Stock Analysis

- Chile

- /

- Industrials

- /

- SNSE:ANTARCHILE

Those who invested in AntarChile (SNSE:ANTARCHILE) five years ago are up 10%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But even in a market-beating portfolio, some stocks will lag the market. While the AntarChile S.A. (SNSE:ANTARCHILE) share price is down 23% over half a decade, the total return to shareholders (which includes dividends) was 10%. And that total return actually beats the market decline of 60%.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for AntarChile

We don't think that AntarChile's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over five years, AntarChile grew its revenue at 7.0% per year. That's a fairly respectable growth rate. While the share price is down 4% per year, the broader market sell off has likely weighed upon it. The fact that the share price is down suggests the market is hardly excited about the growth, that might make the stock worth checking out. If the numbers indicate a trend to profitability, then the share price weakness could be an opportunity.

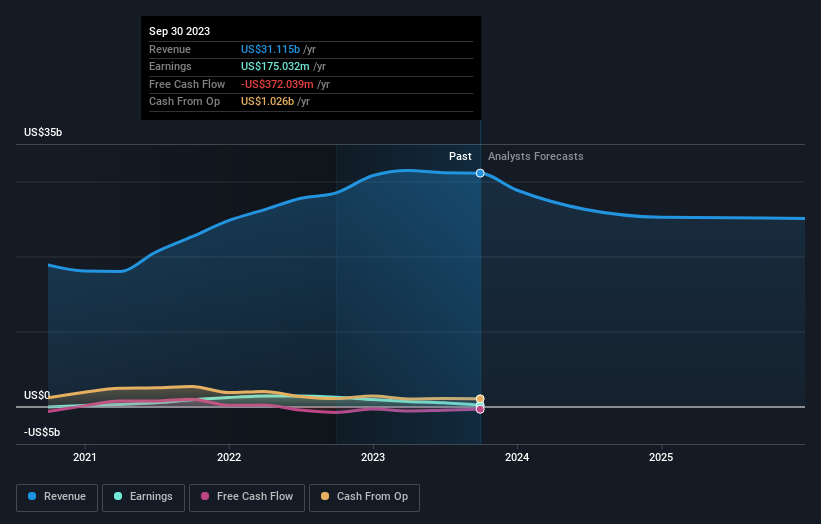

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on AntarChile's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, AntarChile's TSR for the last 5 years was 10%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

AntarChile shareholders are up 19% for the year (even including dividends). Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 2% per year over five year. This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for AntarChile (2 are a bit unpleasant!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chilean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether AntarChile is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ANTARCHILE

AntarChile

Invests in forestry, food and fishing, fuel distribution, energy, mining, and other sectors in South America and internationally.

Average dividend payer with questionable track record.