- Switzerland

- /

- Media

- /

- SWX:TXGN

Exploring Undiscovered Swiss Gems In October 2024

Reviewed by Simply Wall St

The Swiss market recently experienced a volatile session, with the SMI index closing down 0.53% despite initial gains, reflecting broader uncertainties that have impacted key players like UBS and SGS. In such an environment, identifying undiscovered gems becomes crucial as investors look for resilient stocks that can navigate these fluctuations and offer potential growth opportunities amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Elma Electronic (SWX:ELMN)

Simply Wall St Value Rating: ★★★★★★

Overview: Elma Electronic AG manufactures and sells electronic packaging products for the embedded systems market worldwide, with a market cap of CHF239.92 million.

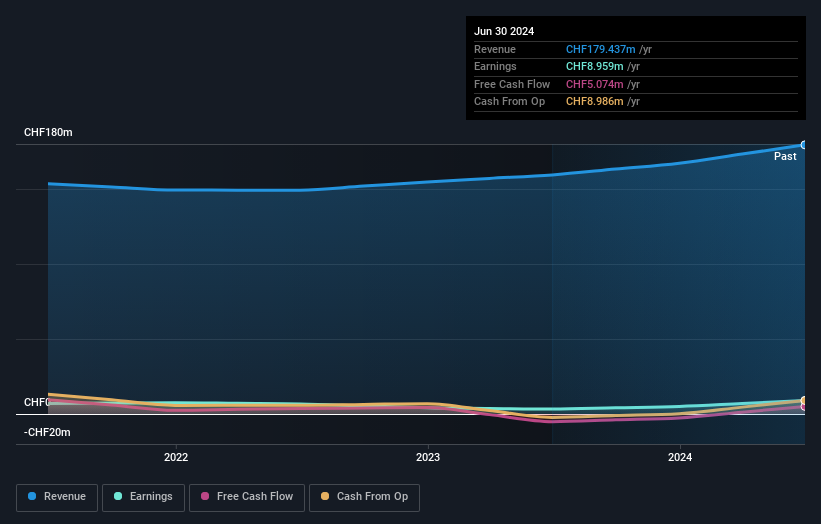

Operations: Elma Electronic AG generates revenue primarily from its Electronic Components and Parts segment, which accounts for CHF179.44 million.

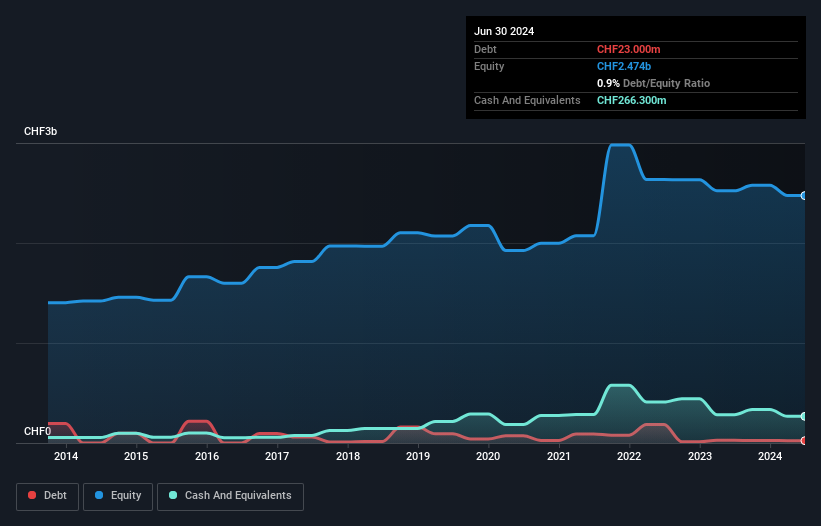

Elma Electronic, a nimble player in the electronics sector, showcases robust earnings growth with a remarkable 170.7% increase over the past year, outpacing its industry peers. The company has effectively reduced its debt to equity ratio from 85.7% to 36.6% in five years, reflecting prudent financial management. Its price-to-earnings ratio of 26.8x is attractive compared to the industry average of 28.5x, suggesting potential value for investors. Recent results highlight net income reaching CHF 4.51 million for the half-year ending June 2024, up from CHF 0.56 million previously, indicating strong operational momentum and promising prospects ahead.

- Click here and access our complete health analysis report to understand the dynamics of Elma Electronic.

Assess Elma Electronic's past performance with our detailed historical performance reports.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

