- Switzerland

- /

- Semiconductors

- /

- SWX:WIHN

More Unpleasant Surprises Could Be In Store For WISeKey International Holding AG's (VTX:WIHN) Shares After Tumbling 25%

Unfortunately for some shareholders, the WISeKey International Holding AG (VTX:WIHN) share price has dived 25% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 82% in the last year.

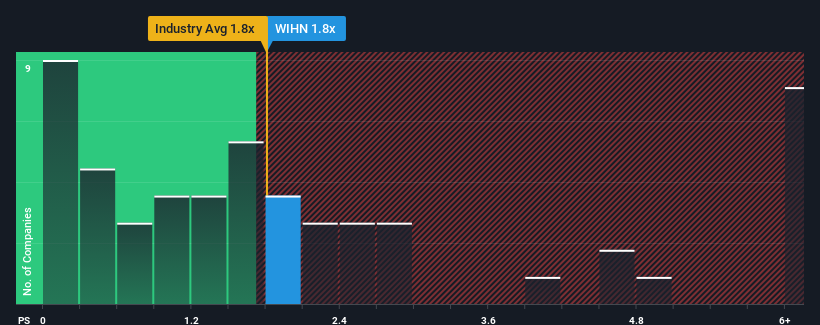

Even after such a large drop in price, you could still be forgiven for feeling indifferent about WISeKey International Holding's P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in Switzerland is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for WISeKey International Holding

How WISeKey International Holding Has Been Performing

WISeKey International Holding has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think WISeKey International Holding's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like WISeKey International Holding's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 44% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 30% over the next year. That's not great when the rest of the industry is expected to grow by 13%.

In light of this, it's somewhat alarming that WISeKey International Holding's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

With its share price dropping off a cliff, the P/S for WISeKey International Holding looks to be in line with the rest of the Semiconductor industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

While WISeKey International Holding's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for WISeKey International Holding (1 doesn't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on WISeKey International Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WISeKey International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:WIHN

WISeKey International Holding

A cybersecurity company, provides integrated security solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives