- Switzerland

- /

- Machinery

- /

- SWX:BUCN

Top Dividend Stocks On SIX Swiss Exchange For August 2024

Reviewed by Simply Wall St

The Switzerland market ended marginally down on Wednesday, as investors largely refrained from making significant moves while awaiting more clarity about the Federal Reserve's potential interest rate cut. With the benchmark SMI experiencing a slight dip and mixed performances across various sectors, it's an opportune moment to consider dividend stocks that offer stability and consistent returns. In this article, we will explore three top dividend stocks on the SIX Swiss Exchange for August 2024 that could provide reliable income amidst uncertain market conditions.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.19% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.68% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.55% | ★★★★★☆ |

| Compagnie Financière Tradition (SWX:CFT) | 4.08% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.24% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.77% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.50% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.68% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.35% | ★★★★★☆ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.58% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

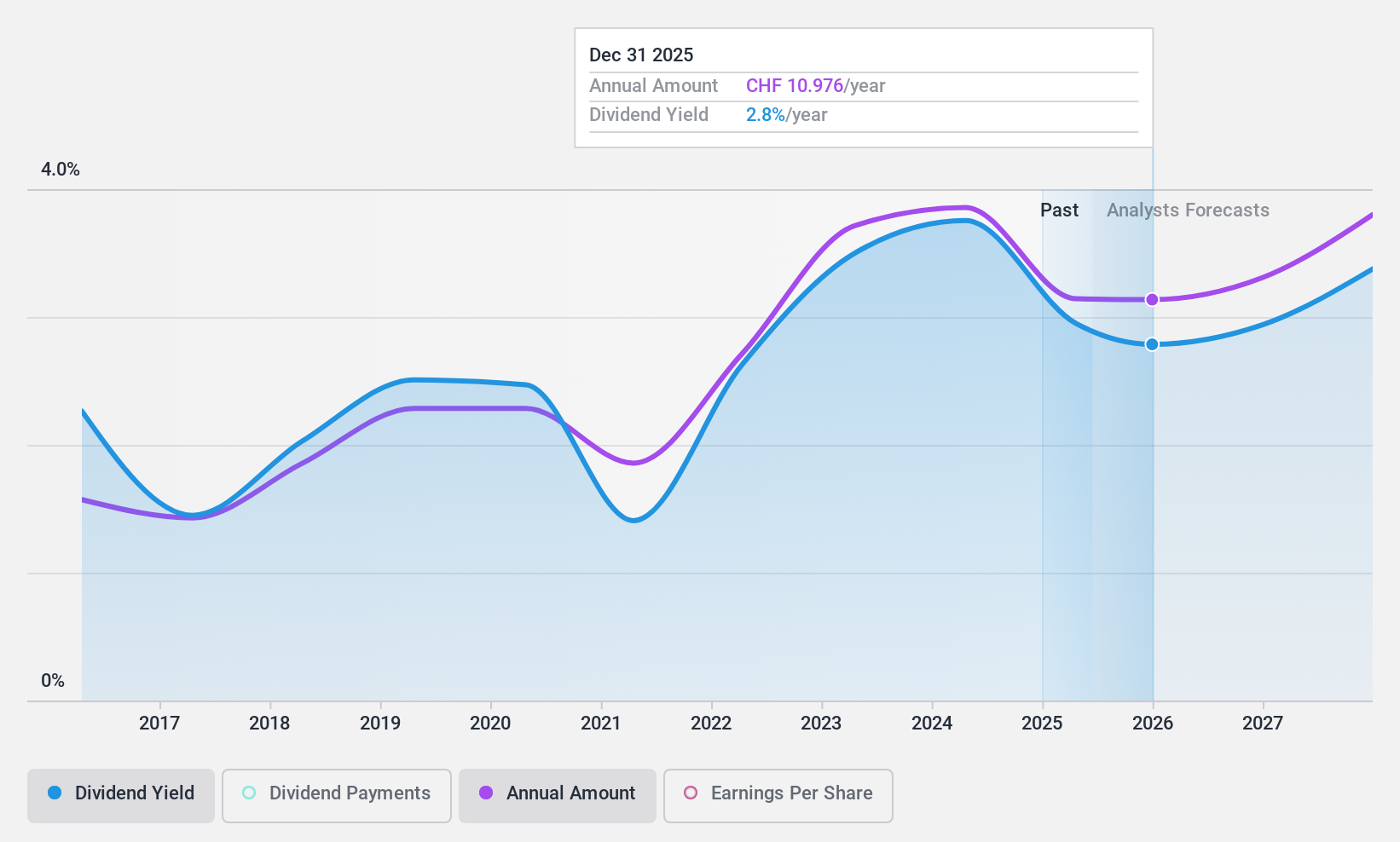

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG manufactures and sells machinery, systems, and hydraulic components for various industries including agriculture, food production, and public maintenance with a market cap of CHF3.65 billion.

Operations: Bucher Industries AG's revenue segments include Kuhn Group (CHF1.27 billion), Bucher Specials (CHF373.90 million), Bucher Municipal (CHF593.40 million), Bucher Hydraulics (CHF699.20 million), and Bucher Emhart Glass (CHF502.10 million).

Dividend Yield: 3.8%

Bucher Industries offers a stable dividend history with payments growing consistently over the past decade. However, its current dividend yield of 3.79% is lower than the top quartile in Switzerland and not well covered by free cash flows, with a high cash payout ratio of 102.5%. Recent earnings showed a decline, with net income at CHF 144.1 million for H1 2024 compared to CHF 198.1 million last year, raising concerns about future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Bucher Industries.

- Our valuation report unveils the possibility Bucher Industries' shares may be trading at a discount.