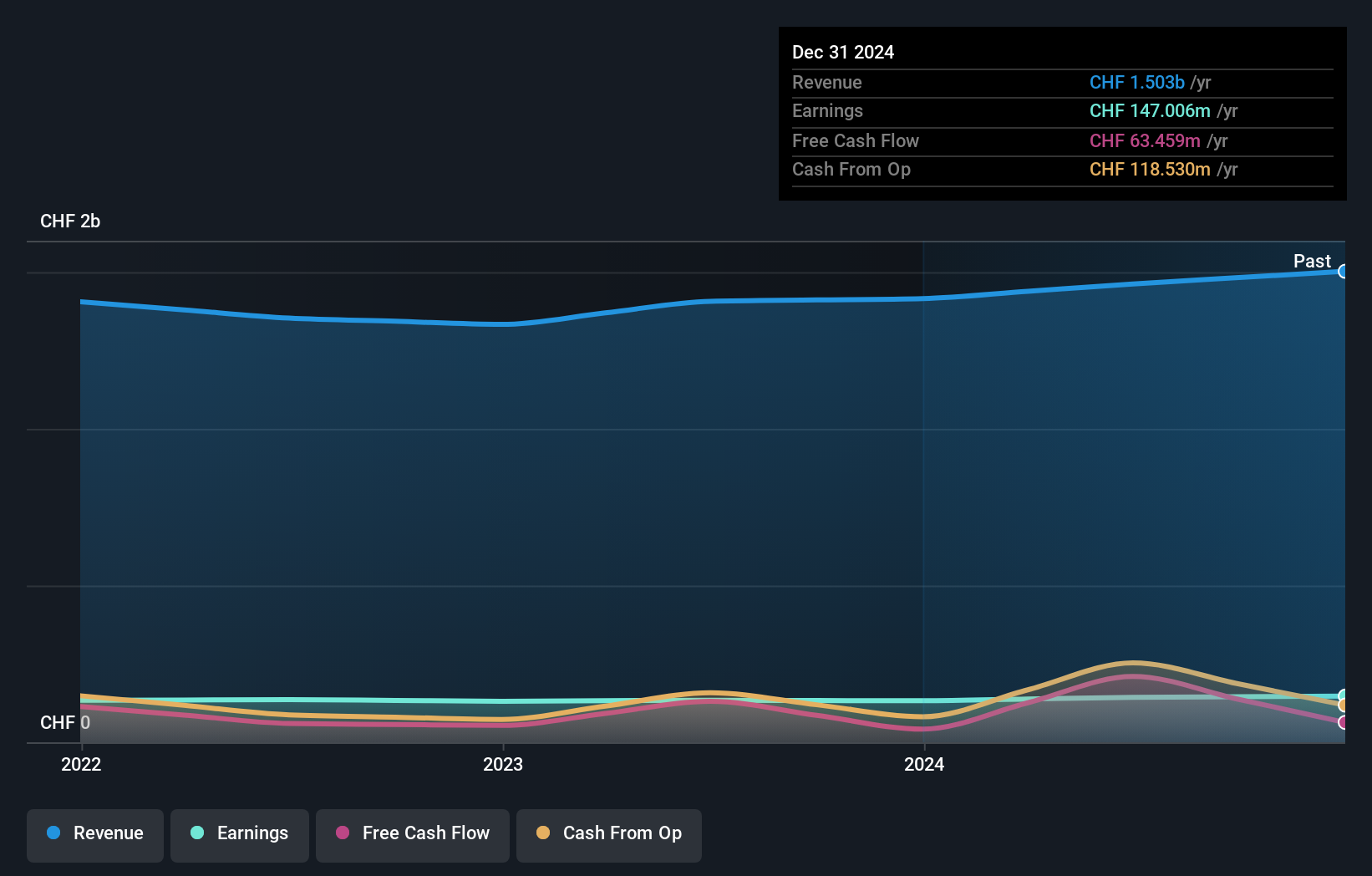

Overview: TX Group AG operates a network of platforms in Switzerland, offering information, orientation, entertainment, and support services with a market capitalization of CHF1.56 billion.

Operations: TX Group AG's revenue streams are primarily derived from its segments: Tamedia (CHF427 million), Goldbach (CHF299.10 million), 20 Minutes (CHF115.60 million), TX Markets (CHF126.40 million), and Groups & Ventures (CHF159.40 million). The company experiences a reduction in total revenue due to Eliminations and Reconciliation IAS 19 amounting to -CHF144.60 million.

TX Group, a promising player in the media sector, has recently turned profitable, with net income reaching CHF 9.6 million for the half-year ended June 2024. The company is trading at a significant discount of 63.9% below its estimated fair value and boasts a debt-to-equity ratio that has improved from 4.4 to 0.9 over five years, indicating strong financial discipline. Despite recent share price volatility, TX Group's earnings per share have shifted positively from a loss of CHF 0.13 to CHF 0.9 year-on-year, suggesting robust performance improvements and potential for future growth within its industry context.

- Click here to discover the nuances of TX Group with our detailed analytical health report.

Examine TX Group's past performance report to understand how it has performed in the past.

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market cap of CHF1.36 billion.

Operations: Vaudoise Assurances Holding generates revenue primarily from its insurance products and services in Switzerland. The company's financial performance is characterized by a net profit margin of 6.5%, reflecting its efficiency in managing costs relative to income.

Vaudoise Assurances Holding, a notable player in the Swiss insurance sector, is capturing attention with its solid financial standing and growth trajectory. This debt-free company reported net income of CHF 81 million for the first half of 2024, up from CHF 70 million the previous year. Earnings growth at 7.1% slightly outpaced the industry average of 6.7%, showcasing its competitive edge. Trading at nearly two-thirds below estimated fair value suggests potential undervaluation opportunities for investors seeking hidden gems in Switzerland's financial landscape. The company's robust earnings quality further underscores its promising position in the market.

Taking Advantage

- Unlock more gems! Our SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals screener has unearthed 15 more companies for you to explore.Click here to unveil our expertly curated list of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland.

Flawless balance sheet average dividend payer.