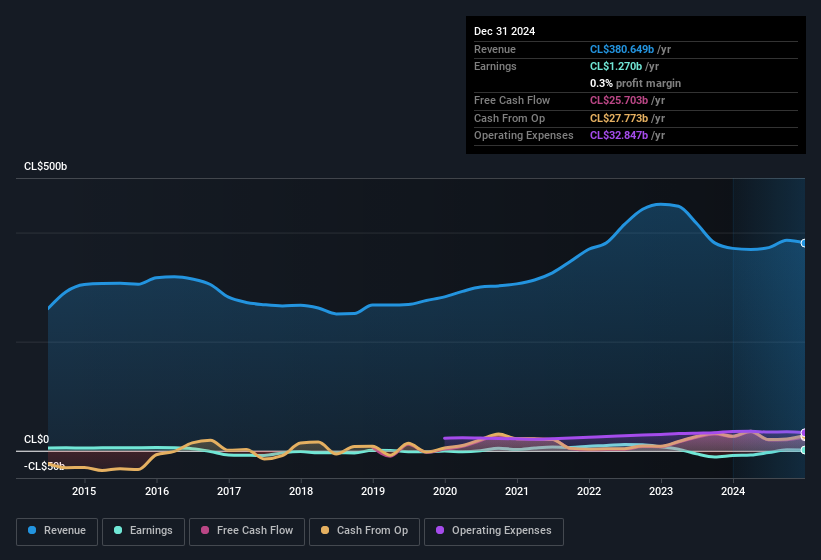

The subdued stock price reaction suggests that Compañía Agropecuaria Copeval S.A.'s (SNSE:COPEVAL) strong earnings didn't offer any surprises. Our analysis suggests that investors might be missing some promising details.

Examining Cashflow Against Compañía Agropecuaria Copeval's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Compañía Agropecuaria Copeval has an accrual ratio of -0.13 for the year to December 2024. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. In fact, it had free cash flow of CL$26b in the last year, which was a lot more than its statutory profit of CL$1.27b. Over the last year, Compañía Agropecuaria Copeval's free cash flow remained steady. However, as we will discuss below, we can see that the company's accrual ratio has been impacted by its tax situation.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Compañía Agropecuaria Copeval .

An Unusual Tax Situation

Moving on from the accrual ratio, we note that Compañía Agropecuaria Copeval profited from a tax benefit which contributed CL$3.7b to profit. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Compañía Agropecuaria Copeval's Profit Performance

While Compañía Agropecuaria Copeval's accrual ratio stands testament to its strong cashflow, and indicates good quality earnings, the fact that it received a tax benefit suggests that this year's profit may not be a great guide to its sustainable profit run-rate. Based on these factors, it's hard to tell if Compañía Agropecuaria Copeval's profits are a reasonable reflection of its underlying profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For instance, we've identified 4 warning signs for Compañía Agropecuaria Copeval (1 makes us a bit uncomfortable) you should be familiar with.

Our examination of Compañía Agropecuaria Copeval has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:COPEVAL

Compañía Agropecuaria Copeval

Distributes and markets agricultural machinery and products.

Excellent balance sheet and fair value.

Market Insights

Community Narratives