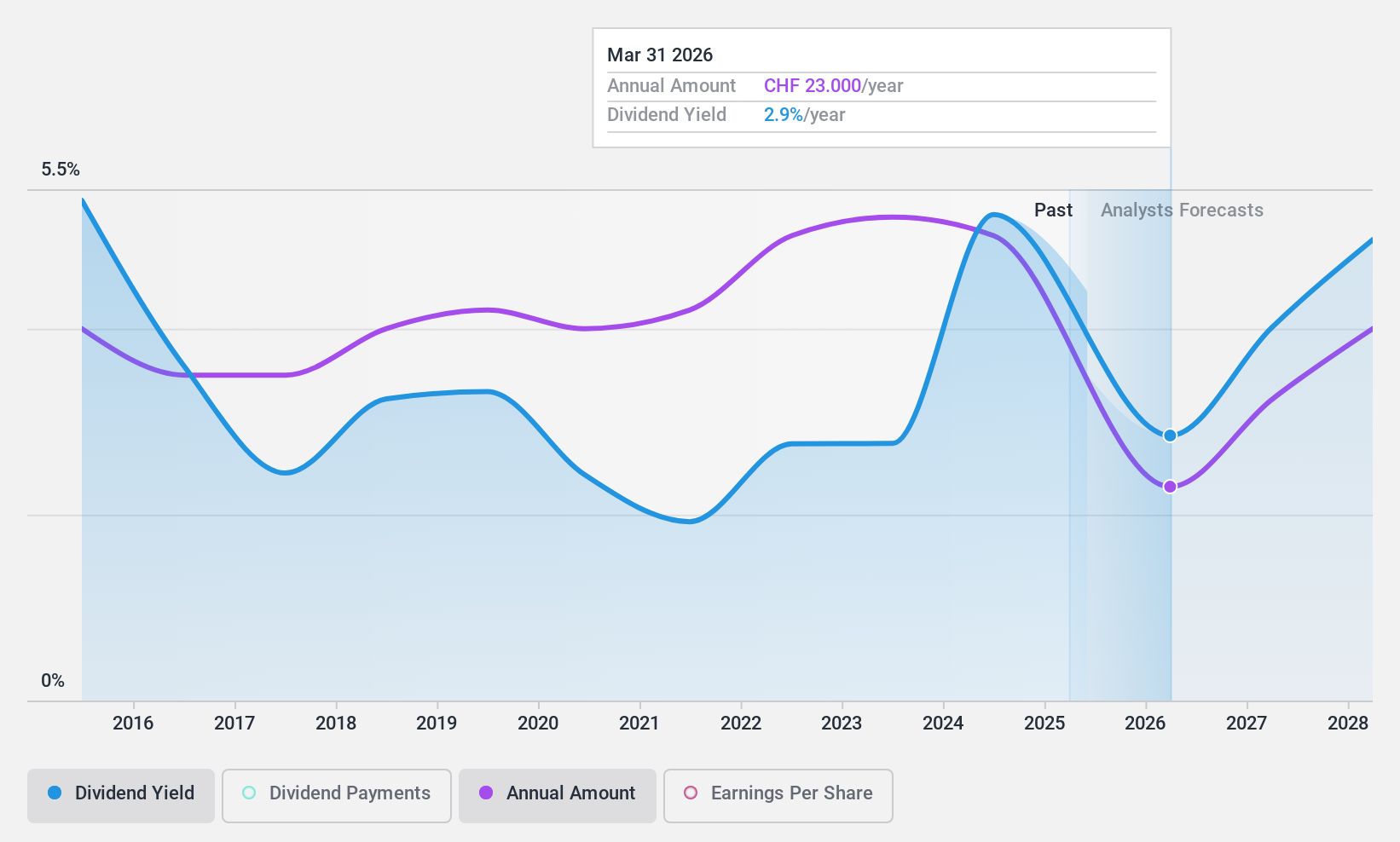

LEM Holding (SWX:LEHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LEM Holding SA, with a market cap of CHF1.42 billion, provides solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Operations: LEM Holding SA generates revenue by offering electrical parameter measurement solutions across diverse regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Dividend Yield: 4%

LEM Holding has shown a mixed performance for dividend investors. Despite a decade of reliable and increasing dividend payments, the current yield of 4.01% is slightly below the top quartile in Switzerland and not well covered by free cash flows, with a high cash payout ratio of 125.8%. Recent earnings reports indicate declining profitability, with net income for Q1 2024 at CHF 4.78 million compared to CHF 20.54 million last year, raising concerns about future sustainability.

- Click here to discover the nuances of LEM Holding with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that LEM Holding is priced lower than what may be justified by its financials.

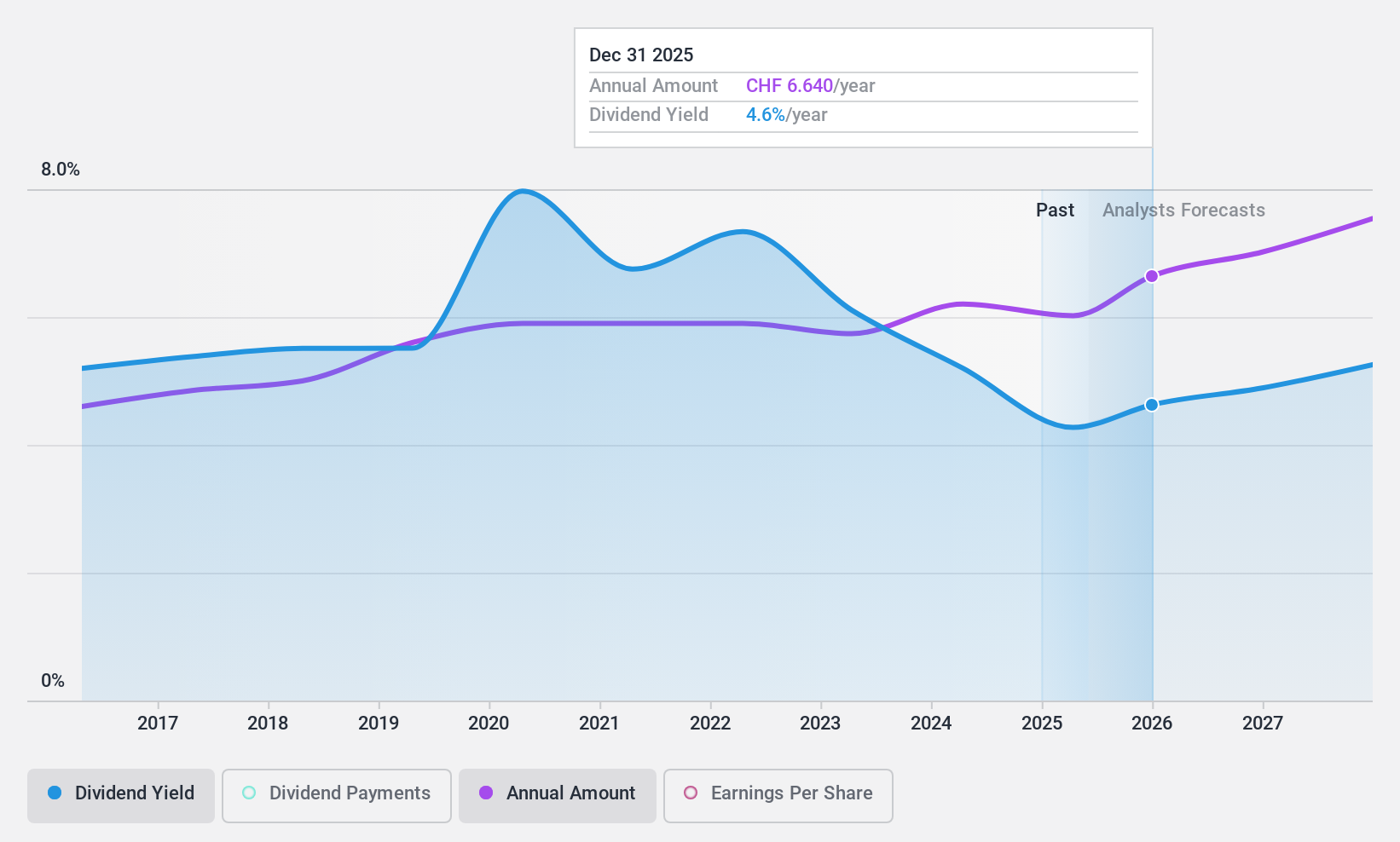

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF32.21 billion, operates globally offering wholesale reinsurance, insurance, various risk transfer solutions, and other insurance-related services through its subsidiaries.

Operations: Swiss Re AG's revenue segments include Property & Casualty Reinsurance ($23.74 billion), Life & Health Reinsurance ($18.09 billion), and Corporate Solutions ($6.06 billion).

Dividend Yield: 5.2%

Swiss Re's dividend payments have been volatile over the past decade. Despite this, its current dividend yield of 5.22% is among the top 25% in the Swiss market. The company's dividends are well covered by both earnings and cash flows, with payout ratios of 53.9% and 48.3%, respectively. Recent initiatives like the launch of Appian Connected Underwriting Life Workbench aim to enhance operational efficiency, potentially supporting future profitability and dividend sustainability amid executive changes slated for early next year.

- Dive into the specifics of Swiss Re here with our thorough dividend report.

- The valuation report we've compiled suggests that Swiss Re's current price could be quite moderate.

Taking Advantage

- Click through to start exploring the rest of the 23 Top SIX Swiss Exchange Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bucher Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BUCN

Bucher Industries

Engages in the manufacture and sale of machinery, systems, and hydraulic components for harvesting, producing and packaging food products, and keeping roads and public spaces clean and safe in Asia, the Americas, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.