- Switzerland

- /

- Semiconductors

- /

- SWX:UBXN

u-blox Holding (SWX:UBXN) Valuation In Focus After S&P Global BMI Index Removal

Reviewed by Simply Wall St

u-blox Holding (SWX:UBXN) has just been dropped from the S&P Global BMI Index, a development that tends to catch the eye of investors tracking index-related funds and broader portfolio shifts.

See our latest analysis for u-blox Holding.

After its removal from the S&P Global BMI Index, u-blox Holding’s momentum is hard to ignore, with an 81% year-to-date share price return and a one-year total shareholder return just over 108%. While some investors are weighing the implications of this index exit, the company’s longer-term performance remains well ahead of many semiconductor peers and suggests that optimism about growth potential is still evident.

If shifts like this have you scanning the market for new opportunities, it is a good moment to broaden your outlook and discover fast growing stocks with high insider ownership

This sharp rise begs an important question: is u-blox Holding’s recent strength a sign that the stock remains undervalued, or has the market already factored in all of its future growth prospects?

Price-to-Sales of 3.6x: Is it justified?

u-blox Holding currently trades at a price-to-sales (P/S) ratio of 3.6x, with its latest share price at CHF135. This is notably higher than the European semiconductor industry average.

The price-to-sales ratio measures how much investors are paying for each franc of sales. In the semiconductor sector, this metric matters because many companies are not consistently profitable and revenue trends offer signals on future growth prospects.

Even with unprofitability, u-blox commands a much higher multiple than its European industry peers, which average 2.3x. This premium suggests that the market is pricing in robust future growth or a significant turnaround. However, compared to the estimated fair P/S ratio of 1.1x, it appears the market may be overenthusiastic, and the stock could eventually revert closer to this level as expectations are tested.

Explore the SWS fair ratio for u-blox Holding

Result: Price-to-Sales of 3.6x (OVERVALUED)

However, slowing revenue growth and a current share price that is above analyst targets could quickly challenge the upbeat outlook surrounding u-blox Holding’s stock.

Find out about the key risks to this u-blox Holding narrative.

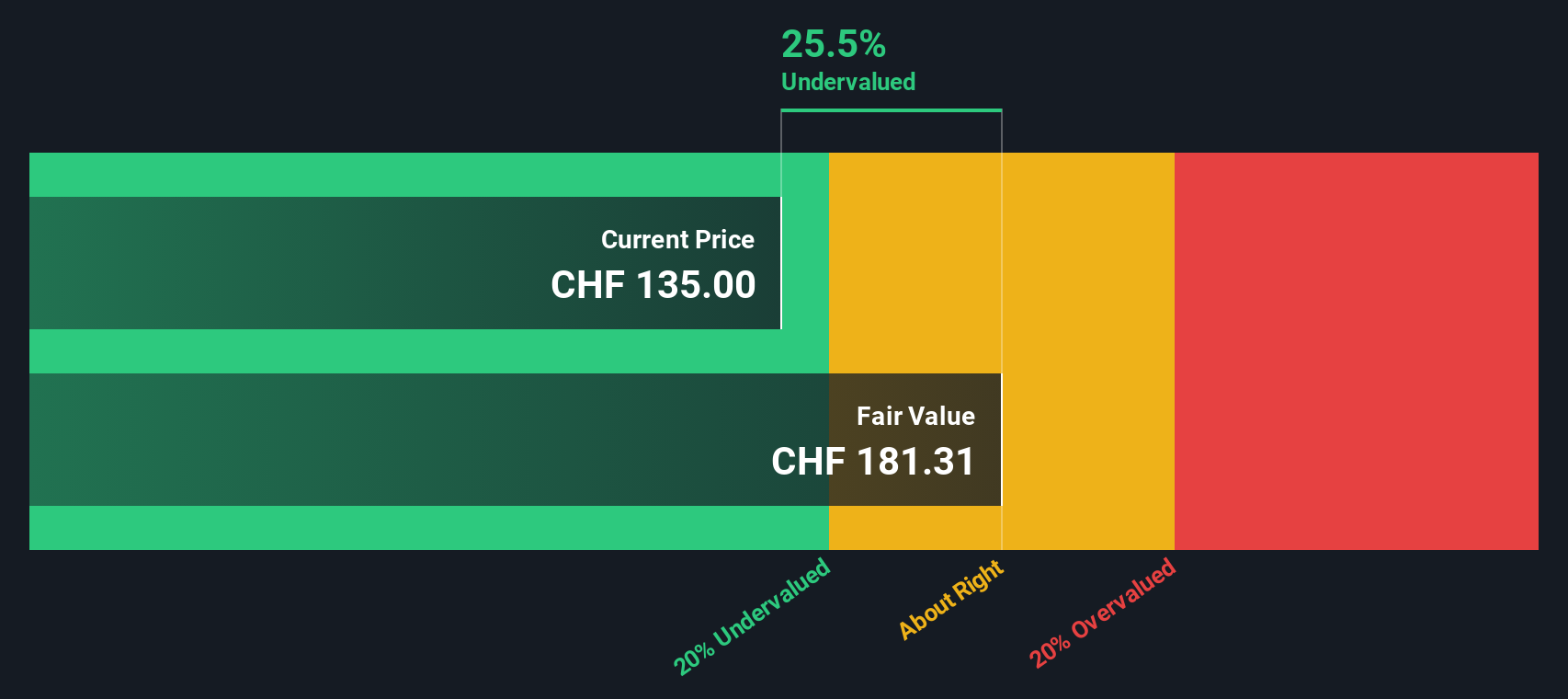

Another View: DCF Tells a Different Story

Taking a different perspective, our SWS DCF model values u-blox Holding at CHF181.31, well above its current share price of CHF135. This suggests the stock may actually be undervalued, which challenges the message sent by the premium price-to-sales ratio. Could this gap reveal an overlooked opportunity, or is the market right to be cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out u-blox Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own u-blox Holding Narrative

If our analysis does not match your perspective or you prefer hands-on research, you can shape your own view in just a few minutes. Do it your way

A great starting point for your u-blox Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Make your capital work smarter by scanning the market for trends, growth potential, and hidden value—all just a click away.

- Unlock sustainability for your income by targeting solid payers with these 16 dividend stocks with yields > 3% offering reliable yields above 3%.

- Seize the momentum in cutting-edge tech by tapping into these 26 AI penny stocks, where artificial intelligence leaders are redefining the competitive landscape.

- Turbocharge your returns by hunting for undervalued gems and growth prospects with these 926 undervalued stocks based on cash flows that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if u-blox Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBXN

u-blox Holding

Develops, manufactures, and markets products and services supporting GPS/GNSS satellite positioning systems for the automotive and transport, healthcare, asset tracking and management, industrial automation and monitoring, and consumer markets.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives