- Switzerland

- /

- Semiconductors

- /

- SWX:UBXN

u-blox Holding AG's (VTX:UBXN) Share Price Matching Investor Opinion

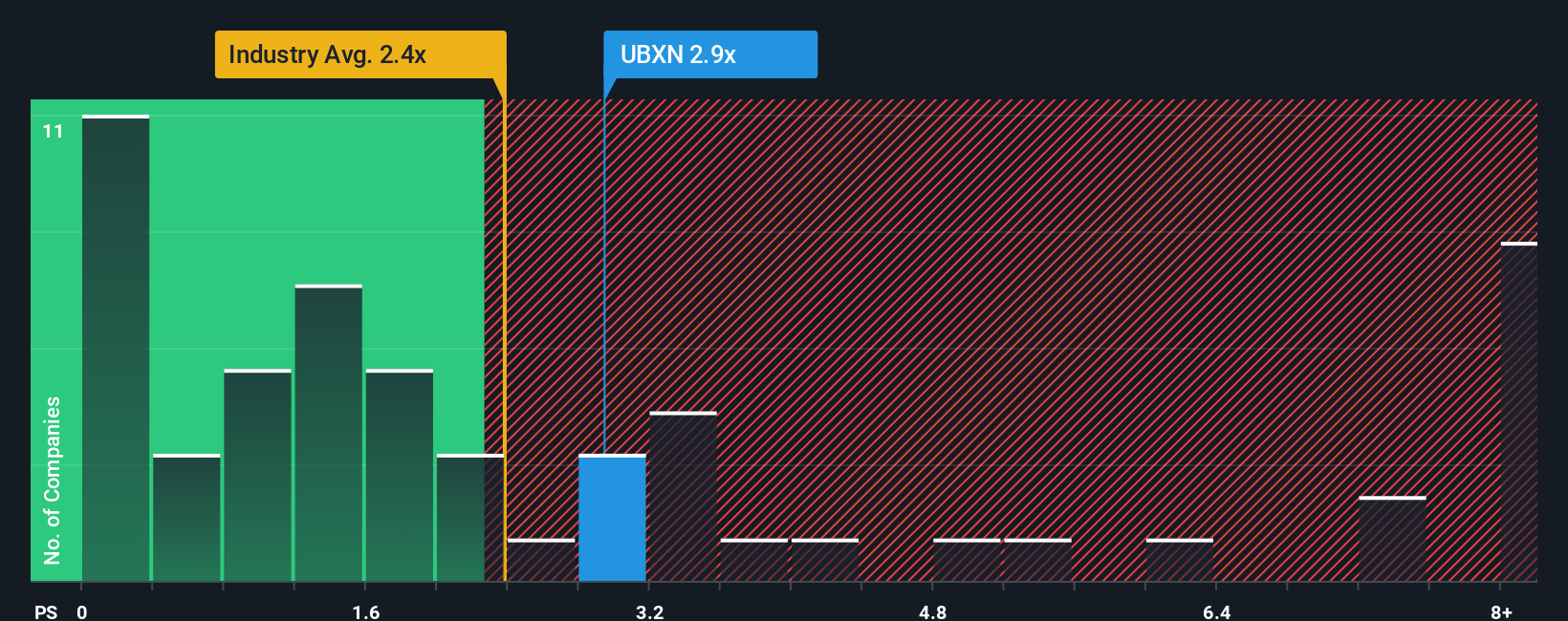

u-blox Holding AG's (VTX:UBXN) price-to-sales (or "P/S") ratio of 2.9x may not look like an appealing investment opportunity when you consider close to half the companies in the Semiconductor industry in Switzerland have P/S ratios below 2.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for u-blox Holding

How u-blox Holding Has Been Performing

u-blox Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on u-blox Holding will help you uncover what's on the horizon.How Is u-blox Holding's Revenue Growth Trending?

In order to justify its P/S ratio, u-blox Holding would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 54%. The last three years don't look nice either as the company has shrunk revenue by 37% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 15% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 10% per year, which is noticeably less attractive.

With this information, we can see why u-blox Holding is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that u-blox Holding maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for u-blox Holding with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if u-blox Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:UBXN

u-blox Holding

Develops, manufactures, and markets products and services supporting GPS/GNSS satellite positioning systems for the automotive and transport, healthcare, asset tracking and management, industrial automation and monitoring, and consumer markets.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives