Sensirion Holding AG's (VTX:SENS) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- Sensirion Holding will host its Annual General Meeting on 13th of May

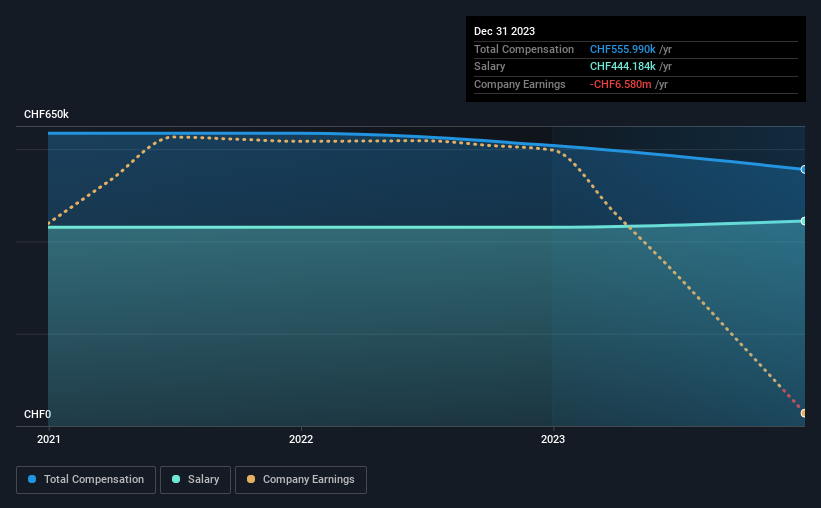

- CEO Marc von Waldkirch's total compensation includes salary of CHF444.2k

- The total compensation is 37% less than the average for the industry

- Over the past three years, Sensirion Holding's EPS fell by 32% and over the past three years, the total shareholder return was 4.1%

The performance at Sensirion Holding AG (VTX:SENS) has been rather lacklustre of late and shareholders may be wondering what CEO Marc von Waldkirch is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 13th of May. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Sensirion Holding

Comparing Sensirion Holding AG's CEO Compensation With The Industry

Our data indicates that Sensirion Holding AG has a market capitalization of CHF990m, and total annual CEO compensation was reported as CHF556k for the year to December 2023. Notably, that's a decrease of 8.5% over the year before. Notably, the salary which is CHF444.2k, represents most of the total compensation being paid.

For comparison, other companies in the Swiss Electronic industry with market capitalizations ranging between CHF362m and CHF1.4b had a median total CEO compensation of CHF886k. In other words, Sensirion Holding pays its CEO lower than the industry median. Moreover, Marc von Waldkirch also holds CHF2.9m worth of Sensirion Holding stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CHF444k | CHF431k | 80% |

| Other | CHF112k | CHF177k | 20% |

| Total Compensation | CHF556k | CHF608k | 100% |

Speaking on an industry level, nearly 48% of total compensation represents salary, while the remainder of 52% is other remuneration. Sensirion Holding is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Sensirion Holding AG's Growth

Sensirion Holding AG has reduced its earnings per share by 32% a year over the last three years. It saw its revenue drop 28% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Sensirion Holding AG Been A Good Investment?

With a total shareholder return of 4.1% over three years, Sensirion Holding AG has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Sensirion Holding that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026