- Switzerland

- /

- Semiconductors

- /

- SWX:MBTN

It's Down 30% But Meyer Burger Technology AG (VTX:MBTN) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Meyer Burger Technology AG (VTX:MBTN) share price has dived 30% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 99% share price decline.

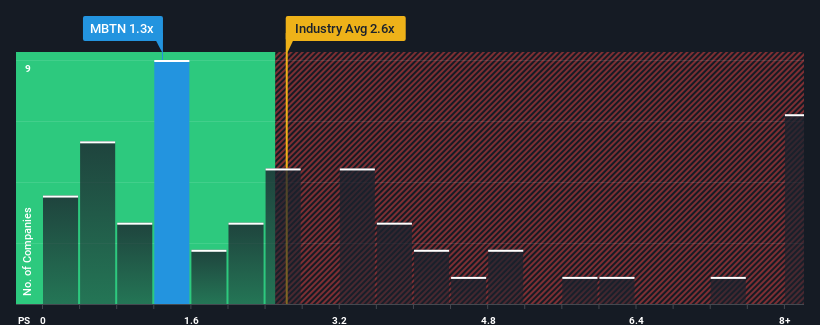

Following the heavy fall in price, Meyer Burger Technology's price-to-sales (or "P/S") ratio of 1.3x might make it look like a buy right now compared to the Semiconductor industry in Switzerland, where around half of the companies have P/S ratios above 2.6x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Meyer Burger Technology

What Does Meyer Burger Technology's P/S Mean For Shareholders?

Meyer Burger Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Meyer Burger Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Meyer Burger Technology?

In order to justify its P/S ratio, Meyer Burger Technology would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 8.3% decrease to the company's top line. Even so, admirably revenue has lifted 49% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 74% per annum as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 15% per year growth forecast for the broader industry.

In light of this, it's peculiar that Meyer Burger Technology's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Meyer Burger Technology's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Meyer Burger Technology currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Meyer Burger Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MBTN

Meyer Burger Technology

A technology company, produces and sells solar cells and modules.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success