- Switzerland

- /

- Semiconductors

- /

- SWX:WIHN

Benign Growth For WISeKey International Holding AG (VTX:WIHN) Underpins Stock's 27% Plummet

WISeKey International Holding AG (VTX:WIHN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

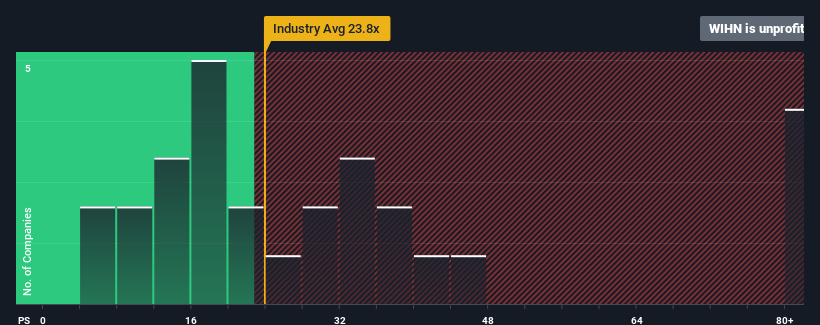

Since its price has dipped substantially, given about half the companies in Switzerland have price-to-earnings ratios (or "P/E's") above 20x, you may consider WISeKey International Holding as a highly attractive investment with its -4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

WISeKey International Holding certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for WISeKey International Holding

How Is WISeKey International Holding's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like WISeKey International Holding's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 74% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 9.0% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why WISeKey International Holding is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Shares in WISeKey International Holding have plummeted and its P/E is now low enough to touch the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that WISeKey International Holding maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 5 warning signs for WISeKey International Holding (3 are concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on WISeKey International Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WISeKey International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:WIHN

WISeKey International Holding

A cybersecurity company, provides integrated security solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives