- Switzerland

- /

- Biotech

- /

- SWX:BSLN

High Growth Tech Stocks In Switzerland October 2024

Reviewed by Simply Wall St

The Swiss market experienced a volatile session recently, with the SMI index closing marginally down after fluctuating between gains and losses throughout the day. In such a dynamic environment, identifying high-growth tech stocks in Switzerland requires careful consideration of their resilience to market fluctuations and potential for innovation-driven expansion amidst broader economic challenges.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 8.81% | 20.48% | ★★★★★☆ |

| Santhera Pharmaceuticals Holding | 24.55% | 35.40% | ★★★★★★ |

| ALSO Holding | 12.58% | 26.76% | ★★★★☆☆ |

| Temenos | 7.58% | 14.39% | ★★★★☆☆ |

| Comet Holding | 19.66% | 47.84% | ★★★★★☆ |

| SoftwareONE Holding | 8.59% | 52.33% | ★★★★★☆ |

| Addex Therapeutics | 26.51% | 33.31% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.24% | 33.25% | ★★★★★☆ |

| Sensirion Holding | 13.86% | 102.68% | ★★★★☆☆ |

| MCH Group | 4.41% | 100.62% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Basilea Pharmaceutica (SWX:BSLN)

Simply Wall St Growth Rating: ★★★★★☆

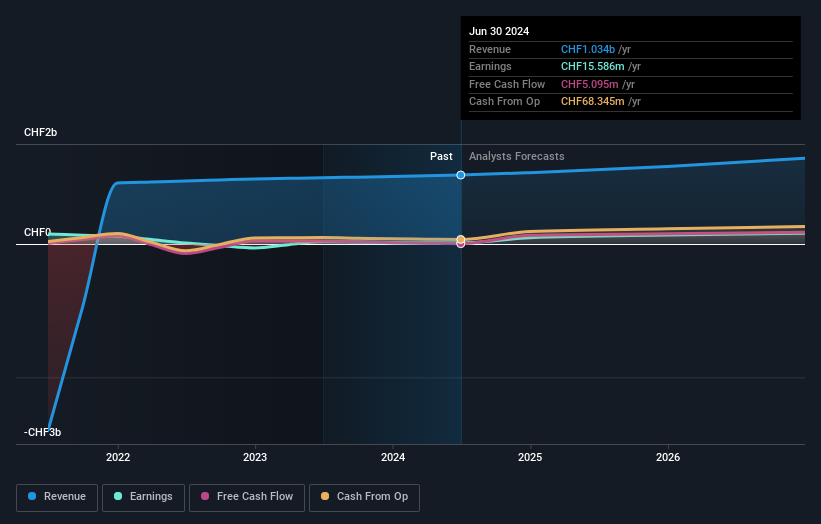

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company specializing in developing oncology and anti-infective products, with a market cap of CHF544.84 million.

Operations: Basilea Pharmaceutica AG generates revenue primarily through the discovery, development, and commercialization of innovative pharmaceutical products, totaling CHF149.02 million. The company focuses on addressing medical needs in oncology and anti-infectives.

Amid a challenging landscape, Basilea Pharmaceutica has shown resilience with a revised upward financial guidance, projecting a significant increase in total revenue to CHF 203 million and net profit to CHF 60 million for 2024. This adjustment reflects a robust growth trajectory, notably with the expansion of Cresemba's market exclusivity in the EU until October 2027—a strategic move that underscores its commitment to long-term value creation through innovation. Furthermore, Basilea’s focus on R&D is evident as it strategically allocates resources towards expanding indications for existing products, ensuring sustained relevance in the competitive pharmaceuticals market. With earnings anticipated to surge by 33.2% annually and R&D expenditures aligning closely with these innovative pursuits, Basilea is positioning itself as a dynamic player within Switzerland's high-tech biotech sector.

SoftwareONE Holding (SWX:SWON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SoftwareONE Holding AG is a company that offers software and cloud solutions across various regions including Switzerland, Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific with a market capitalization of CHF2.14 billion.

Operations: SoftwareONE Holding AG generates revenue primarily from its operations in the EMEA region, contributing CHF611.29 million, followed by NORAM with CHF158.45 million and APAC with CHF148.50 million. The company's business model focuses on providing software and cloud solutions across diverse geographical markets, leveraging regional strengths to drive sales.

Amidst strategic maneuvers, SoftwareONE's potential merger with Crayon and private acquisition talks led by Apax Partners highlight its proactive stance in navigating the tech landscape. Despite a recent dip, with shares at CHF 2.4 billion, the firm's revenue growth forecast of 8.6% signals robust sector dynamics compared to a slower Swiss market growth of 4.3%. This is underscored by an aggressive R&D investment strategy aimed at innovation, crucial for maintaining competitive edge in a rapidly evolving industry. Moreover, expected annual earnings growth soaring at 52.3% illustrates SoftwareONE’s capacity to potentially outpace market expectations significantly, positioning it as a resilient contender amidst economic uncertainties affecting client purchasing behaviors.

- Navigate through the intricacies of SoftwareONE Holding with our comprehensive health report here.

Gain insights into SoftwareONE Holding's past trends and performance with our Past report.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a company that develops, markets, and sells integrated banking software systems to financial institutions globally, with a market capitalization of CHF4.63 billion.

Operations: Temenos generates revenue primarily through its Product segment, contributing $879.99 million, and its Services segment, which adds $132.98 million.

Temenos, with its recent executive reshuffles and strategic buybacks, underscores a robust commitment to innovation and market expansion. The appointment of technology veteran Barb Morgan as Chief Product and Technology Officer is set to enhance Temenos's AI-driven platforms and cloud solutions, pivotal in the banking sector. Financially, the company's R&D expenses have been substantial, supporting a 14.4% forecasted annual earnings growth which outpaces the broader Swiss market projection of 11.7%. Additionally, Temenos has repurchased shares worth CHF 200 million, reinforcing shareholder value amidst a competitive tech landscape. These maneuvers not only reflect a proactive approach in governance but also align with industry shifts towards scalable SaaS models crucial for sustained growth in volatile markets.

- Click here to discover the nuances of Temenos with our detailed analytical health report.

Evaluate Temenos' historical performance by accessing our past performance report.

Key Takeaways

- Dive into all 12 of the SIX Swiss Exchange High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basilea Pharmaceutica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BSLN

Basilea Pharmaceutica

A commercial-stage biopharmaceutical company, focuses on the development of products that address the medical needs in the therapeutic areas of oncology and anti-infectives.

High growth potential with excellent balance sheet.